How Virginia is solving the measurement problem with a combination of tools

By cameron in Uncategorized

“The industry is so fragmented,” said Esra Calvert, Virginia Tourism Corporation’s Director of Research, when asked to describe her biggest challenge in tracking Virginia’s ad effectiveness. “We are working with so many diversified vendors from big to small, and it can be difficult to bridge the data in real time.”

The goal, according to Calvert, is to achieve a 360-degree picture of the consumer. She wants to understand the post-demographic consumer, which TrendWatching.com describes as follows:

“People – of all ages and in all markets – are constructing their own identities more freely than ever. As a result, consumption patterns are no longer defined by ‘traditional’ demographic segments such as age, gender, location, income, family status and more.”

Though a 360-degree picture is still out of reach, Calvert uses a combination of measurement tools, including traditional survey and big data tools like Adara, and Arrivalist, to get her as close as possible.

With the right data, she will be able to attribute ad success to specific platforms and campaigns, allowing her to optimize her media budget for the most profitable and beneficial visitation to Virginia. In this article, we’ll take an in-depth look at three primary tools Calvert is using to understand their strengths and why the combination works.

Tracking through traditional surveys

Using a profile of her target market, Calvert surveys a panel of respondents to measure paid, owned, and earned media.

Surveys typically try to help travel marketers understand the why behind ad effectiveness including if the ad influenced the visit decision, and if the ad impacted the visitor’s overall perception of the destination. Survey results help Calvert and her team assess the success of the ad campaign and overall traveler perceptions of the Virginia brand.

For example, through a survey, a DMO might learn that some aspect of the ad was not appealing the viewers or reduced intent to visit. They may also learn that travelers are more enticed by ads the show close-up images of food rather than ads that show beautiful mountain ranges.

Tracking through enhanced surveys

Destinations with large media campaigns are also working with research firms to tag digital ads and serve panelists surveys once they view those ads. These surveys are then compared to responses from a control group who did not view the ads. With the control group, a DMO can be more confident that its findings are a result of the ad not the result of some external factor.

Virginia’s survey data shows that one out of two travelers recalls the DMO’s social media content, which primarily comes from the virginia.org blog. Adara, a tracking tool that Calvert uses, demonstrates that this blog accounts for 11% of hotel revenue, based on impressions tracked in 2017.

While surveys allow for truly deep insights into why consumers are behaving in certain ways, it can sometimes take weeks or months to gather and analyze the data. Calvert also needs real-time data on what media is converting so she can make smart short-term planning decisions. For this, she turns to “big data” tools like Adara and Arrivalist.

How Virigina uses Adara

Adara, and its main competitor Sojern, use huge data sets of booking, loyalty, and search information to build a profile of potential visitors based on their online activities, allowing destinations like Virginia to get a closer look at that post-demographic consumer.

Adara collects only first-party data, meaning directly from hotels and airlines, while Sojern collects data both from first-party sources and from travel booking sites. Regardless of the source, both platforms provide real-time data on what media is converting.

Adara can track consumers around the web to better understand where they might be likely to travel and how they plan trips. Using its database, Adara can tell when consumers are searching for specific destinations and serve them a related ad.

For example, if a consumer is searching Nashville hotels, the platform will serve an ad for Nashville, which may entice them to watch a sponsored YouTube video, which may then drive them to book. Adara uses booking rates for those exposed to the ad to understand how effectively the ads drove visitation. The platform helps marketers understand how the combination of ad exposures interacted to entice the traveler to visit the destination.

Calvert described a recent insight her team gleaned using Adara to track a brand partnership targeted toward families:

“Not only we have seen conversion from booking data, we have also seen that consumers booked hotels at 50% higher rates than average [as a result of the campaign.]”

The drawback for tools like Adara and Sojern is that some bookings may be attributed to an ad view when, in fact, the traveler was planning to book regardless of the ad’s message.

In these cases, the visitor-in-question may have been searching for Nashville hotels, already planning to book. This visitor probably would have visited Nashville without seeing the ad but is still counted in the metrics, leading the DMO to attribute a higher percentage of bookings to its ads than is warranted.

