It’s the end of search as we know it (and I feel fine)

By cameron in Uncategorized

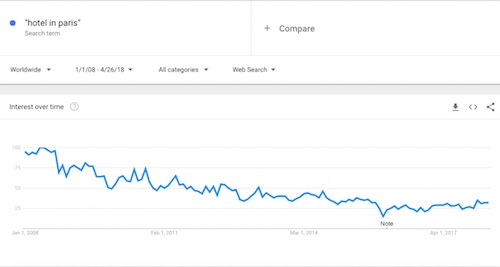

Over the years, online hotel bookings have increased dramatically: according to Statista, last year the market value for hotel reservation made on the web was over 42 billion in the US alone. However, the search volume on classic search engines (such as Google or Bing) for generic travel-related keywords is constantly decreasing. Let’s analyze this GoogleTrend’s graph for the query “Hotels in Paris” over the past decade:

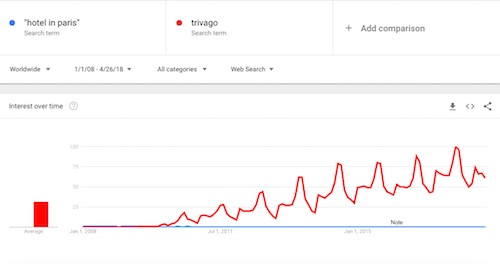

Now let’s compare it with a different term: “trivago”.

Surprised? You shouldn’t be. This, in fact, does not mean that web users are no longer interested in booking a hotel in Paris (or in any other city, as the trend is pretty much the same on every destination), but simply that the starting point for online bookings is no longer, as it used to be, the classic search engine, but what is technically called a vertical search engine or, more specifically, a metasearch engine.

Surprised? You shouldn’t be. This, in fact, does not mean that web users are no longer interested in booking a hotel in Paris (or in any other city, as the trend is pretty much the same on every destination), but simply that the starting point for online bookings is no longer, as it used to be, the classic search engine, but what is technically called a vertical search engine or, more specifically, a metasearch engine.

The evolution of search

But let’s take a step back. Until a few years ago, booking a hotel online was a remarkably frustrating experience: once you chose the destination you had to browse through dozens of brand.com sites, search for rates, location, fill endless contact forms to, eventually, find out that the hotel you liked was fully booked. This process could take days, while today the same result can be achieved by simply applying a filter on TripAdvisor, with a much faster and less frustrating UX.

Back in 2008, without a proper aggregator, the only possibility web users had was to search for very generic keywords on search engines. This explains why, only a decade ago, the query “Hotels in Paris” was at its peak of popularity, while today the same query produces only 1/4 of the original volume.

Hyperlink organization is no longer enough

At its core, a metasearch engine is nothing more than a content aggregator, we all know that. Instead of indexing the whole surface web, a metasearch engine focuses on specific pages, related to a specific topic to provide specific results. Their success (not only in travel) is due to the fact that, as the contents on the web become more complex and heterogeneous (images, videos, news, etc.), the traditional hyperlink organization is no longer sufficient.

As I write this paragraph, there are more than a billion web pages and, according to a study conducted by QMee, five hundred more are created every minute. So, especially in the case of an industry like ours, characterized by a large dispersion of information, metasearch engines are particularly useful to find the information one is looking for.

Metasearch engines are nothing new

Although metasearch engines in travel started to grow during the last decade, their ancestors can be traced back to the 90’s: the search engines results’ fragmentation back then, in fact, generated the need for specific aggregators, such as MetaCrawler, BigSearcher, lxquck or Vivissimo. And, even though the advancement of search engines algorithms made this comparison tools no longer necessary over time, metasearch engines are still of extraordinary value in those situations where the information are very fragmented, such as, for example, that of hotel rates and inventory distribution.

Is SEO dead?

According to a New York Times study, less than 15% of the online search leading to a purchase starts from a classic search engine. This means that, for a hotel, being among the first positions for secondary keywords such as “Hotel + City” or “Best Hotel + City” is no longer as crucial as it used to be. On the contrary, we can safely say that it is pretty much useless. Most of the guests will discover a hotel on a vertical search engine (or on an OTA, or an app) anyway, so the SEO efforts needed to be indexed for these secondary keywords are getting less and less important in terms of pure brand awareness. “SEO is dead” is surely an overstatement but, at least in the accommodation industry, this seems to be (at least partially) the case.

