Which stakeholders stand to benefit the most – and least – from Airbnb’s quest for a billion guests?

By cameron in Uncategorized

With last week’s rapid-fire announcements, Airbnb has joined the ranks of ‘companies that freak the industry out,’ such as Google. Just observe reactions to Google’s latest move in travel: Google is coming for us!

While this mass hysteria is usually overblown, there’s a similar reaction afoot when it comes to Airbnb. After the company announced its roadmap to one billion guest arrivals by 2028, the American Hotel and Lodging Association released this statement:

“Airbnb’s latest scheme is just further proof the company is trying to play in the hoteling space while evading industry regulations. If Airbnb wants to enter the hoteling business, then it needs to be regulated, taxed and subject to the same safety compliances and oversight that law-abiding hotel companies adhere to.“

The statement goes further, pointing to commercial operators that use Airbnb:

“The question that cities and neighborhoods should be asking – will these ‘Plus’ or ‘Boutique’ listings include commercial operators exploiting Airbnb’s platform to run illegal hoteling schemes that have fractured our communities, raised serious safety concerns and increased the price of rent while depleting affordable housing options?”

Surely, Airbnb is not a nefarious destructor of communities and as bad of an actor as the AHLA says…right? Or is it really that the AHLA’s job is to protect the interests of its members — and thus the direct and sustained pushback against all things Airbnb?

Who’s right and who’s wrong? Who should really be afraid of Airbnb’s quest to leverage its platform to book one billion guest arrivals by 2028? Let’s take a look at how this ongoing disruptive force may play out in travel for a variety of stakeholders.

Hotels

Since the start, hotels have been the most vocal detractors of Airbnb. The knee-jerk reaction early on was a classic travel industry trope: that the pie was only so big, and Airbnb’s gain would be hotels’ loss. Well, this Pie Theory is just wrong. Travel continues to grow at around 4% a year, meaning that there’s always new market share up for grabs. The pie is expanding.

And there’s an argument to be made that Airbnb facilitates a different type of travel, making certain people more amenable to traveling. Or at least making it so that travelers can go on trips more often. If that’s the case, then these travelers could just as easily be convinced to stay at hotels — after all, Airbnb convinced them to stay at one of their listings. Couldn’t hotels market themselves to these travelers as well?

Beyond the argument against Airbnb as a direct competitor to hotels, there’s one clear advantage: an additional distribution channel puts downward pressure on commissons. If Airbnb manages to maintain its low commission rate as it expands supply (it’s not cheap to put market managers around the world), then hotels could see a significant shift in the economics of distribution.

This is a good thing for hotel owners, and if these savings are passed along, then hotel guests could also be quite happy with their hotel partners. And a happy guest is the first step towards a loyal guest, reinforcing the hotel’s competitive position with the traveler.

OTAs

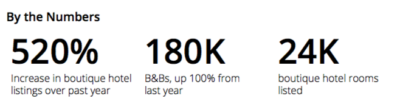

It’s clear that Airbnb can now be considered an OTA. Boutique hotels are already beginning to see their first bookings via the platform, thanks to the partnership with Siteminder. In his keynote address during the company’s 10th birthday celebration, Airbnb CEO laid out additional categories for accommodation beyond Shared Rooms, Private Rooms, and Whole Homes. Those new categories are Vacation Home, Boutique, B&B and Unique.

Airbnb expands hotel inventory.

The evolution of inventory sort is entirely due to the need to serve more travelers, and to connect them to the right accommodation for a specific trip. As travelers stay in hotels for some trips and vacation rentals for others, Airbnb must evolve to keep pace.

The additional categories not only further refine Airbnb’s inventory but also give the company new categories to approach for listing – like Airbnb’s Siteminder partnership, it’s all about expanding access to a variety of accommodation types as Airbnb pushes straight into a head-to-head battle with the now-legacy OTAs.

On the flip side, Airbnb has a massive demand engine that can power it to new heights. The ability to play hard against the massive established OTAs will be made much easier since the company has an in-build demand generator. Plus a very sticky brand, one that will be made more loyal by focusing on experiential brand positioning like Airbnb Concerts and other live events that further establish brand credibility.

