11 ideas for airlines, generated from Mary Meeker’s latest report

By cameron in Uncategorized

This is a viewpoint from Mike Slone, chief experience officer for Travelaer..

A few days ago, KPCB partner and internet legend Mary Meeker released her 2018 Internet Trends report, a 294-slide presentation examining the impact of the internet on the global economy and how it is changing the daily lives of its users. And while the travel industry was once again largely ignored – with the exceptions of Uber, Airbnb, and Booking.com, it is important for airlines to download this report, study it, and learn how to use these emerging trends to their advantage (without having to take on Uber and build flying taxis).

Context

I’ve studied the entire presentation, top to bottom and came away feeling as if most of the travel industry has been left in the dark. It is embarrassing that out of a 294-page report only one airline was mentioned and it was a reference to the 1960’s when American Airlines started processing data. Unlike other industries, airlines are clearly doing very little to set any trends and innovate through the internet – which explains why booking air travel is often frustrating.

The way that airlines sell their ‘travel as a service’ is outdated and broken, and this is largely because their technology is driven by just a few monolithic companies that have no interest in being innovative. They collect massive transactional revenues each year by keeping things the way they are. Most within airline IT believe in the mantra that, “reliability comes only with legacy,” and that is why IT chiefs are not able to drive change, spark efficiency and support business and customer needs.

To fight this, the airlines need to change their IT strategy of building a few major digital destinations, such as a responsive website and a mobile app, and instead think about how all of the products and services they have to offer can be sold anywhere, anytime, and using a myriad of payment systems.

Here are some quick ideas for those airlines willing to innovate and differentiate in order to help their IT teams break free of the boxes that have confined them to the 1990’s.

1 – The Future of Travel Starts with Amazon (soon) [slide 62]

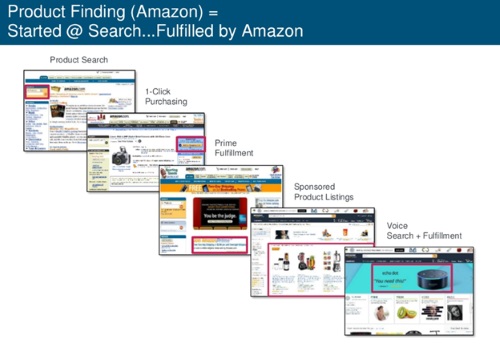

Did you know that 49% of product searches today start with Amazon.com, versus 36% via a search engine? Amazon’s e-commerce market share has expanded from 20 to 28% over the last five years. Whether we like it or not, Amazon will have a hand in defining how the future of travel is purchased. It may not be directly involved today, but when (when, not if) it enters the travel space, Amazon will have the ability to majorly influence how Customers buy their travel.

Airlines should start planning for this now, beginning with a strategy to integrate their products into the Amazon ecosystem. Similar to how the metasearch engines and Google are using NDC to book airlines directly, setting up your airline digital platform to easily be distributed and sold through Amazon is a step in the right direction. If you are building and consuming API’s and are NDC-certified, you are positioning your airline to work with Amazon directly.

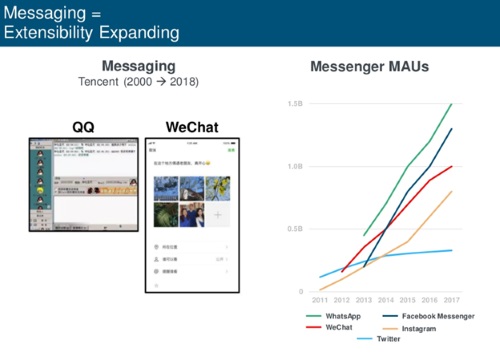

2 – Don’t Ignore Messaging [slide 22]

2 – Don’t Ignore Messaging [slide 22]

Messaging apps are growing at a staggering pace year over year – 40% last year globally. The increase in China, where messaging apps are already prevalent, was more than 50%. There are three messaging apps — WhatsApp, Facebook Messenger, and WeChat — each of which have more than 1 billion active monthly users. That’s an astonishing amount. Travelers are increasingly shunning the 1-800 number and instead turning to social media and these messaging apps for all of their questions, concerns and feedback. Gartner has even predicted that by 2020, 90% of customer service engagement will happen though social media.

Initial messenger chatbots haven’t met customer expectations or solved any actual pain points in the customer journey, but the sheer growth rate of messaging alone should convince airlines to invest in teams that can answer questions via messaging channels, and also support them with chat bots that solve Customer problems.

