Travel apps strengthen in 2017, airlines start to catch up

By cameron in Uncategorized

A global study of 2017 app usage from App Annie shows that travel app usage increased during 2017 and that airline apps are becoming more engaging.

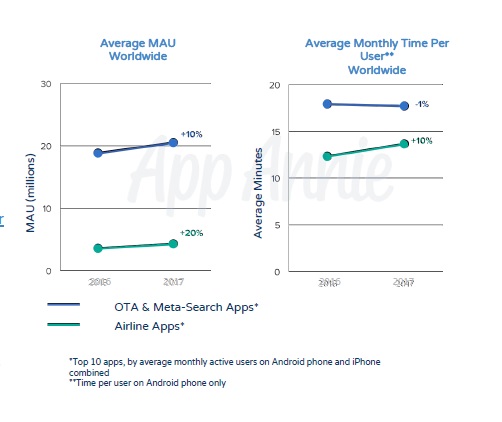

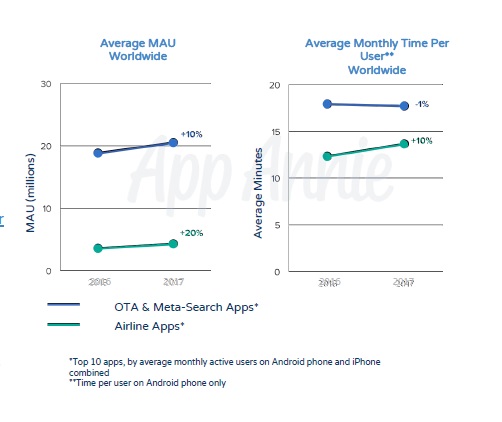

The app economy analyst’s 2017 Retrospective looks at the overall app market and some specific verticals, including travel. The positive picture for airline apps is based on its finding that airline app users are spending on average 10% more time in app compared with 2016. In contrast, OTA and meta apps are seeing a 1% drop in time spent, although this metric is restricted to the habits of Android users.

However, users are still spending more time on OTA and meta apps than on airline apps.

Looking at monthly active users (MAUs) across the top ten travel and airline apps on Android and iPhone, OTAs and metas added 10% more users in 2017 to reach more than 20 million. Airlines are adding users at a faster rate – up 20% – but volumes remain in the low single-digit millions.

App Annie explains:

“Airlines are increasingly adding features to their apps in order to enhance the travel experience and reconnect with their most loyal customers. In turn, these features extend contact time, boost loyalty and provide opportunities for cross-sell and upsell”.

The growth in travel app usage – at least when looking at sessions on Android – is also positive, with mature markets such as the US, the UK and Japan seeing growth rates of 55%, 90% and 30% respectively.

App Annie includes big travel markets such as India and Brazil as “emerging,” explaining that “vast download numbers are driven by new smartphone owners discovering and experimenting with new apps…”

Some of India’s biggest travel firms have been involved in an expensive land grab for new app users, offering incentives in order to try to win new, and hopefully loyal, customers. The counter argument is that users are loyal to apps which offer utility and relevance rather than one-off discounts.

During 2017, India overtook the US to become the world’s second largest market when measured by downloads. The study suggests that the increased access to 4G connectivity in India is behind the increases, reinforcing the importance of infrastructure in the app economy’s future.

On message

Elsewhere, Facebook-owned products dominate the global picture (other than in China) for social apps. But with many travel firms now active in the messaging sub-sector of the app landscape, the dominance of WhatsApp Messenger over Facebook Messenger in important inbound, outbound and domestic travel markets is worth noting.

In terms of monthly active users across 2017, WhatsApp Messenger comes out top in Germany, Indonesia, India, Russia, Spain and the UK. Facebook is top in France and the US but in all markets where Facebook appears in the top three, it outperforms the specific messaging app. (Click on the image to see a larger version in a new window).

The most used app globally is Facebook, followed by WhatsApp Messenger, WeChat and then Facebook Messenger.

One of the key findings in the report, which runs to 160+ pages, is that “worldwide app engagement is well above mobile web” with “smartphone users spend 7x more time in native apps than in mobile browsers, and tend to access them 13x more often”.

Click here to register for the full report.

Related reading from tnooz:

Mobile, human psychology, digital omnivores and travel (April17)

![]()