Wake up – loyalty means nothing without a quality experience

By cameron in Uncategorized

Real loyalty is elusive so many continue to rely on discounting or ‘payback’ to encourage purchases. Though this approach works, it does not foster sustainable loyalty, and puts travel brands in a vulnerable position.

A survey, published by the Expedia Affiliate Network and Points during the Eye for Travel Summit, is labeled as “a wake-up call for sleepwalking loyalty programs.”

The research, conducted by Atomik Research in October 2017, features feedback from 523 senior employees of offline and online travel agencies, corporate travel agents, loyalty companies and airlines from Europe, the Middle East, the Americas and Asia.

84% of respondents say they have experienced growth in loyalty over the past two years.

The highest percentage gains come from respondents in France (94%), China (90%) and Brazil (85%); 74% of US respondents say loyalty has increased.

While this sounds like good news, many attribute this performance to discounts that dilute revenue and to a number of factors outside of the quality of their product and services.

61% of all survey respondents said they rely heavily on discounts, despite doubts about their efficacy.

Brazil is the top discount travel market, with 72% of respondents in the country saying they rely on discounts.

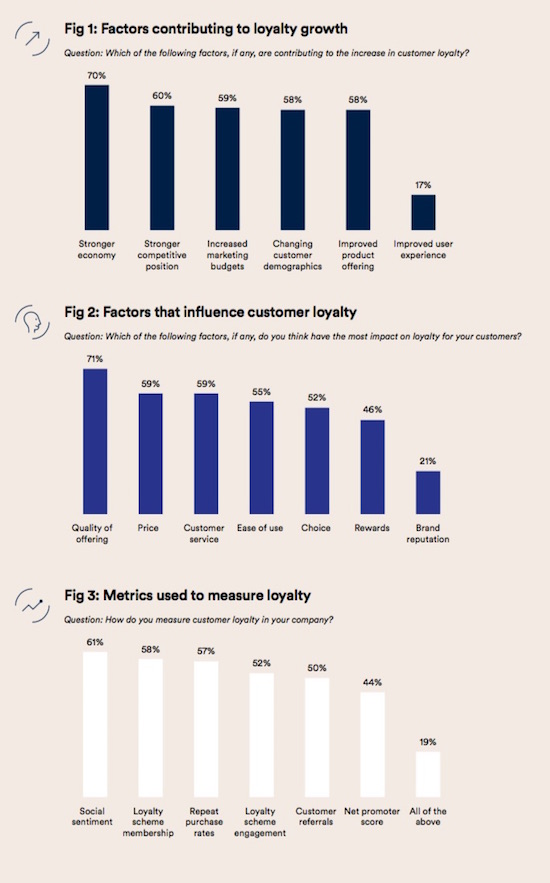

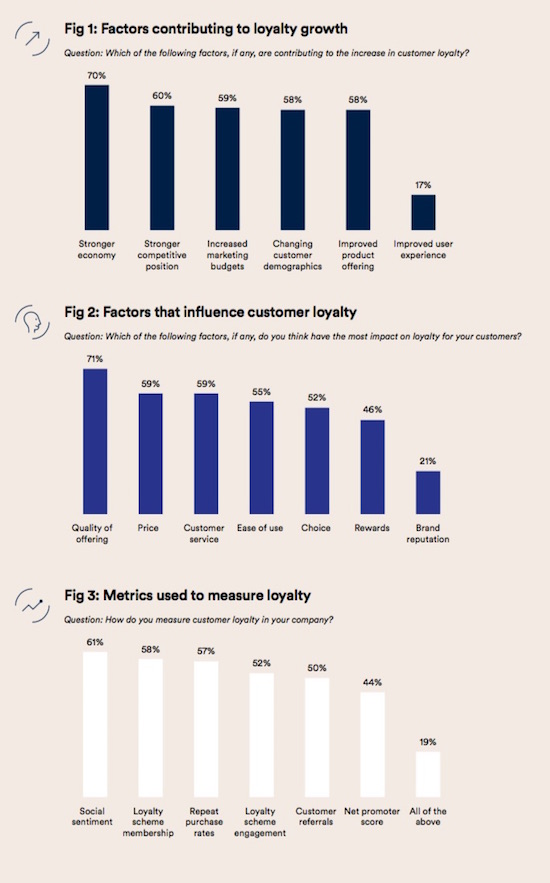

The majority of survey respondents cite external factors such as a stronger economy (70% overall, 88% in the UK and 82% in Brazil), increased marketing spend (72% in the UK and 73% in Japan) and changing customer demographics, as the key to their loyalty gains.

Pay-back

Points and miles programs have been profitable for airlines, creating a new source of revenue when it was most needed.

Points and miles are used by 52% of respondents, rising to a peak of 82% in the UK.

Whether they have encouraged flyers to fly more often with an airline is a matter of debate. After all, with shrinking competition in key markets some may fly with a particular carrier out of necessity and not because they happen to be part of the airline’s mileage program. Nonetheless, they have become habitual both for the brand and for consumers.

