Expedia sets sights on legacy tech with ambitious ‘travel platform’ for hotels

By cameron in Uncategorized

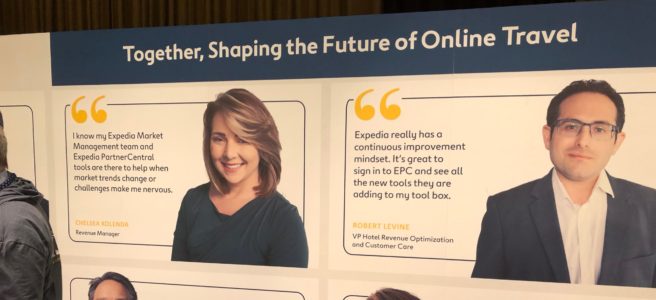

At this year’s Expedia Partner Conference in Las Vegas, it’s hard not to see the similarity between Expedia’s latest slogan — “shaping the future of online travel” — and the long-running slogan over at Amadeus — “shaping the future of travel.”

When asked about the connection informally, one exec shrugged it off as unintentional. Regardless of messaging, Expedia has clearly defined ambitions to build the world’s first all-property solution for hotels. The company’s lodging arm calls this the Expedia Travel Platform, bringing hotel operations, revenue management, brand loyalty, and distribution together to provide better value to hotels.

It’s also hard not to see how that ambition puts other tech solutions providers on notice. The resounding message from the company is that Expedia isn’t just an OTA but also a technology partner providing solutions for the travel and hospitality industries — that just happens to have a massive demand engine at its core.

Private label “Expedia-powered technology”

It’s one thing to distribute inventory to other people’s channels, and quite another to package a lucrative conversion channel with “Expedia-powered” technology solutions.

The company’s reach gives it plenty of opportunities to challenge the solutions’ business of the legacy players, something that the company is eager to do, says Expedia Lodging Partner Services president Cyril Ranque:

“The reason why we invested in a company that does hotel operations…is because, over time, when the ALICE system is in-property and integrated, it optimizes the internal back office operations.

“But it also optimizes the relationship with the guest. Then we can plug that into our own apps and provide a completely seamless consumer experience, from the search, to the booking, to the on-property experience, to the post-stay reviews.”

Yes, this story has been told before. Expedia has always wanted to be seen as a technology company and often promotes its heavy investments in improving its products. But the ambition is greater than ever before, with the company building solutions for its ecosystem at a rapid pace. For those who might question the company’s resolve in a post-Dara era, there’s a fire in the belly that’s palatable across all units and executives.

In order to expand its perceived value to partners — and continue to justify its hefty commissions — the company plans to build on three pillars: operations, revenue, and data. It will invest in a modern take on a PMS, develop a global revenue management platform, and use its data trove to provide real-time insights. All in the name of improving the economics and competitiveness of its hotel partners.

ALICE! Who the #$*! is ALICE?

Earlier this year, Expedia led a majority investment in a company called ALICE. The startup has a bold goal of transforming the way that communications work across a hotel’s operations.

Rather than a property management system, the company calls it a hotel operations platform. While there are some minor distinctions, the cold, hard truth is that ALICE is a modern PMS built for the post-legacy technology era. It’s not a big leap to include reservations capabilities for a full PMS.

In speaking about the investment in ALICE to a closed media session, Expedia’s VP of Global Product Benoit Jolin emphasized the importance of improving hotel operations:

“Guest expectations are skyrocketing, [and while] synchronized communications is not as glamourous, [it] makes the most impact.

Hotel operations is the next space for disruption. No one has designed a system across the hotel: maintenance, housekeeping, guest communication. Hoteliers need to be connected and engaged across the proliferation of channels…[we will] see more vendors emerge that help hotels manage these touchpoints.”

On stage in front of nearly 4,500 people, Jolin likened the ALICE experience to “the world’s best orchestra,” a technology that allows hotels to “be great all the time” and “see where the points of failure are.” The company sees ALICE as the backbone of hotels.