How Virginia uses Arrivalist

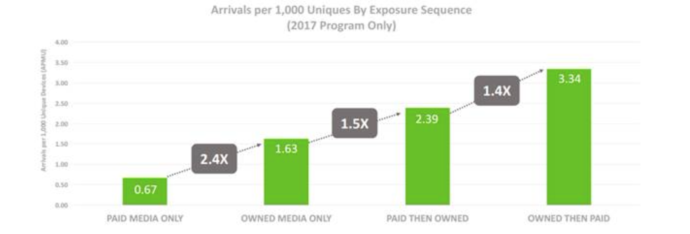

To mitigate any misattribution, Calvert uses Arrivalist, which uses cookies to track the location of mobile devices to measure “arrivals.” This allows DMOs to demonstrate a connection between the ads they are buying and the people who arrive in the destination. Arrivals uses the metric Arrivals per 1,000 impressions (APM) to measure arrival rate.

Arrivalist places a tracking pixel in digital ads, i.e. sponsored media, emails, and banner ads. When a potential visitor views the destination’s ad, Arrivalist drops a cookie onto her device, which tracks the device’s location to determine if and when the traveler arrives in the advertised destination.

Arrivalist then compares visits from pixeled devices to total devices to understand the arrival rate, i.e. what percentage of arrivals were prompted by the destination’s ad. The last piece allows marketers to conclude that “this form of marketing drove a higher arrival rate.”

Using Arrivalist, Calvert’s team has been able to show that the virginia.org blog’s efficiency rate is 53% higher than the benchmark arrival rate for Virginia’s website visitor (1.03 APM versus 0.67 APM.)

Understanding the incremental impact of advertising is so important to DMOs because they have few concrete ways of understanding whether it was their ad campaign that drove visits, or whether it was something else, such as a new TV show set in their city or a hit song about the destination.

Three benefits of smart measurement

With Arrivalist information, destinations can accomplish the following:

1. Optimize media spend by buying ad space on platforms that spur the most arrivals.

By comparing arrival rates for ads on one media platform against another, i.e. comparing banner ads on two different travel booking sites, marketers can optimize media spends and buy ad space on those platforms that are most likely to convert to arrivals. Additionally, arrival data can show marketers which geographies are bringing in the highest volume of visitors and in which geographies visitation is lagging.

2. Better understand the consumer journey by measuring the length of time it takes travelers to plan trips to a given destination

Arrivalist can also help travel brands understand the consumer journey by tracking the length of time between initial ad views and arrivals. For example, a weekend destination, such as Atlantic City, probably has a shorter consumer journey than a ski destination like Aspen, Colorado.

Atlantic City marketers may want to serve ads to potential travelers in New York City right before the weekend since they will likely book last minute and will not need to fly, while Aspemarketers may want to serve ads three to four months ahead of ski season to give travelers ample time to request time off work, rent cabins, books flights, and acquire ski gear.

3. Reduce inaccurate measurements resulting from ad fraud

Ad fraud researcher Dr. Augustine Fou emphasizes that optimizing for arrivals helps reduce the inaccurate measurements that result from bots “clicking on” and “viewing” ads.

“Humans visit Montana, bots don’t,” Fou said, arguing that tracking arrivals ensures that marketers are tracking the behavior of real humans who will come spend money in the destination.

Arrivalist has helped Calvert and her team show that integrated marketing works. “We know that

those who were exposed to owned media first then paid media, arrived in Virginia at a higher rate compared to other forms,” Calvert said.

The results? Integrated marketing works

Virginia’s survey backs up this finding. Calvert said, “those who are exposed to integrated marketing (paid, earned and owned media) consider and intend to visit Virginia at higher rates – 11 percent and 12 percent more respectively – compared to those who were not exposed to integrated marketing.”

As useful as big data tools like Adara and Arrivalist can be, marketers are still left wondering about the true motivation for taking a trip, which brings us full circle back to traditional surveys.

Taken together, traditional surveys work well with more real-time data tools such as Arrivalist and Adara. While, the latter two tools allow marketers to make timely decisions, more traditional tools are still the best way to go deeper and to illuminate the why behind ad effectiveness.

Combining the three tools often illuminates the big picture. Calvert concludes that:

“both Adara and Arrivalist data are showing conversion based on video mediums we can track. Visual storytelling is an important component of content as video is efficient in conversion and improves the perception of Virginia, according to more than 70% of travelers we surveyed.”

Special Thanks to Virginia Tourism Corporation Director of Research, Esra Calvert, ad fraud researcher Dr. Augustine Fou, travel writer and speaker Doug Lansky for sharing their experience and expertise.

![]()