Fizzle and flop or crackle and pop: Will blockchain in travel see mass adoption in 2018?

By cameron in Uncategorized

This is a viewpoint from Trond Vidar Bjorøy, blockchain investor and advisor.

While there isn’t much yet to indicate that blockchain technology will be a panacea for travel industry pain points, 2017 saw quite a few interesting projects emerge. Most of them coming from well established companies, some of these initiatives I suspect had little function outside of marketing, while others were actual attempts of using private (also referred to as permissioned) blockchains to improve internal business processes. A few of these projects were covered in a previous article.

Although Hyperledger, one of the largest private blockchain projects, has seen weakening support lately, these usually tokenless ledgers will find their enterprise use cases, streamlining business processes and improving upon existing centralized solutions. One company using a permissioned blockchain, is Travel Ledger, a project looking to streamline the settlement of travel services, however not looking to disrupt BSP or ARC as it’s focusing on non-air transactions only.

That said, I have yet to be convinced that private chains make much sense over a regular database, unless you plan to link them to a public chain at some point. I’m quite certain that more value will be created where blockchain is used to build new solutions, rather than improving upon old things – I expect decentralized applications (known as dapps) built on public, permissionless protocols to be so much more powerful and disruptive than simply recreating existing services on closed chains. Let’s look at a couple of the projects that are using public blockchains to address industry wide challenges.

Moving from the whitepaper to proof-of-concept

Winding Tree received quite a lot of attention last year and has started gaining some traction recently with several big name partnership announcements, both investing and piloting integration projects. This purely infrastructure B2B initiative could see some actual usage throughout the year, as partners start putting their inventory on the Winding Tree platform and others build front ends which lets you and me use the Winding Tree protocol to book our next business trip or holiday.

A testnet has been made available for public trial and the team is currently working on a demo app for hotels and expect to see a wide variety of apps being built on top of their platform.Talking about a paradigm shift for distribution might be a bit premature, and the team definitely has many hurdles to cross, but if the project succeeds it will provide forward thinking suppliers with an alternative distribution channel, and could be a door-opener for the industry’s adoption of blockchain technology and cryptoassets (aka cryptocurrencies).

Aside from Winding Tree, the travel industry arguably hasn’t seen any serious crypto economy projects launched yet. There is CryptoCribs, a vacation rental platform and competitor to AirBnB. You pay for rentals with cryptocurrencies but the project doesn’t have its own token or economy. At the moment not a lot of their process actually happens on the blockchain, so it basically appears as AirBnB with lower fees.

GOeureka from Singapore (disclosure: I’m an advisor) is a blockchain startup which so far has raised $8 million in a private presale and is running their ICO later this year. GOeureka is positioning itself as a next-gen solution for online hotel booking — an unbiased and transparent technology partner for the hospitality industry, aimed to give the OTAs a run for their money.

The value proposition to hoteliers and customers include features such as commission-free bookings with no rate parity clauses, a re-booking feature that ensures customers always get the lowest price.

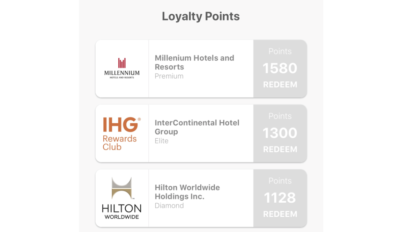

The most intriguing feature of GOeureka is arguably the introduction of an interoperable loyalty program. Their website and mobile apps give users access to their loyalty points from multiple programs and suppliers across a single platform. Customers will be able to use points earned at one hotel to pay for a room, or a restaurant dinner, at another hotel.

Now, there are several other blockchain startups in the travel space that are planning an ICO this year. A few of them were listed in an article last month. Doing a bit of searching I came across around 30 projects that have either recently completed, are in the middle of, or are planning a token sale in 2018.

However, from an investor point of view, it’s difficult to tell which projects are actually planning to follow up on the ambitious plans outlined in their whitepapers, and which ones are… well, scammy ones. While it does feel good seeing projects like Winding Tree evolving beyond the white paper, and actually building the products they’ve been paid to build, it’s no secret that the unregulated ICO space is still considered the Wild West of investing.

Crypto has some of the most brilliant minds out there but also the most greedy ones. There are too many bad actors taking advantage of investor FOMO (Fear Of Missing Out) and we need to shake them out before the crypto movement can really progress.

On cryptoassets, ICOs and bubbles

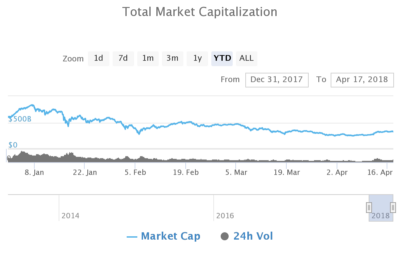

The total cryptocurrency market cap has fluctuated wildly since the start of the year, from a high of over $800 million to a low of $250 million. Even so, this is up around 2000 percent since March 2017. As it grows, I’m having an inner fight with myself. One day I keep thinking it’s going too fast, this bubble is going to pop soon, and the next I get a feeling of “we haven’t seen anything yet, just wait until the rest of the world finds out”.

