Using data to help shift tours and activities from mobile-friendly to mobile-optimised

By cameron in Uncategorized

Sponsored by Checkfront.

The go-to statistic when discussing the potential of tours and activities comes from research which says the sector will be worth “$183 billion by 2020.”

That sum represents a vast opportunity – for B2B tech providers, B2C distributors, wholesalers and aggregators, the businesses providing the tours or hosting the activities, the investment community and more.

The valuation from Phocuswright came in a report released in July 2017, Tours & Activities Come of Age. Using that phrase as a starting point, the sector is undoubtedly embracing early adulthood with enthusiasm but is still finding its way.

Mobile to the fore

Like all sectors in travel, a deep understanding of mobile is essential for tours and activities providers. Mobile, not unlike the tours and activities sector itself, is mature and evolving at the same time, with room to grow.

With more than 50% of the world’s internet traffic coming through mobile as of this April, tours and activities providers should have a mobile strategy in place. Understanding the specific trends behind mobile use in tours and activities can make the difference between having a mobile-friendly site and a mobile-optimised one.

An awareness of mobile trends in other travel segments and the wider m-commerce world also helps.

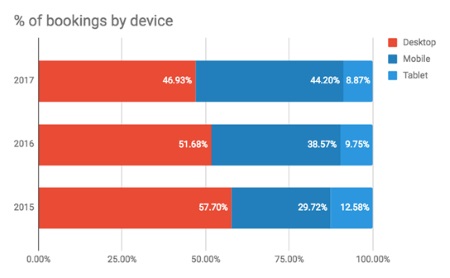

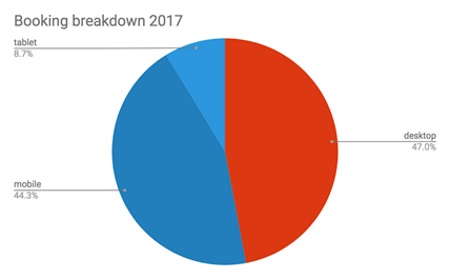

Checkfront’s internal data showed that in 2017, mobile bookings accounted for 44.3% of bookings. If tablets are included as mobile – at what point does a large smartphone become a small tablet? – then mobile breaks the 50% barrier.

Our findings for the past three years confirm the growth of mobile bookings as a percentage of our overall business.

The 49% increase in mobile bookings over the past three years contrasts with the 10% drop in desktop bookings. Tablets have also been on the decline. The latest tablet tracker from IDC notes that shipments of tablets in the first quarter of 2018 were down 11.7% compared with the same period in 2017, although it noted that detachable tablets (Microsoft Surface, Ipad Pro) were up, and that Google’s belated entry into the detachable sector could revive the fortunes of tablets.

This hardware industry shift may or may not impact tours and activities booking patterns. But what is clear is that mobile – in its widest sense – should be the central pillar of a tours and activities provider’s multichannel approach.

Tours and activities do not exist in isolation. There is usually a flight, rail or car journey involved, some accommodation and other travel. Mobile bookings are increasing across all these product types. Travelers who book their flight on their mobile, or check-in to their hotel using a smart key, will expect their tours and activities provider to offer the same mobile-friendly experience.

Booking windows

Other components of the travel experience need to be booked in advance. Flights need to be booked in advance to secure not only the best price but also a seat on the specific departure and return dates. Accommodation is less constrained in terms of capacity, but many travelers want to know where they are staying ahead of time.

Airlines, hotels and third-party distributors have strong commercial imperatives to sell early – it helps visibility, cash-flow and yield management processes. Over the past few years, airlines and OTAs have upped the ante in this area by adding “scarcity marketing” messages to their booking flows, along the lines of “Only three seats left at this price” or “26 people are looking at this page now”, all designed to get people to book immediately.