Jolin also points to an important consideration for all hoteliers: the “operational tax” of implementing new solutions. Sure, a solution might be free. But if it takes an hour a day to manage, then there is an operational tax that ends up costing the hotel money. Time as tax.

So if the return on that time is not there, then the hotel actually loses out by implementing a technology. Jolin promises a “zero operational tax on the property” and “seamless integration rather than having to learn another workflow.” A bold proclamation that is surely music to any time-starved and tech-overloaded hotelier.

Revenue solves everything

Expedia first announced its Rev+ revenue management product at least year’s partner event. The insight that drove the investment was that the company sits on an enormous amount of data that can provide the basis for a powerful revenue management solution.

The bet has begun to pay off: the company claims 20,000 users for Rev+. In an on-site product iteration forum alongside hotel partners, Lodging Data Technology Director Nicolas Daudin has yet-another bold mission for the company: to not just build the best revenue management tool in the world and “redefine the way revenue management technology works.” It’s hard to keep track of the various emphatic mission statements across Expedia, but the passion is clear.

Daudin identifies three areas that underpin his passion: the quality of the product, the size and granularity of data, and the company’s reach across over 400,000 hotels. By combining these three things into its Rev+ product, Daudin sees the desired outcome of building a tool that pushes more hoteliers to take advantage of revenue management technology.

With revenue management technology adoption sitting at about 15 percent, there is a lot of room to run. This massive opportunity has plenty of competition, across both legacy technology companies like Sabre and Amadeus but also smaller niche players. The competition for the customer is only going to get more intense.

Data: It’s not the size that matters

“It’s not the size that matters, it’s what you do with it.” Those words, from MGM Resort’s SVP of Revenue Management Kelly McGuire speaking on stage, resonated with the audience. Having a large data lake is useless if you’re not able to derive any meaningful insights from it.

With this third pillar, Expedia plans to use the scale and scope of its data to out-insight its competitors. And while legacy players have to deal with strict contracts the define how and where data can be used, much of Expedia’s data is its own. This is an asset that sets Expedia apart, and positions it to outperform any potential competition from other companies (such as Google), says Expedia CEO Mark Okerstrom:

“You just look at the amount of data that we sit on across the Expedia Inc properties. Six hundred million visitors visit our sites every single month. The amount of purchase intent information that we have is very significant. And it’s not just intent — we actually have what was done. No one else has that kind of end-to-end knowledge about what has happened.”

This is a compelling value to partners of all sizes, as they don’t have to be masters of technology. There’s then a clear value for commissions paid by partners — Expedia may take a cut, but the technology and insights will make the business more money in the long run.

The company can then use its extensive research and testing capabilities to learn what does and doesn’t convert, and then deliver those change rapidly — there were 22,305 lodging enhancements in 2017.

This folds into the revenue management platform — making real-time recommendations to revenue managers related to pricing decisions — and throughout the rest of the organization. Companies with relatively commodified core products can differentiate effectively with the ability to use the data trove to deliver real-time or near-real-time insights.

Relationships first

Convergence is real. The larger a company gets, the wider its pursuit of growth becomes. It’s not just about consolidation, but about bringing together the right product mix for customers.

Of course, it’s inevitable that Expedia would get into tech solutions for its partners. Growth demands it. And while much of this growth comes from strategic investments and acquisitions, the core truth is that the company with the strongest relationships will thrive.

It comes down to who has the strongest market representation, who has the most relationship-oriented sales teams, and who has the strongest trust amongst its client base. When faced with a world of diminishing growth opportunities, it’s about fostering strong relationships with customers — and then building products that serve them best. This is the virtuous cycle that keeps on giving.

Travel and hotel provided by Expedia. Read our Ethics Statement here.

Related reading:

How Expedia sees the future in sharing its technology

![]()