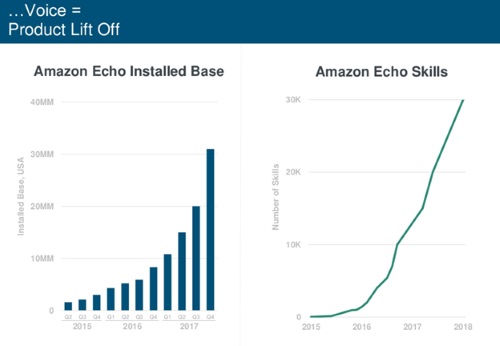

3 – Personal Travel Assistants and Concierges Will Become a Reality [slide 26]

The home voice (Alexa, Google Home, etc.) install base is currently growing by more than 50%, but more importantly the skills built for these platforms are also growing at the same rate. Voice technology is at a crucial point due to speech recognition hitting 95% accuracy and the recent sales hike for the Amazon Echo, which went from over 10 million to over 30 million units sold, in total, by the end of 2017.

Personal travel assistants and concierges are going to become a virtual reality (pun intended) for everyone before long. Although none of the current applications are concierges, if you want to see some examples of travel companies are already experimenting with Alexa check out this here’s airlines using Alexa link and this information from Skyscanner.

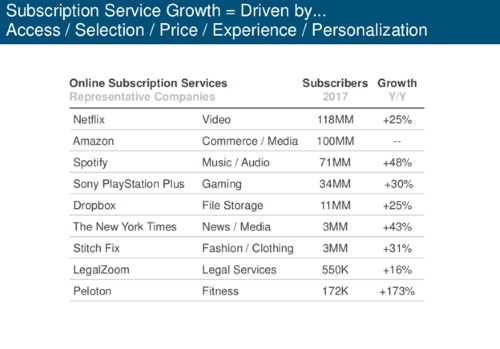

4 – New Revenue Models [slide 80]

Outside the travel industry, product purchases lead to brand loyalty, with many consumers evolving quickly along the acquisition path from buyers to regular subscribers. We are talking massive adoption. For example, Netflix was up 25%, The New York Times was up 43%, and Spotify increased its subscribers by 48%, year-over-year in 2017.

One example of an airline providing their customers a subscription like model is Le Pass from Air France. With Le Pass you can create your own bundle of pre-paid flights, share them with friends and family, and even pay as little as 20% upfront of the total pass cost.

Why not take it a step further and allow customers to pay each month for a subscription that will allow them to hop on a few flights, or make it easy for frequent flyer program members to use their points for flights through a subscription – six flights per year at €600 or something similar?

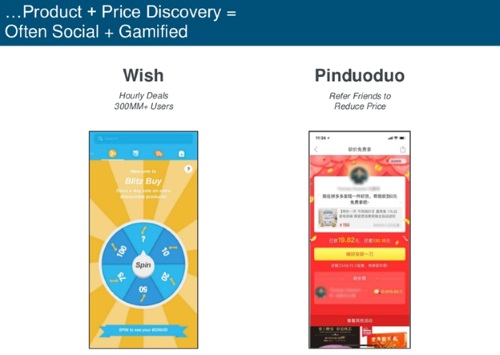

5 – Product + Price Discovery = Often Social + Gamification [slide 86]

5 – Product + Price Discovery = Often Social + Gamification [slide 86]

Today apps such as Wish produce hourly deals for 300 million users, and then Pinduoduo reduces the price of these products for every friend a user refers. It’s gamification. We all know that airline customers ultimately want the best prices on flights above all else, so why not incorporate new discovery-focused pricing tactics to similarly gamify their digital experience?

According to Inc. before turning 21, the average American has spent 2,000-3,000 hours reading books and more than three times that playing video games. To this point the airlines, and they are not alone, have struggled to convert this new generation into loyal customers. Providing a fun and collaborative approach to the booking experience can help change the perception of the brand and also generate incremental revenue.

As a bonus, if these airline customers share certain deals, why not given them an even reduced price for spreading the word to their friends and family?

6 – e-commerce strong, yet airlines are not close to 100% direct [slide 48]

According to Meeker’s report, today roughly 13% of all retail sales come from e-commerce, up from about 5% a decade ago. Even though e-commerce revenue growth continues to be strong outside of the airline world, the airlines continue to struggle to increase direct bookings, especially with competition coming from metasearch and online travel agents who have much more sophisticated digital platforms.

The philosophical thought experiment, “If a tree falls in a forest and no one is around to hear it, does it make a sound?” is an appropriate exercise for airlines to consider as they craft there digital strategies. There is much we can all learn from taking a holistic view of the trends report in terms of improving eCommerce growth. Airlines should look at things such as personalization, instacart, one-click purchasing, and new seamless payment options.

7 – Personalization is no longer the exception; it is the rule [slide 29]

Personalization is a real, living, breathing part of many industries, but within travel it is more commonly an overused airline conference buzzword that is – in truth – very infrequently deployed by the airlines. But perhaps they should consider that a good number of Frequent Flyer Program (FFPs) members would be willing to share a wealth of their personal data with the airlines in return for a simple, contextual and more relevant user experience.

According to a Forrester report, “36% of US adults think online retailers should do more to offer personalized experiences.”

