The $28 billion opportunity for hotels

By cameron in Uncategorized

Sponsored by iSeatz.

Ancillary bookings represent a significant opportunity for hotels to add revenue while increasing guest engagement. The airline industry adopted the practice of cross-selling and up-selling trip extras more than a decade ago with impactful results. How can hotels do the same and best complete their guests’ travel experience by offering products beyond hotel rooms?

iSeatz, a technology company specializing in custom, brand-driven ancillary booking solutions, partnered with Phocuswright to research the business travelers’ interest in purchasing trip extras from hotels. The results from that research are presented and discussed in their new white paper, Business Travelers and their Demand for Ancillary Services.

This article will share some of the findings of the new white paper, which show that the majority of business travelers surveyed are very interested in purchasing either on-site or off-site extras. The research also identifies business traveler segments and details the preferences on when, where, and what extras business travelers are interested in buying.

The hotel dilemma

Hotels, both large chains and independent boutiques, can learn from other companies in the travel sector who have successfully implemented an ancillary sales strategy. Airlines were quick to offer ancillary services more than a decade ago. Now these non-core services such as priority booking, baggage fees and car rentals make up an estimated US$28 billion in revenue annually for the top ten airlines. This trained travelers to purchase travel add-on services during checkout, and at other cross-sell merchandising points such as confirmation emails.

Hotels that participated in the white paper cited reasons why they do not currently offer ancillary services. Many talked about resources, including a lack of technology to streamline ancillary offerings for both on-site and off-site trip extras. With many hotels having their staff and management doing multiple jobs, hotel management is reluctant to add another task to management’s plate. This highlights the need for digital ancillary technology to address these valid concerns and reduce such effort while simultaneously scaling the operation.

Both general managers and revenue managers alike understand the need to offer a positive experience to their guests and to create loyalty to the hotel brand. Based on our research, managers are focused on perfecting the on-site process, instead of branching out and offering new services to differentiate their brand from their competitors.

Business traveler interest

Guests – especially business travelers – are interested in an integrated, seamless travel experience. Many business travelers make their own travel arrangements. Unlike leisure travel, business travelers are still expected to be connected to the office, juggling multiple tasks and deadlines while traveling. With their focus split between the office and traveling, business travelers are receptive to offers that will make booking their trip easier.

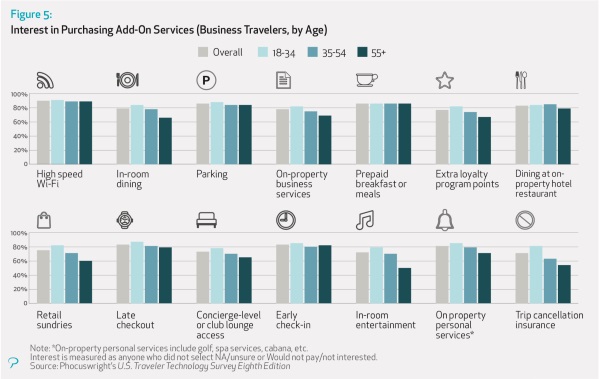

Since many travelers expense costs back to the company, ancillaries that increase productivity provide value. Trip extras that increase productivity include wifi access, early check-in/ late check out to continue working between meetings and travel. More than 70% of business traveler respondents indicated they are interested in purchasing more than core hotel products such as on-site dining, retail sundries and transportation options.

The research shows that the average business traveler is between the ages of 25-45 and is enrolled in at least one hotel loyalty program. These travelers also go on trips more often than the average leisure traveler. Younger business travelers are also interested in mixing work and play, with 12% of surveyed business travelers taking advantage of “bleisure” travel. Additionally, many business travelers are interested in booking products such as trip cancellation insurance (45%), high-speed wi-fi (41%), parking (41%), transportation options (23%), and museum/attraction tickets (25%) at the time that they are booking their stay.

(Click on the image to open a larger version in a new window)

Another opportunity to promote trip extras is once business travelers are in-destination. Many travelers were open to offers from the hotel for in-destination trip extras and were open to booking these ancillaries once they arrived. Business travelers surveyed were most interested in purchasing off property local dining (36%), access to fitness/wellness activities (32%), and tickets to live shows/ events (31%), while in destination or on the day of service.

So how can hotels make this happen?

Given the demand for ancillaries identified in this research, hotels can be confident in offering these as a means to increase engagement with customers and build loyalty through the entire customer travel journey.

Hoteliers wants their guests to have a fulfilling experience while staying on their property. Customer loyalty programs have increased in importance and hotels understand good customer service and customer loyalty is imperative to future growth. Business travelers are more loyal than the average traveler with 59% belonging to at least one travel loyalty program.

An ancillary strategy that is managed and implemented, with constant communication at the individual properties, can offer a consistent guest experience across the brand. Off-site ancillary offerings are opportunities for hotels to access more wallet-share for the business traveler’s trip. Offering car rentals, or restaurant reservations through strategic partnerships and additional loyalty points add revenue streams to the hotel, boosting profits without increasing ADR.

To learn more about the business traveler’s interest in ancillary services, download the complete white paper Business Travelers and their Demand for Ancillary Services, here.

To learn more about iSeatz and how we can help build a customized ancillary strategy for your business, please visit iSeatz.com.

This article by iSeatz appears as part of the tnooz sponsored content initiative.

![]()