A data dive into the power and positioning of Google Flights

By cameron in Uncategorized

This is a viewpoint from Gitit Greenberg, director of digital insights at SimilarWeb.

When the biggest name in technology decided to create a targeted product for travel in 2011 it set off alarm bells across the industry. Google is such a massive player that involvement in almost anything has a ripple effect that fundamentally reshapes entire sectors. Yet, for all the hype, Google Flights has been a relatively minor player in the overall online booking space. Until recently.

Over the last few years, the online giant’s foray into flight bookings has become a more substantial factor with a major impact.

As airline brands increasingly look to establish direct channels to potential customers, any source that can provide this access becomes critical. This increased competition also directly affects the metasearch market, long dominated by the likes of Kayak and Skyscanner who make their impact by directing traffic to OTAs and brands themselves.

The OTAs are also watching these changes closely. Though Google’s VP of travel and shopping, Oliver Heckmann, categorically stated, “We are not becoming an OTA… either now nor in the future,” changes can happen so rapidly that these words should be taken with a very heavy grain of salt.

So, how could it impact the wider ecosystem? Consider the following scenarios and their potential impact on the different levels of the flight booking space.

Airlines

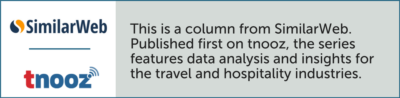

The brands with the most to gain from this move are likely the airlines themselves. Looking at the three US-based airlines that received the highest proportion of traffic from Google Flights’ referring URL, googletraveladservices.com – alaskaair.com, united.com, and flyfrontier.com – it becomes clear how big the benefits could be.

These sites are seeing around 20% of their overall desktop traffic coming from referrals – or traffic that begins from a third party site. While Google Flights does have a slightly different structure, including a potentially paid component, the nature of the format most aligns with referral traffic.

Of this traffic, between 24% to 30% is coming from the obvious destination and industry leader, kayak.com. While alaskaair.com only sees 4% of their referral traffic from Google Flights, united.com and flyfrontier.com are seeing 29% and 30% of referrals respectively.

These numbers align with Kayak and even surpass them in one case, providing a clear indication of the potential Google Flights has to fundamentally disrupt the way traffic arrives to top airline brands.

SimilarWeb – Referral traffic to airline sites

This change is taking place alongside a wider trend where airlines are making a strong play to grow their direct traffic to the site. The combination of an increasingly competitive referral landscape and a growing desire to own more of the traffic flow to their own internal site could have a massive impact on the metasearch sector.

OTAs

The aforementioned promise aside, if Google Flights continues to succeed, an expansion into the most lucrative side of the travel business may be inevitable, with signs pointing to the move happening sooner rather than later.

OTAs are hubs for transactions in flights, hotels, car rentals, tours, attractions and more and the ability to sit at the center of these transactions may be too much to pass up. Google’s move into becoming an OTA would be particularly interesting because it leverages a strength that the average metasearch engine has – organic search – with the capacity to own the conversion process more fully.

Of all of the decisions, few would be as likely devastating for the wider industry. Playing a referral role would help support brands but potentially hurt metasearch engines and OTAs.

On the other hand, staking their claim on the conversion itself would fundamentally shake up the process stripping away the potential values to the airline brands, metasearch engines and other OTAs alike. These factors may limit the ultimate entry into this type of model, but the ramifications are fascinating to consider.

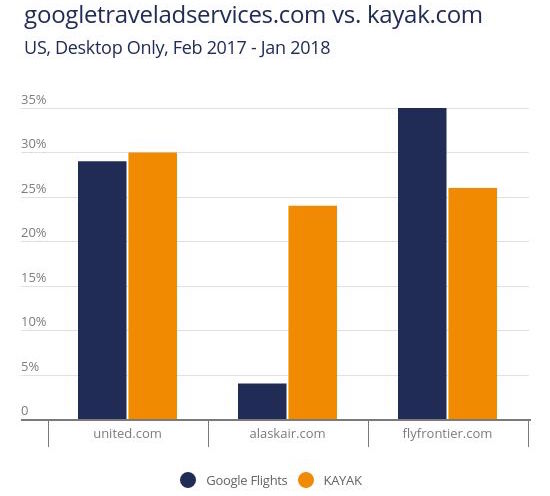

On the positive side for current OTAs, it also seems like the least likely option. At the moment, as seen below, Google Flights is actively promoting OTAs alongside brands. This move seems like a clear attempt to placate the OTA interests and navigate their entry into the market carefully.

Flight search on Google Flights

Metasearch

Leaving the most likely for last, the metasearch sector may be the most vulnerable to a major rise by Google Flights. These sites rely on their status as the ideal cog in the connection between customer and seller – whether it be a hotel or airline.

The presence of Google Flights here is significant because the tech titan already dominates, and is so closely associated with, the search process. If they can manage to improve their capacity to connect customers and brands more effectively while becoming a channel of choice for customers, the impact would be massive.

The key may be in organic search and direct traffic. Companies like TripAdvisor drive huge amounts of traffic with a massive content base that touches on the primary needs a potential traveler may be looking for.

Others place a similar emphasis on their brand strength to increase direct traffic and the clear relationship with their customer base. The result is that a huge share of traffic for top metasearch engines comes from these channels. The focus on brand and search is critical as it may be the primary means of keeping Google Flights at bay.

Opinions and views expressed by all guest contributors do not necessarily reflect those of tnooz, its writers, or its partners.

Photo by Omar Prestwich on Unsplash

![]()