As Stuart MacDonald, vice president and general manager, Points Travel says:

“Ultimately, the key to winning loyalty is still winning over the customer, and as the survey shows there’s still great value in loyalty points and miles, which remain a top loyalty investment worldwide. There’s a reason why the investment in such programs remains so high. Efficiently leveraging proven loyalty tactics—coupled with emerging innovation and data science—continues to drive efficient results. Points Travel empowers programs to drive additional member engagement through rich points offers and additional redemption opportunities on hotels and cars, worldwide.”

Points and miles can encourage repeat bookings, and programs can also supply valuable consumer information that can form the basis for better personalization, but the value of loyalty currency varies depending on the quality of the brand backing it.

Results from the airline industry show that, while the sky may have no limits, there is a ceiling to the effectiveness of miles.

The airline industry is the least likely to report loyalty growth, with 71% pointing to an increase over the last two years and 29% reporting no change. Loyalty companies are the second weakest sector for growth, with 79% reporting an increase.

Earned loyalty

The most enduring loyalty is earned loyalty—when a consumer will go out of his/her way to buy from a brand because it delivers quality product and services consistently, with only moderate consideration of the price. So long as the brand continues to deliver at a high standard, that type of loyalty is weatherproof—it can withstand changes in the marketplace and competition. As Apple shows, discounting doesn’t ever have to factor in the equation.

Travel brands surveyed recognize the importance of a quality offer in boosting loyalty.

71% of respondents said quality of offering had the greatest impact on loyalty and that customer experience and improved breadth of product and service were valued more than discounts by their customers.

But there seems to be a fear of breaking away from discounts as a marketing tool and also a reticence to invest in improving the quality of the product and service offering.

Only half of respondents said they are working to improve their product range and their customer experience, and 33% are working on improving their breadth of product and service offering.

Qu’est-ce que c’est loyalty?

The adage is that you can’t improve what you don’t measure, but you also can’t measure what you can’t define.

The EAN/Points survey reveals little consensus on how to measure loyalty, and few respondents take a comprehensive approach.

The most popular measurement tactic overall is social sentiment (61%), but there are significant regional differences: social rises to a high of 80% in the UK, but plunges in parts of APAC, falling to 34% in Korea and 30% in Japan.

Social sentiment may be a useful tool for tracking reputation—certainly a poor reputation will not help loyalty—but the buzz around your brand may not reflect the business of it. An airline can have a bad reputation or negative sentiment clouding over it but still continue to enjoy full aircraft because of market control. Market dominance is not loyalty, but the accountants don’t care until market dynamics change.

Loyalty survey from Expedia Affiliate Network and Points

Hacking loyalty

Earned loyalty—where the brand is the go-to brand even in cases where it is not the cheapest offer in the market—can be hacked. Ease of use and “sticky” features that offer non-monetary benefit to consumers are features that can be engineered into the sales funnel.

Though new ideas like personalization and gamification are believed to be effective, particularly by the airline industry, very few companies are actually doing it (30% and 57%, respectively).

Tnooz spoke with Oliver Hoare, senior director business development at Expedia Affiliate Network who shares his views on the learnings of the report as well as ways in which brands can develop habit-forming systems that encourage repeat buys and are resistant to market changes.

Hoare says:

“I think what’s important is to look at the different tactics of what companies do for loyalty versus what people want for loyalty. What companies usually do most in loyalty is discounts and coupons, personalization and it’s earning points or miles. If you look at what is very effective, in terms of tactics, it is breadth of product and service and improving customer experience.”

“It is really important that companies do start to see when we talk about loyalty that it’s not just a race of the bottom in terms of seeing who can offer the lowest rate possible.”

UX is critical to loyalty, both in IRL and in digital touchpoints.

“Real loyalty is built from ease of use, customization and customer service. These things are harder to do. There are two clear channels from an Expedia point of view, via our template solution and via API. Both have great levels of product and quality of content. One allows a very low-touch, great ease of use from a consumer point of view. Other, by API allows partners to build their own bespoke solution while still having that same breadth of supply loyalty and content that allows them to really focus personalization.

“One of the success stories that we rolled out a few years ago is hotels.com Partners. It’s essentially the hotels.com platform, that is constantly optimized and has a very large amount of A/B testing. What airlines want is this quality of usability and service, but selling hotels is not their core priority. Their core priority is flying planes all of the time, and let us convert the template to use it as an optimal Customer Service offering.”

Engineering loyalty is an ongoing process, and it will require bold moves, but it doesn’t have to turn the business upside-down.

“I would say that loyalty is incredibly important, but were not looking to completely revolutionize, were looking to optimize. That can be done in many different ways. But, just offering loyalty at a reduced rate is not loyalty. That’s just an opportunistic buy.”

Related reading:

Does your travel experience drive customer loyalty?

Cracking the code to make airline loyalty count

Designing a loyalty programme around the modern day traveller

![]()