Total market capitalization for crypto.

I think the rest of the world is just starting to find out now but I don’t believe cryptoassets are in a bubble, yet. The industry is still in its infancy and institutional money is still holding off on entering the market, primarily due to uncertain future regulatory measures.

Being in a bubble isn’t a bad thing though if we end up benefiting from the innovation which gave rise to it, but I expect the market cap to reach the trillions before we need to start worrying about bubbles and crashes (I don’t consider the crypto market’s 30-40 percent swings every other month crashes). It’s also worth noting that Bitcoin already crashed several times in the past but came back stronger each time.

Even though we might not see a crypto collapse yet, if at all, most ICOs launched in 2017 will fail, to an even larger extent than regular tech startups. A recent report from Deloitte showed that out of all open-source blockchain projects created on GitHub since 2015, only eight percent are still active, defined here as having been updated over the last six months. Recently we also read that nearly half of last year’s ICOs have failed already.

While they have democratized fundraising and lowered the bar for entrance, ICOs come with higher risks for investors than traditional VC. There are many inexperienced teams and entrepreneurs out there now holding a lot of money, and it isn’t unlikely that we’ll see an even higher failure rate than in Deloitte’s report.

However, expect this number to go down quite a bit in 2018, as the ICO market matures and moves beyond the white paper-only projects. Fraudulent fundraisers will be fewer as regulators finally start coming down hard on them, and it will be uncommon seeing companies run their token sale without a single line of code or any high profile partnerships to show for.

The dominance of Ethereum

The large majority of companies running an ICO are building their solution on top of the Ethereum blockchain, illustrating Consensys founder Joseph Lubin’s point about Bitcoin being an app while Ethereum is an entire app store. At the time of writing, 91 of the top 100 tokens, per market cap, are based on Ethereum.

This dominance is reflected in the number of transactions happening on the blockchain. In January, Ethereum was regularly processing more than one million daily transactions, three times Bitcoin’s number (the numbers have gone down a bit on both chains now).

These are impressive numbers considering that Ethereum only has a handful of applications with a substantial amount of traffic running in production yet, so most of these transactions are from crypto trading only. And while today’s numbers are manageable, some of Ethereum’s planned scaling measures need to be implemented before too many of the major dapps move to production, or network congestion could get really bad. The CryptoKitties fad showed us how quickly one dapp is able to gain massive adoption, but also the network’s limitations.

Most dapps will likely have volatile user bases. Switching costs are zero (except for a minimal miner’s fee when transferring your funds between wallets) and with open-source projects, anyone could fork your code at any time and try to attract users to their own version of your application or protocol, offering a slightly modified, or just cheaper, service.

So your business model needs to have some elements to protect you from this scenario. This is where the importance of a well-designed token economy to fuel network effects come into play.

The tokenized future of blockchain in travel

Coins and tokens are far more than just speculative assets. The currency and store of value aspects are probably the least exciting use case for them. Most of the tokens out there were never designed to be used as currencies anyway — Some cryptoassets are cryptocurrencies but not all cryptoassets are cryptocurrencies.

They are a new asset class that enables decentralized platforms and applications, and the tokenization of real world assets. This makes looking at how tokens serve as a new mechanism for ownership far more interesting than their use as currency, hence why I prefer the term cryptoassets over cryptocurrencies.

Regulated security token offerings are coming as well and we’re only just seeing the start of these now. Among the first companies who reportedly have filed their ICO with the SEC, is ShoCard, who are building a ‘Single Travel Token’ aiming to streamline the airport experience for travellers.

Platform tokens like Ethereum’s Ether, and utility tokens like Winding Tree’s Líf and GOeureka’s GO, represent the next phase of the Internet. Protocols and dapps like these are going to decentralize industries and the web itself piece by piece, bringing blockchain technology to the masses.

Through seamless user experiences serving as an abstraction layer, users won’t have to relate to or understand the technology itself anymore. And the satisfaction that comes from instant payment and settlement, and moving funds between dapps, will gradually see these applications outperform their centralized counterparts and bring mainstream adoption of cryptoassets.

So…fizzle and flop? Or crackle and pop?

It’s been said about confirmation bias that one of the best ways to figure out whether or not you’re right, is to actively look for information that proves you’re wrong. Now, my views may be a bit coloured after having spent a lot of time in the crypto echo chamber lately. Still, I dare say, if you’re a sceptic, don’t write off cryptoassets as noise and an unnecessary use case for blockchain technology, before thoroughly researching and understanding the potential that lies in asset tokenization.

And travel industry executives need to stop playing blockchain buzzword bingo soon. It’s time to actually start paying attention to the rapidly emerging, parallel crypto economy, or you risk getting left behind at the station. Ignore at your own peril.

However, to answer my question in the article title; no, it’s still very early days and mass adoption is probably a few years away. Blockchain is immature and experimental tech, and doesn’t scale well at all. Roy Amara’s adage is fitting here: “We tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run.”

Opinions and views expressed by all guest contributors do not necessarily reflect those of tnooz, its writers, or its partners.

![]()