Retailers heed this expectation by continuing to invest in technologies that facilitate real-time, tailored experiences customized to each individual customer. The good news is that customers are willing to share information about themselves in exchange for these richer brand interactions: in fact, that same report states that 81% of US online adults are comfortable with retailers using their personal information to in order to personalize their shopping experience.

8 – Instacart – three-click booking [slide 49]

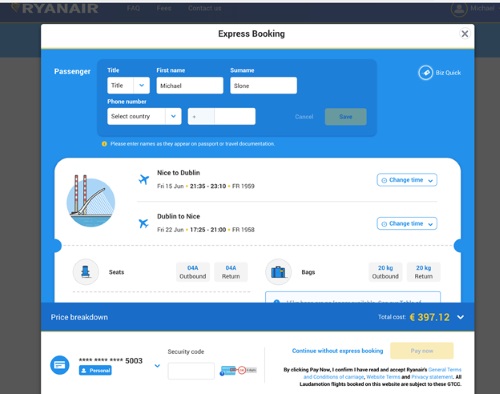

Ryanair has had Express Booking for awhile now and it is still the closest thing to an Amazon one click flight purchase experience that exists today. Express Booking allows the customer to easily book a flight in three total pages (home page, express booking page, confirmation page).

The fact that no other airline has attempted something similar says a lot about that legacy IT mentality mentioned earlier, which was originally adopted to prevent massive technology flops, but today that mentality is costing the airlines millions in lost revenue.

9 – One-click purchasing, voice search + fulfillment [slide 63]

According to Meeker, around 60% of all payment transactions are now done digitally, with over 500 million mobile payment users in China alone. This is made possible because payment processors and vendors store credit card details with the customer’s permission. Even though this functionality can be found on some airlines, it is rare to find an airline that connects users through a persistent login, much less store credit card details.

Business travelers frequently travel to the same destination and have consistent travel preferences (day of week, time, seat preference, etc.). The airlines need to work on creating accounts through their loyalty programs that make it easy to pay quickly whether the customer is online, on the plane, or in person at the airport. The data has already been provided so why not make it easier for your most valuable clients to book their travel? Time is money!

10 – Investment in artificial intelligence [slide 201]

Meeker says artificial intelligence IT project spend will grow by over 5%. Yet, the reality is that use of AI is still very limited within the travel industry. Some airlines claim to be using AI when it comes to chat bots, but not in a way that has solved any real customer pain points or improved the customer experience in any significant way. Airlines need to look beyond the chatbots and integrate AI throughout their core digital systems.

And not be afraid to take some risks, because the rewards for the travel industry could be huge, and as of yet, there is no such thing as perfect regarding AI.

For example, my team has invested time and resources to build an airline centric natural-language processing (NLP) engine that processes large amounts of natural language data for the acronym heavy airline industry. The reality is that it isn’t perfect, but rather like a child that will soon be an adolescent. We need to continually educate and train the NLP engine for it to be increasingly successful (as in, accurate). It isn’t necessarily getting smarter artificially.

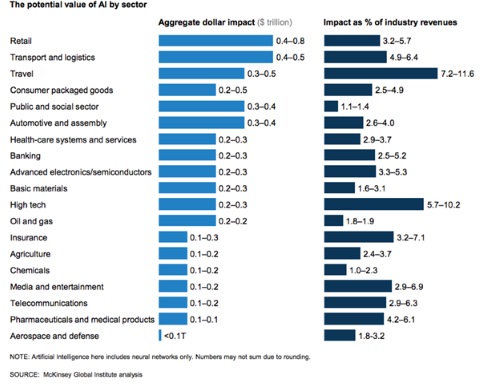

But those potential rewards for making the investment are huge. McKinsey Global Institute’s latest research on AI, analysed 400 use cases across 19 industries, and interestingly enough thinks that the travel industry is where AI could create the most value as a percentage of total revenue – driving potentially 7 to 12% of impact as a percentage of annual revenue.

Why travel? McKinsey Global Institute partner Michael Chui, the main author of the report, says that, “travel companies perform complex marketing, sales and operations, all areas where McKinsey sees AI creating the most value.”

11 – User experience matters [slide 17]

Airlines continue to ignore the importance of simplicity when building out digital products. When products are simple, and easy to use they become pervasive. Perhaps they should consider the following sage advice from Slack’s CEO when building/buying consumer facing digital solutions:

“Every bit of grace, refinement & thoughtfulness will pull people along … and every petty irritation will stop them and give the impression that it is not worth it.”

Airlines must adopt an “easy to use” mentality when designing and building digital products. They must learn to fail fast, learn from their mistakes, and then quickly adapt the user experience based on their learnings. The days of spending six months designing a new digital experience and then two years building a new digital platform are over. Create short digital sprints, test, rinse and repeat.

Here’s the full report:

This article by Travelaer appears as part of the tnooz sponsored content initiative.

![]()