Following the leader – Booking.com ahead in the online travel stakes

By cameron in Uncategorized

This is a viewpoint from Gitit Greenberg, director of digital insights at SimilarWeb.

The elephant in the online travel room is that while consumers are offered a massive variety of options, the industry is lead by two primary players – Booking Holdings and the Expedia Group. But in the past year, it was booking.com, the namesake of Booking Holdings that led the way in online travel.

Over the past year booking.com was the most visited travel site in the world with more than 426 million monthly visits. This number represented a 7% increase in traffic on the previous year speaking to a giant that is continuing to grow.

Yet, even more interesting than its overall numbers was the strategy they employed to create such an impressive and far reaching digital impact.

So how did booking.com grow into the global leader of online travel? It answered three key questions on a country by country basis.

Where do visitors come from?

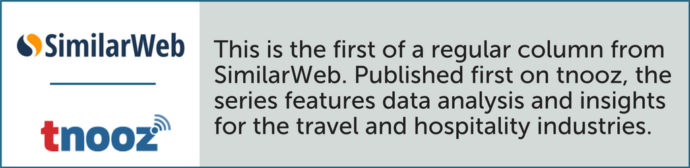

Telling a travel industry insider that booking.com is the largest travel site in the world is unlikely to elicit any shock. The giant, and its continuing dominance is so significant that the holding company that was one called the Priceline Group was renamed to bear its name. But, tell them that over the past 12 months, Russia was the site’s top source of traffic and the likelihood of surprise increases significantly. From May 2017 to April 2018, Russia amounted for 6.9% of the desktop traffic to the site, narrowly passing the US at 6.8%, though the lead can change on a monthly basis.

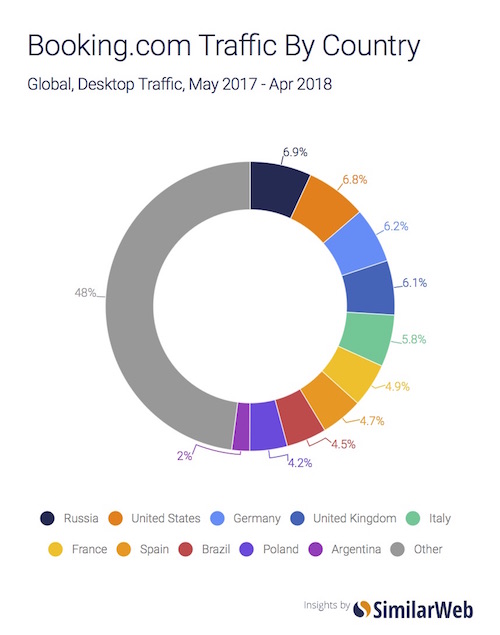

The ability to drive such success across so many countries begins with a strategy that understands the differences in marketing approaches in each country. For example, in Russia booking.com receives 19% of traffic from email, dwarfing the 6% that comes from email in the US or the 5% that arrives from Germany. And this doesn’t just happen in its largest market.

In France paid search and email play larger than average roles, while the US has the heaviest focus on referrals. The ability to understand and optimize for channel specific behavior has turned into a major advantage for booking.com.

Which devices are they using?

From a global perspective, in the 12 months from May 2017 to April 2018 55.4% of all traffic to booking.com came from mobile web. The immediate assumption looking at this data could be to make a much bigger focus on strategies optimized for the unique experienced enabled on mobile devices. Yet, the brilliance of booking.com’s strategy lies in its capacity to tailor its approach with this metric serving as a significant north star.

The range is fairly wide with the US seeing 68.2% of traffic from mobile web, compared with 55.2% for Germany and only 44.2% for Russia. While the standard differences are important, it also speaks to a much more tailored marketing strategy including the types of keywords used to drive traffic, and the channels that are optimized for. Though booking.com isn’t the only one in travel leveraging a strategy like this, their ability to make use of such a wide variety of tactics with high efficacy is a testament to the sophistication of their approach.

Where are the market opportunities?

Building a specific strategy for each market is a critical piece of the puzzle for booking.com’s efforts, but equally critical is the ability to adapt to market dynamics. Of late, no market has shown the value of this approach as effectively as US.

In the Spring of 2017, TripAdvisor shifted its strategy away from Instant Bookings and its OTA approach back to a metasearch focus. The decision had a massive impact on the market, not a hugely surprising factor considering tripadvisor.com’s dominance in US web traffic.

However, the ability to quickly turn this change into a competitive advantage displayed booking.com’s ability to effectively adapt and thrive in changing landscape. In the May 2017 to April 2018 period, most of which followed TripAdvisor’s adjustment, booking.com saw 12% of its desktop traffic come from referrals. In that time, traffic from tripadvisor.com grew to more than 30% of its traffic share from this source – up from 21% on the period from January to April 2017.

![]()