Excellent acquisitions

Thanks to the improved user experience of these aggregators, predictably, in recent years there has been a real acquisition race by hospitality big players, anxious to exploit the potential of these platforms. In 2013, Booking Holdings acquired KAYAK and, in 2017 the Momondo Group; Skyscanner is controlled by Ctrip (which has a commercial partnership with Priceline since 2012), while Expedia Group owns the majority of trivago’s stock.

According to SimilarWeb, more than 10% of the Booking.com traffic comes from metasearch, and that number used to be way higher, up until when the Priceline Group (which accounted for more than 40% of trivago’s revenue) decided to dramatically reduce its investments in metasearch ads. Expedia shares similar numbers.

Hybrid metasearch engines

This decrease in investment can seem surprising, but let’s take into consideration that the line between metasearch engines and OTAs is getting more blurry every day, so there is a real risk of advertising overkill and brand dilution.

For example: Stephen Kaufer, TripAdvisor’s CEO, has repeatedly claimed to be more than satisfied with the metasearch model and not interested in becoming an OTA, but this seems merely a matter of semantics.

The latest metasearch tactics, in fact, have several grey areas, with OTAs advertising on metasearch engines and metasearch engines advertising on different metasearch engines, on a PPC endless vicious circle. This ambiguity could impact the whole metasearch ecosystem and, on a future not so far away, OTAs could play the only role of simple booking engines, where the user lands just to put his credit card data, after having chosen the hotel on an aggregator.

It is not surprising, therefore, that after over a decade of monopoly in the online distribution, the major OTAs had to (at least partially) reinvent themselves, by diversifying and broaden their products in order to stay relevant. Think about all the B2B tools that the main players provide today: from BookingSuite’s RateIntelligence to Expedia Travel Ads. Because, if up until now metasearch engines merely aggregated third-party data, they now provide the option to complete one’s reservation without even leaving the result page. And that, for an OTA, is a problem.

Fixing the search

Fixing the search

According to Terri Scriven, Head of Travel for Google UK, an average consumer today consults up to ten different sites with an average of over thirty searches before making a purchase: an extremely complex, confusing and difficult process, especially if you consider how much disparity, both of information and rates, can be found on the different distribution channels. Therefore, “fixing” this fragmented booking journey is an ambitious (yet not so far-fetched) goal

for the Alphabet’s company.

Google has profoundly changed our habits and not just the online ones. According to a study by Columbia University, for example, the action of googling has even an impact on the way we store memories. The human brain, in fact, underwent a deep change in the way it stores information, producing authentic selective amnesias : we now tend to forget all those things that we are sure we can find online with a minimal effort. Our minds simply adapted. So, referring to Google as just a search engine is an understatement, to say the least.

The end of metasearch engines

On the contrary, it could be the one player able to simplify the booking process once for all, which could start and end without the users not even leaving the SERP. Think about how Google improved the MyBusiness listings look over the years, for example, with more accurate contents, photos, reviews, rates, availability, Q&A, and suggestions, making them look almost like OTA’s mini hotel pages.

This is no longer a question of classic search vs vertical search, but rather “post-vertical-search” or “post-metasearch” (to use neologisms), where Google could provide results, contents, inventory, and -eventually- process the final transactions. Google, at least in the US, allows guests paying for their booking through its wallet : instead of redirecting the click to the advertiser’s booking engine, the system simply displays a Buy With Google button, that takes the user to a hotel-branded page hosted by Google. Checkout is simplified and the user can easily book his room. A much more fluid, satisfying, frictionless and user-friendly experience, of course, but with a real risk of market monopoly.

What now?

The times when Google used to simply showed ten organic results seems like history. On a standard Google search, in fact, it is easy to get multimedia results directly in the SERP. Try googling “funny cats” and you will probably only have 3 or 4 links, together with a dozen of videos and images. According to several studies, last year Google responded with universal search results to more than 80% of queries, (mainly YouTube videos, images, and news). Having all the “action” in the SERP could be a revolutionary step in hospitality, as it would bypass OTAs, brand.com websites and metasearch tout-court. Let’s keep in mind that travel is the third industry for revenue for Google, preceded only by financial services and retail, so the interest is pretty high.

Conclusions

The extreme competitiveness in travel is slowly bringing search engines, OTAs and metasearch engines to converge towards an increasingly homogeneous model. The reason is simple, almost Darwinian: the model that will prove to be the most efficient in terms of scalability and efficiency for the end user is going to prevail. Larry Page once described the “perfect search engine” as something that “understands exactly what you mean and gives you back exactly what you want”. Judging by the results that Google gives us back today, we are not so far away from it.

![]()