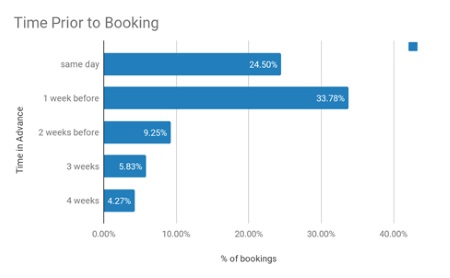

For tours and activities, the mindset is different. Our research showed that one-in-four bookings are made on the same day that the activity is consumed. This trend towards in-destination booking is driven by many factors, but the dominant one is the most obvious – people use their mobile phone when they are away.

In the early days, travelers were reluctant to use mobiles, especially on international visits, because of concerns about the cost. But network operators are now offering data plans which include cost-effective international roaming. Travelers not on the appropriate data plan can easily find wifi hotspots in coffee shops, hotel lobbies and department stores to serve the same purpose.

Another change in the mobile landscape is the willingness of consumers – including travelers – to transact using their device. It is vital that tours and activities providers make sure that their mobile site can accept payments in a seamless and secure way. A mobile-friendly web site with a poor payment process is not friendly at all.

However, our research found that most bookings for tours and activities come through in the week before departure. From there, booking rates drop week by week.

There are many contributing factors to this week-before-departure time frame being dominant. In terms of the path to purchase, leisure travelers in particular are starting to prepare for their imminent trip, telling friends, thinking about packing, buying last minute essentials. Booking a tour in advance solidifies the anticipation. The bigger picture excitement about the total trip feeds in to the specific excitement around an activity and event.

For tours providers, this albeit tight advance booking window allows sufficient time to prepare and make sure that the experience is a memorable one for the guest. It can also allow a business with a suitable CRM platform to engage with the traveler in advance, to foster a personalised relationship which has the potential to boost the potential lifetime value of the customer. Upsell and cross-sell opportunities may also arise, with the obvious caveat of ensuring that the products offered are relevant.

Conversion rates

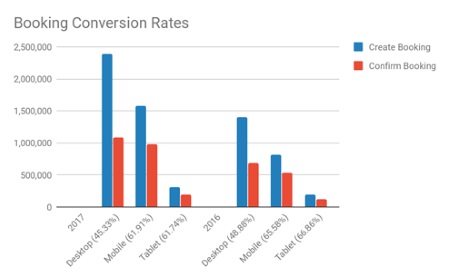

Our research found that conversion rates on mobile devices are higher than desktop. In 2017, 61.91% of mobile users who created a booking followed through to confirmation, compared to 45.33% of desktop users. These rates are slightly down on 2016, reflecting an overall increase in traffic volumes.

Conversion rate success depends on many factors and here tours and activities providers can take a steer from the wider m-commerce world. comScore identified in a report called “Mobile’s Hierarchy of Needs” five reasons why mobile users in general are reluctant to convert – security concerns, inability to see product detail, difficulty in navigating the site, inability to comparison shop across devices and difficulty inputting details.

These concerns are relatively straightforward to address with a mobile-optimised site. As mentioned earlier, if your mobile site doesn’t show your product clearly enough then it is not mobile-friendly.

Tours and activities convert better on mobile than desktop because mobile users are often closer to the purchase decision. We found that mobile sessions were shorter than desktop, suggesting that mobile users would come in, find a tour or activity and book it, exhibiting a more functional approach that desktop users, who spend longer in the consideration stage.

We also found that mobile users visit fewer pages than their desktop peers, again suggesting a more functional approach.

The other side to this functional attitude is that mobile users are less patient, not prepared to click around a site if it doesn’t do what they expect. The bounce rate for mobile is higher than desktop.

Conclusion

Having a mobile-friendly website should no longer be an afterthought and everyone should be thinking about a mobile-optimised website. Tour and activity operators must take a mobile-first approach — or risk losing half of their online customers. Here are some tips to optimize the mobile booking experience:

- Remove all distractions and lead visitors to make a booking with clear calls-to-action

- Provide date searchability for your experiences

- Minimize form fields and/or offer auto-fill options

- Assure refunds to help visitors overcome anxiety about booking on mobile devices

- Easily offer assistance through instant messaging or click-to-call buttons

This article from Checkfront appears as part of the tnooz sponsored content initiative.

![]()