August’s hotel tech news in 1000 words

By cameron in Uncategorized

This is a viewpoint by Simone Puorto.

Washington Post columnist Michael Dirda once wrote that “August is hardly the month to start working your way through the works of German philosophers”, and that we should “save Hegel, Heidegger, and Husserl for the bleaker days of February”.

I kind of agree. On the other hand, the industry never takes vacations. August may not be the best month to pick up your copy of Sein und Zeit, but it’s not an excuse to disconnect completely, so here are five things that happened while you were sunbathing.

1) Google launched “Promoted Hotels” on Maps and “Location Score”

Although the “Ad” tag has been visible for some time, Google insists that those map results were merely organic and there was no way to manipulate them via paid ads.

But recently Google appears to have changed its tune. This is potentially good news for hotels, OTAs and metasearch engines who can now bid to be on these top visibility slots, thanks to a pretty straightforward PPC system: the click on the ad is free and the advertiser only pays if (and when) the user check the rates on Google Hotel Ads.

Google is still beta-testing the feature. Based on the tests I ran, for example, there are around a dozen “promoted hotels” in Rome, Italy, ranging from anonymous two-star properties to famous brands such as Hotel delle Nazioni, but it should be soon openly available to everyone. I experimented with different queries, and it looks as if the ads only trigger for destination search, not for branded queries.

If your main marketing KPI is ROI, this may not be for you – Promoted Hotels looks more like an advanced display campaign than an end-of-funnel booking one. That being said, it can be a great opportunity to increase awareness, especially in highly competitive destinations.

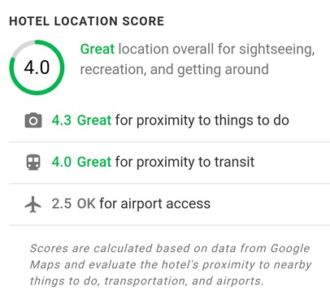

Less exciting perhaps but still interesting, is Google’s new “Location Score” tab.

According to Google, the score is calculated based on Google Maps data, and evaluates the hotel’s proximity to the main attractions, to public transport and airports. The three criteria, however, do not seem to have the same weight in the algorithm and, according to the first tests I ran, it looks like the most important criteria is how close the hotel is to the main city attractions.

Even for this new feature, I could not find the tab when running brand searches, but only for the more generic query “hotel + city name”.

2) Parity rate – should you really stop clicking around?

Apparently not. According to a study published by Fornova, in fact, Booking.com is cheaper than brand.com over 14% of the times. Not to mention B2B2C resellers offering better deals for more than two in three of the queries.

It is interesting that the study surfaced right when Sweden became the sixth EU country to abandon OTAs’ rate parity clauses. The decision comes at a time when the distribution chain has become so complex and opaque that the main concept of rate (dis)parity seems anachronistic at best.

But for the Swedes this is a headache. I remember that during an event in Stockholm I was invited to a couple of years ago, the audience was very touchy when it came to the subject. Anyhow, the decision, similar to what happened in Italy or over here in France, also prevents OTAs from dimming, penalizing or de-ranking properties based on their rate strategy.

My personal opinion about the whole rate parity problem – and I am probably biased – is that I haven’t seen any big change in countries where the clause is no longer enforced. I hope, for my Sweden friends, they will be the exception.

3) Accor bets on WhatsApp

In about 90% of the French brand properties, guests are now given a dedicated phone number to interact with the staff via instant messaging. From room service to cleaning requests, guests can communicate “using the methods they are most familiar with“, according to Thomas Dubaere, COO of AccorHotels Northern Europe.

It looks like the group preferred to play it safe and focus on the not-particularly-innovative, yet easily-accessible-to-the-average-user platform of WhatsApp, rather than invest in more sophisticated technologies.

4) Expedia focus on peer-to-peer rental

HomeAway has been part of the Expedia Group since 2015, and over the past three years has focused almost exclusively on improving its technology in synch with its new owner. Finally, however, Expedia is ready to launch its counter-offensive against Airbnb.

According to CFO Mark Okerstrom, HomeAway is moving to “phase II”, meaning “property acquisition”. At the moment, HomeAway generates about 10 percent of Expedia’s total revenue, but this percentage is estimated to grow. With almost two million non-hotel properties, in fact, HomeAway has a very strong inventory.

Brian Chesky, CEO of Airbnb (almost 5 million listed properties) says that his main competition “consists of two companies: Expedia and Booking.com”. It will be interesting to see if a relatively young company like Airbnb will be able to withstand the competition of these two giants

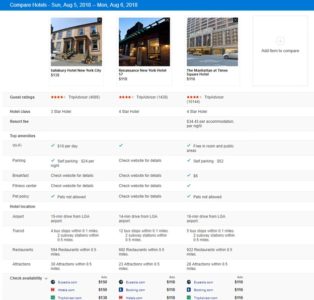

5) Bing improves its hotels listings

On August 3rd, Bing revealed on its blog three new features designed to help users “estimate and compare prices across multiple providers, give insights to make the right trade-offs around price, and get more savings on products through a new deals experience”.

The message “all built to help you save money” mimics the general tone of metasearch marketing. The “booking tips” feature suggests to users better or less expensive accommodation alternatives, “price trends” monitors the price evolution for a destination, while a completely redesigned comp-set tool allows users to find the best deal thanks to a surprisingly intuitive grid.

6) Amadeus buys Travelclick

Luis Maroto, President and CEO of the Amadeus IT Group, stressed that the company goal has always been to provide the industry with the tools it needs to grow its businesses and provide an exceptional guest experience, and that the combination of the two portfolios will enable Amadeus to supply hotels of all shapes and sizes. Even though the best tools that Amadeus will inherit from TravelClick will probably be its excellent business intelligence, the acquisition will also serve to fill some other technological gaps.

This is a viewpoint by Simone Puorto.

Opinions and views expressed by all guest contributors do not necessarily reflect those of tnooz, its writers, or its partners.

![]()