Where are airlines in the battle for online dominance?

By cameron in Uncategorized

This is a viewpoint from Gitit Greenberg, director of digital insights at SimilarWeb.

With digital giants like Airbnb, TripAdvisor, and a myriad of others battling for dominance, the travel industry has become home to some of the most exciting online brands. Visibly missing from this mix are the companies most responsible for getting us from one place to another – airlines. Overall, the airline industry has seen relative stagnation in their web traffic, as sites like expedia.com, orbitz.com, skyscanner.net, kayak.com, and others have become the standard destination for booking travel.

Yet, there are some that have shown unique proclivities for digital growth and the tactics they use may hold the key to the further development of this sector. Presently leading OTAs leverage flight bookings to drive traffic to top-tier travel services like hotels. However, the newfound digital presence of airlines could have a significant impact on the travel sector as flights are typically the first stage a traveller will take before booking an entire travel package.

So, which airlines are poised to drive change in the travel sector and how are they doing it?

The rise of organic search

The key measure of brand awareness is Direct traffic and branded search as both demonstrate the highest degree of intent on the part of the potential customer. If you take the time to specifically type in united.com, for example, you are leaving little doubt to the online destination you intend to visit. Accordingly, the statistic is among the most effective measures of the growth and development of a given brand. The key question is how to increase this metric. A deeper look at some of the top performing airlines in 2017 may give a critical clue.

Among the top performers in the sector, qatarairways.com and aircanada.com showed some of the most significant and impressive traffic increases with US visits increasing by 30% and 24% respectively. Interestingly, both brands rode waves of increased direct traffic, increasing by 12% and 16%, respectively. For Qatar Airways and Air Canada, the improved awareness followed strong investments in Paid Search.

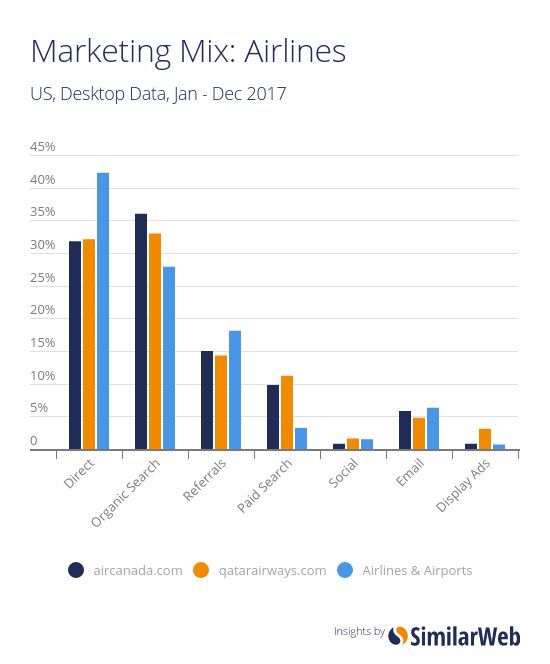

In the graph below, the marketing mix for aircanada.com and qatarairways.com is compared to the overall industry benchmark in gray. What jumps out is the comparatively heavy investment in paid search in an attempt to grow traffic overall.

This strategy is interesting in that it can often be cause for concern because this type of traffic may not have the same quality and can even damage overall brand awareness efforts. Yet, in the case of both airlines the paid search strategy is paying dividends on both fronts. Overall traffic is up as mentioned above, while both direct traffic and branded organic search — people searching for terms like Qatar Airways or Canada Airlines — are on the rise. Specifically, aircanada.com saw their organic search increase by 20% over the last two years in the US, while qatarairways.com saw an even more substantial climb of nearly 50%.

Holiday creation

Few industries benefit — or suffer, depending on your perspective — from the effects of seasonality like the travel industry. The reality is that holiday seasons are fairly set and most travellers focus on these time periods. The result is incredible competition for online share of voice during these peaks, while the entire industry trudges through the troughs of these cycles. Yet, one brand decided to break the trend and turn the seasonality in their favor.

Southwest Airlines, largely known for domestic travel in the US, has become one of the top digital performers largely on the back of their unique capacity for drumming up interest during periods where interest is anything but expected. In June of 2017, the company launched a 72-hour sale that saw their web traffic more than double from a normal daily average of 1.47 million visits to nearly 4.2 million on June 6th. This jump was an impressive step forward of over 30% on the equivalent peak from 2016.

The key was recognizing an opportunity to create tremendous interest in one period that would both drive immediate returns while growing brand recognition. Essentially, southwest.com created the equivalent of a Black Friday for airlines with their brand being the only participant.

The ability to facilitate a digital rush like this has paid major dividends for the brand and also underscored the incredible potential of the ‘Create a Holiday’ strategy across the sector. The ability for a brand to own the calendar, as opposed to being owned by it, could have major ramifications and dramatically increase the digital market share for these companies.

The digital travel landscape has been dominated by a number of high profile players including top OTAs and metasearch engines. Yet, the growing capacity of airlines, hotel owners, and the like to own digital traffic flows would not only increase their own value but dramatically impact the entire ecosystem. And, as new market strategies emerge to increase brand awareness and direct traffic, we are likely to see new trends and players in the travel sector coming soon.

Related reading:

Big trends in 2017: TripAdvisor, Costco’s rise and what they mean for the travel industry

This is a viewpoint from Gitit Greenberg, director of digital insights at SimilarWeb.

Opinions and views expressed by all guest contributors do not necessarily reflect those of tnooz, its writers, or its partners.

![]()