Sabre makes a point

By cameron in Uncategorized

When Sean Menke took over as CEO of Sabre in late 2016, the first things he talked about were return on investment, margins, speed to market and the potential of getting its GDS and PSS to work more closely together.

Eighteen months – or six financial quarters – later the Sabre shake-up is well under way. It appears Menke has been able to start preparing the business for the future, while still satisfying the three-months-at-a-time demands of the market.

Q2 highlights

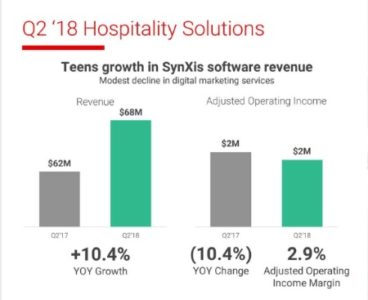

Between April and June this year, Sabre has a “solid” quarter across its travel network, airline solutions and hospitality solutions businesses.

Execs told analysts that Sabre is on track to meet its full-year guidance. Beyond that timeframe its financial projections are not public but there are lots of hints in the earnings call about how the business will be run in the future.

And a lot of what Sabre execs talked about at its STX events in Dallas and London this year are also relevant when looking into the future.

Combining the PSS and GDS (and more)

The most obvious manifestation of Sabre’s desire for these two parts of its business to work together is the creation of a new Travel Solutions division, which will be overseen by Dave Shirk, promoted from his role at head of Airline Solutions. The aim of Travel Solutions is to:

“Increase go-to-market effectiveness, better serve customers and align development of GDS, PSS and NDC solutions with umbrella organization over Travel Network and Airline Solutions.”

This was one of the recurring themes at STX London last month, and connects into another part of Sabre’s future based around its cloud strategy and micro-services. The idea behind micro-services is to “develop once, deploy often”.

So the idea is that a seat-map developed by airline IT for a brand dotcom can then be deployed across the Travel Network.

At STX London, Sabre’s head of hospitality solutions Clinton Anderson talked in general terms about how there could be a hospitality component to Travel Solutions (although the event took place before Travel Solutions was launched).

He used phrases such as “new economic models” and “profitable distribution” to describe what could theoretically be possible when systems are connected. The example given was that an airline flying from New York to Paris could sell that data on to a hotel, which could then market to these specific passengers. The cost to the hotel for this lead could be less than an OTA commission or other customer acquisition channels, while the revenue coming to the airline could offset the booking fee.

He noted that there could be “a change in the dynamics of the relationship between hotels and airlines” and that conversations were taking place about this future relationship, but there was nothing concrete to share.

Return on investment and margins

While these “new economic models” are part of the future, Menke’s focus on margins and return on investment is very much part of the present. And in the Q2 earnings call yesterday, it all got a bit feisty – relatively – when one of the analysts wanted more information on a comment made about an OTA deal in Latin America that Sabre had walked away from.

The analyst wanted to know whether it was a current deal (which would impact current revenues) or a potential one (which would impact future revenues).

“Not going there,” was (now former) CFO Rick Simonson’s response.

Menke chimed in:

“We’ve talked about walking away from specific OTA opportunities in the India marketplace. And we saw one in Latin America that just did not make sense from an economic perspective.”

Avoiding deals which do not make economic sense would seem an obvious way to run a business, but the fact that Menke talked about this from day one would suggest that this was a problem in Sabre that needed addressing.

In a similar vein, he talked about its digital marketing services for hotels, which is a “project-based revenue stream…resource intensive and lower margin.” The plan for this part of the business is to look for long-term strategic relationships rather than one-off custom developments.

At STX London, there were a few examples of Sabre’s current approach to its clients. Proactive collaboration is probably a better phrase than less accommodating, but there is an element of the latter coming into play. Shirk (who was head of airline solutions at the time) talked about “a more rigorous and thorough approach” to customer requests, making its existing clients pay for an estimate on some work before Sabre looked into it.

“I need to know before spending that you are serious” he told a room full of clients.

Elsewhere at STX, Sabre’s NDC chief Kathy Morgan said that Sabre was not working with any airline which was not at NDC 17.2 level. Her argument was that previous versions of NDC were not stable enough for Sabre to do what it wanted.

As a reminder, this is what IATA itself said about 17.2:

“This new version features significant enhancements in terms of robustness and consistency, which will make NDC implementations for airlines and technology providers more effective and faster to market.”

And what was the reaction to Sabre’s line in the sand? “We found that lots of airlines modified their tech roadmap to get up to 17.2,” she said.

Links

Click here for the Q2 2018 earnings release

Click here for the Q2 2018 presentation

Click here for the Q2 2018 webcast

Related reading from tnooz:

Sabre sets out its NDC roadmap, promises solutions in 2018 (May 2018)

Sabre CEO introduces vision to eliminate silos across the company — and travel industry (April 2018)

Sabre’s new CEO to focus tech investment on returns and speed to market (Feb 2017)

![]()