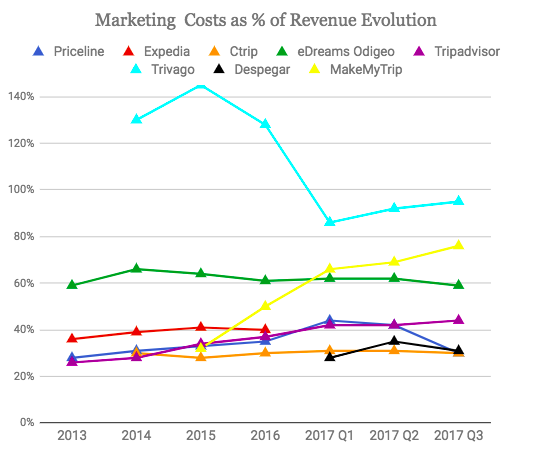

So should OTAs be scared? Yes, absolutely. If there’s not consolidation in the cards (Expedia, ahem, Uber), then once Airbnb goes public, it will be an ever-more-formidable force. Flush with cash, the company could turn on an advertising spigot that rivals the Expedias and Pricelines of the world.

Right now, the company doesn’t need to spend as much on marketing as the OTAs, which means that it can get away with the lower commissions it’s promised. Between lower commissions and less money spent on advertising, Airbnb is poised to shake things up fast.

Image from TravelTechMedia on Medium

Unlike the way that Google risks cannibalizing the ad spend of its advertisers by introducing competing products, Airbnb is able to leverage a robust marketplace of passionate hosts and a different kind of community.

Even with the many professionally-managed listings, Airbnb has maintained a certain level of brand affinity as it has matured. The only brand that comes to mind with a similar fanbase is HotelTonight. Come to think of it, maybe Airbnb should buy HotelTonight…

Destinations

Destinations should be absolutely thrilled about Airbnb’s ambitions. The company touted some stats that show its power in non-major markets:

Guest growth in emerging markets over the past year, per Airbnb.

One of the more compelling arguments against the fact that Airbnb siphons business away from hotels is how the percentage of guest arrivals in the Top 10 markets has shifted over time. In 2009, 88% of guest arrivals were in its Top 10 markets. By 2017, that figure had plummeted to only 14%, meaning that the guests are spreading far beyond traditional — and competitive — hotel markets.

Along that same vein, the number of markets with at least 100,000 guest arrivals was zero in 2009. That number expanded to 265 by 2017, showing that guest arrivals have spread much further afoot as the company matures. This has serious benefits for under-trafficked destinations that can benefit greatly from the additional tourism revenues.

Given that Airbnb can often scale without the need for additional high-impact tourism infrastructures, such as hotels and resorts, many of these destinations can enjoy incremental growth due to Airbnb’s global reach.

Of course, there is a dark side to this growth. As tourism increases, the pressure on destinations also grows. There is the need for shared infrastructure, such as sewers and utilities, to expand alongside tourism growth. The additional dollars into a destination also attracts for-profit professional operators that are outside the traditional definition of the home share economy.

All of these pressures can combine to challenge a tourism-dependent community to serve locals alongside the influx of visitors. And as supply is pulled off the long-term rental market, there are fewer housing options for locals who help make the community worth visiting in the first place.

Travelers

Last but not least are the travelers. The actual customers that the industry was built to serve. It is without argument that greater access to accommodation inventory benefits everyone.

When it comes to a competitive environment that keeps prices in check and monopolies at bay, choice is usually better for the consumer while consolidation is generally worse. And one of the hassles of vacation rentals has long been the inability to search multiple accommodation types in one place. This gap was a driving force in Expedia’s purchase of HomeAway, for example.

If Airbnb sticks to its promise of lower commissions – often as low as three percent – there’s also the potential for hotels to pass along the savings to travelers. While there’s no guarantee to this, a lower commission structure could reasonably create some competitive pricing among hotels. It would also lead to economic pressures across the travel value chain – ultimately, this could mean a much better experience for travelers.

None of this is guaranteed. And of course, the journey has just begun. Airbnb ‘only booked’ around 100 million guest nights in 2017. So a tenfold increase in that number by 2028 is no small feat. There’s going to be a lot of feathers to ruffle, and, for better or worse, the travel industry may just never be the same again.

The writer’s travel and expenses were covered by Airbnb. Please read more about our ethics policy here.

Photo by Ben White on Unsplash

![]()