Metasearch power plays: What hoteliers need to know about staying competitive

By cameron in Uncategorized

This is a viewpoint from Tim Davis, CEO at PACE Dimensions.

Most hoteliers understand how metasearch advertising influences the deals visible to consumers. Bid too low and your listing won’t show. Bid too high, and your customer acquisition cost is out of line.

To further understand this dynamic with an eye on how hoteliers can compete in metasearch, we turned to the data to see just how the big players dominate the metasearch listings. With that information, we can see where hotels stand the best chance of being seen.

The maturation of metasearch

Metasearch sites account for over 45% of global unique visitors in travel, according to PACE Dimensions’ analysis of SimilarWeb data for the top 10,000 travel websites. This is greater than the proportion of unique visitors for OTAs, both globally and in the US.

In fewer than ten years, hotel metasearch comparison has progressed from nothing to a sector that generates in excess of $6BN in advertising.

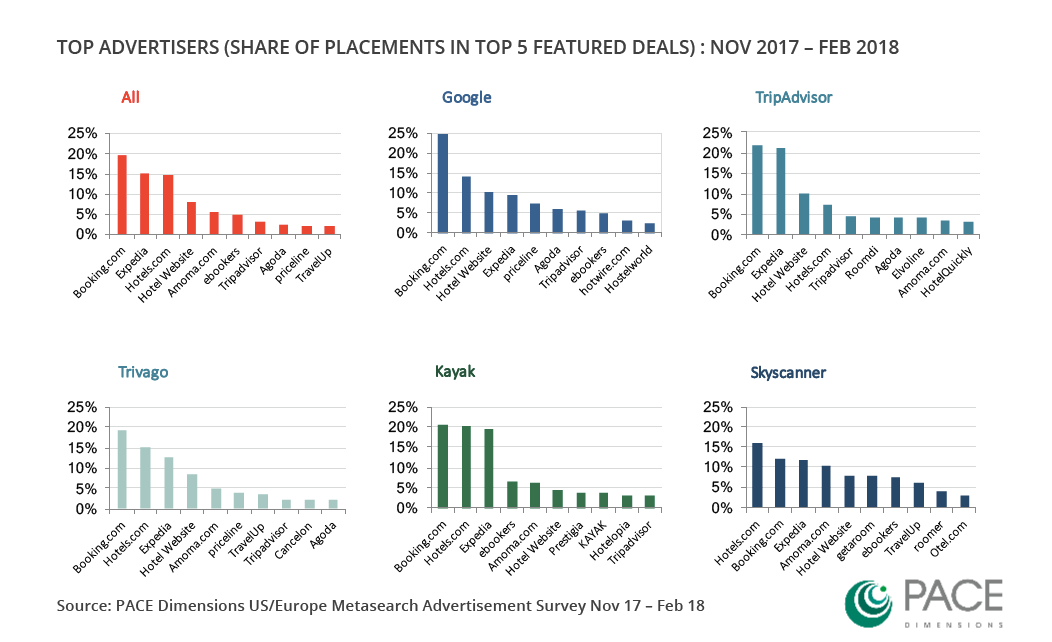

As part of a wider piece of research into digital media and online retail for travel and hotel bookings, PACE Dimensions analysed the top advertisers by metasearch site. This included over 10,000 metasearch results for the share of featured (i.e. easily visible) deals attributed to leading advertisers. The assessment was conducted in October 2017 and reviewed the top five hotels listed in each search for each of the leading metasearch comparison tools: Google, Trivago, TripAdvisor, Kayak and Skyscanner.

Here’s the share of placement mix across popular metasearch platforms, which informed the analysis that follows:

Implications for hotels

Booking.com remains the leading retailer in metasearch. Despite reports that Booking.com pulled back on digital advertising spend at the end of last year, it still retained a 20% share of top placements averaged across all metasearch sites. Booking.com had the highest presence on Google, with a 25% share of top placements.

The two biggest players outspend all hotels combined. Booking Holdings and Expedia outspend all hotel brands combined. Hotel company advertising generates only an 8% share compared to a 52% share for Expedia and Priceline companies.

Despite reports of rivalry, Booking.com still leads on top spot placements for Trivago. Based on our research, Booking.com had a 19% share of top placements on Trivago. Booking.com had a lower total share of top placements than Expedia companies combined (including Hotels.com) on Trivago, but still led all other advertisers.

Hotel websites fared best for top spot placement on TripAdvisor and Google. Hotel websites had greater visibility on Google and TripAdvisor, as the top three advertisers on these platforms. By contrast, hotel brands fared worst of all on the combined flight and hotel metasearch sites: just a 7% share on Skyscanner and 4% on Kayak.

Power in ownership

Our research highlights the role of ownership and allegiances behind the main metasearch players. While Google and TripAdvisor have independent status (given that they are not affiliated with a retailer), Booking Holdings owns Kayak, Ctrip owns Skyscanner, and Expedia owns Trivago. Media-owned metasearch comparison sites (TripAdvisor, Google) drive more direct traffic to hotel companies while those owned by retailers drive nearly all their metasearch traffic to retailers.

What’s more, the market power of Expedia and Booking Holdings creates significant barriers to vertical integration for Google and TripAdvisor. TripAdvisor’s attempt to introduce instant booking caused resistance and was ultimately scaled back, showing how challenging the environment can be.

So, what next?

The industry will continue to be shaped by the weight of the big players. Metasearch is maturing and consolidating, reducing the breadth of competition. A few key players hold most of the power, making it unlikely that smaller new entrants will succeed.

Consumers’ tendency to “single home” during the search and planning phase means hotel companies need to be visible on all major comparison sites. But, as we’ve seen, the big retailers outspend hotel companies all of the time. This makes it even more challenging for hotels to gain visibility for direct bookings when dividing advertising spend between multiple channels.Transparency will continue to be an issue.

While hotel metasearch sites help consumers compare a wide range of providers it is not made clear to them how top spot listings are advertising dependent. Metasearch sites give the impression of responding to customer requirements but are not entirely upfront about the factors affecting visibility. This includes retailing practices like price framing, where the difference between the highest and lowest available price is misleadingly presented as a discount.

Emerging technologies will accelerate the lead of the key players. Of all the emerging technologies, artificial intelligence will have the most significant impact on the market. It will favour the large-scale leaders with the money to invest and large quantities of customer data. This will enable the leaders to make more accurate predictions about consumer behaviour and more meaningful moves towards personalisation during the search and booking process.

Disruption. Airbnb and other private accommodation providers will increasingly compete with hotels through metasearch channels and OTAs who combine both types of listing in the same display. As Airbnb begins to sell independent hotel rooms via its own platform competition among retailers may increase with the potential to put pressure on commission rates.

Given the maturation of the metasearch sector, new entrants are more likely to come from other established media or multisector retail companies. This could include the likes of Facebook or Amazon, given their established consumer bases, vast access to consumer data and significant spending power.

Opinions and views expressed by all guest contributors do not necessarily reflect those of tnooz, its writers, or its partners.

![]()