Airbnb pounces with ads against OTA commissions and a survey showing dissatisfaction among smaller hoteliers

By cameron in Uncategorized

A new front has opened up in the battle for hotel bookings: OTAs vs Airbnb. After Airbnb announced its intentions to open up its platform to hotels, there were major implications for stakeholders across the travel and hospitality industries.

Airbnb wasted no time in going on the offensive, launching a new ad campaign directly challenging the OTAs on how much money is taken as a commission from hotels. In this case, size does matter, as hotels aggressively push towards increasing direct bookings through a variety of methods.

The ad, shown below, asks hoteliers to consider Airbnb as a means to reduce reliance on the ‘big OTAs.’ The company has touted its much lower commission structure, anywhere from 3% to 5%, as a key benefit for hotels. And of course, this lower commission structure certainly threatens to upend the business model of the OTA incumbents.

In an open letter to hoteliers, other features of Airbnb’s hotel offering include no contracts, ability to differentiate hotels from rooms/whole homes on Airbnb search, and access to Airbnb’s global demand generation engine. The company also promised, “new tools coming soon.”

For their part, OTAs are being forced to consider how to deliver greater value to hoteliers. Just last December, Expedia announced its plans to expand its offering to include technology solutions to hotels — moving beyond just being seen as a distribution channel to be a ‘platform for hotels.’

Survey says: Dissatisfaction among hoteliers

Airbnb also commissioned a study of how hoteliers feel about the OTAs. With the usual caveat around company-sponsored research, it’s worth considering the findings which show how vulnerable OTAs could be.

If the findings are accurate and represent true sentiment, there’s plenty of room in the mix for another large distribution channel. In general, more competition is a good thing. Quality comes up and prices go down. This is a good thing for both hotels and travelers.

The survey had a small sample size of 49 owners of small accommodations. The majority (74%) owned B&Bs, followed by owners of boutique hotels (20%). The rest were scattered among hotels, inns, and motels, with a few non-owner GMs included in the results.

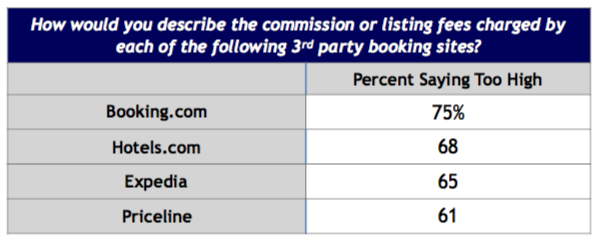

While not a washout, clearly this cohort thought booking/listing fees were too high across the major OTA players:

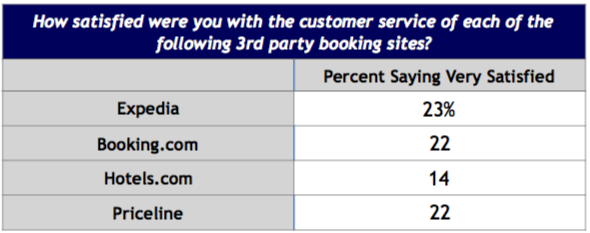

Customer service was also an issue with nearly 3 in 4 of those surveyed. This shows how challenging it can be to serve smaller operators — for Airbnb to be successful, it’s really going to have to step up and fulfill this promise.

By calling it out here, the company has drawn a line suggesting it will provide better customer service. No easy feat, given the expense of populating the world with local market managers that liaise with hotels.

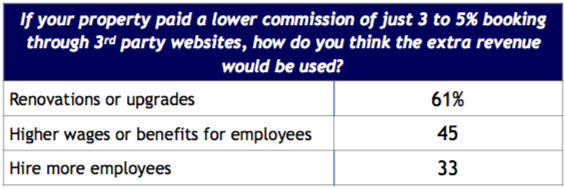

When it comes to using savings, the hoteliers would use the additional revenue made from lower commissions to improve properties, offer wage increases, and hire more people. Of course, this money could also simply increase the profitability of operations.

There’s no guarantee that any commission savings would be passed on to the guest in the form of improved facilities or service.

Nonetheless, this is shaping up to be a powerful argument from Airbnb to hoteliers: we take less money so you can offer a better guest experience. And a better guest experience increases loyalty and creates a virtuous circle.

The full survey results are below.

Photo by Alexandre St-Louis on Unsplash

![]()