Listen up: voice assistants are not quite ready to fly

By cameron in Uncategorized

A review of retail trends among US consumers prepared by comScore reveals that voice assistants such as Alexa and Google Home may not be quite ready to help consumers transact in meaningful ways.

While the price points to acquire these devices and the buzz around them have made them popular household gadgets, and 77% of owners say they really like having smart speakers in their homes, most of those who own the devices are not using them for consumer transactions.

In fact, the top four reasons for buying a smart speaker were: 1) to use it as a speaker to play audio, 2) to have a new fun gadget at home, 3) because of hands-free interactions and 4) it was a gift.

The most common comments about voice assist devices were that they are useful (71%) and makes life easier (54%) and important in their daily lives (40%); but they seem to be useful in ways that are not particularly meaningful to brands.

The top 5 most common uses are:

- checking weather (81%)

- asking general questions (77%)

- streaming music (74%)

- Timers/alarms (60%)

- news or sports updates (48%).

30% of owners use these devices for home automation features.

The bottom-five least common uses for devices include:

- sending/reading text messages or emails (15%)

- ordering food/services (13%)

- getting stock price information (13%)

- translating languages (9%)

- and financial services unrelated to the stock market.

Only 18% will use their home smart speaker to find local businesses or make reservations; whereas 81% will use these devices to check the weather.

That said, as many as 30% of owners have used the home assistant device to buy something, 13% of them to buy food/service, but financially sensitive activities raise security concerns among consumers.

More than two-thirds (69%) of owners said they were concerned about security when using their devices and 36% expressed concerns over privacy.

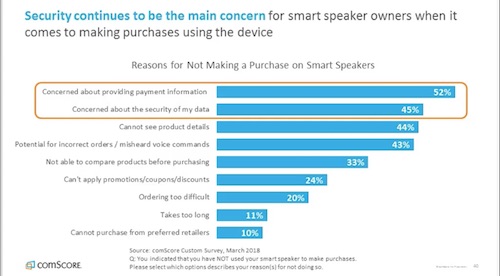

More than half (52%) of owners were concerned about providing payment information via a voice assistant and 45% were concerned over the security of their personal data. As many as 43% were concerned over the potential of incorrect orders or misheard voice commands.

Most relevant in a travel context, 33% says they wouldn’t make a purchase on a voice assistant device because they are unable to compare products before purchasing, 20% say transacting is too difficult and 11% say it takes too long. These responses were to consumer goods purchases, which are less complex than assembling a travel itinerary.

Even if some of these hurdles are overcome by smoother user interface, including with the introduction of visual home assistant devices—like advancing Siri function on an Apple TV which might ultimately display the item searched for on the screen—these speakers are not building brand loyalty.

As many as 42% of users referred to their needs in generic terms (laundry detergent) rather than specifying a brand (tide). The inherent query and search functions programmed into these devices also steer consumers away from brands; 18% say the speaker had suggested a brand they haven’t ordered before and only 38% of speaker queries asked the consumer to specify a brand of the product they needed.

Speaking out

For travel brands, this may mean that having a position in the voice assistant landscape is less meaningful unless the function is directly related to common queries such as weather at the destination, a countdown to the holiday, traffic advice when heading for the airport, or specific travel tips.

But if the home assistant isn’t expressly programmed to prefer travel branded data over generic data in this regard then these functions may not pop up.

For example, if a traveller wants to know the weather in Paris over the coming week of their trip, what brand touchpoint can be forced into the query? What is to keep Google Home from just answering the question based on weather even if a travel app also supplies this information? If Google Flights now claims to predict flight delays better than airlines, what will force a flight status query via American or Delta or United, etc.?

While voice search is buzzy, it’s not ready for prime time. Probably the best use of time is to explore entertaining applications that play-up to how users use devices—a travel branded playlist of music to set the mood for the next trip, or a quick language course to help polish skills before the journey, or a branded travel tips/destination guide pod-cast which travelers could listen to as they count-down the days.

Again, the key thing would be to find skills that align with the natural interactions between device owners and their devices and which would be unique enough that the speaker’s algorithms would not prefer standard query results.

Another solution to the brand dilution dilemma might be to make “ask brand” a query prompt. For example, “Alexa, ask Air Canada to recommend the best poutine in Montreal” could tie-in to Air Canada’s well-established annual Best Restaurants list.

In this sense, the objective of the travel brands’ voice assistant feature is not transactional, which can be better delivered through mobile apps or desktop, but as a brand content platform that helps highlight expertise and build familiarity.

For airlines, “What’s showing on my flight?” may also be a useful voice assistant skill. It would be an excellent way to share the quality of the in-flight entertainment catalogue.

If an IFE supplier can help tie that voice skill into a programming selection mobile app so that the films the flyer selects are queued up to play in the cabin, then even better.

Related reading:

How the rise of bleisure among Millennials is shaping travel technology

With Facebook’s chatbot M dead, how will text based AI for travel fare?

![]()