Travelstart starts to take ownership of its hotel inventory

By cameron in Uncategorized

Africa’s online travel market has a different look today, with flights-focussed Travelstart taking a majority stake in South Africa’s biggest accommodation site, SafariNow.

Terms of the deal have not been disclosed.

SafariNow lists 23,000 properties, mainly in South Africa but with some inventory elsewhere on the continent, covering self-catering, vacation rentals, hotels, guest houses and bed and breakfasts. The properties are directly contracted.

Background

Travelstart is based in South Africa but has 13 different points of sale in Africa, the Middle East and Turkey.

The business has a nomadic corporate history. It started out in Sweden in 1999, partnered with lastminute.com in the Nordics for a few years from 2002, relocated to Cape Town in 2004, launched in South Africa in 2006 and sold its legacy European operations to eTraveli in 2010 in order to concentrate on “frontier and emerging markets”.

It picked up $40 million in funding back in 2015, with Africa’s biggest mobile network MTN jointly leading the round.

Its founder Stephan Ekbergh has remained CEO throughout its journey, and talked through the SafariNow deal with tnooz. He said that the SafariNow brand and team will remain in place, and that the SafariNow inventory will be added to Travelstart’s hotel channel, which is currently populated exclusively by content from Expedia Affiliate Network.

“We want to have a comprehensive database of hotels in South Africa, and SafariNow will supplement what we’ve got through Expedia. It also has a good relationship with corporates in South Africa and this is an area we want to get closer too.”

He also liked SafariNow’s direct contracting expertise. “We tried it ourselves and weren’t that great at it,” he admitted, “so we are looking to learn from them. Many properties are so small they don’t have a great tech set up, so we’re looking to offer them a bundled solution with distribution, PMS capabilities…”

The competitive landscape in South Africa is intense “with competition coming from everywhere”. Booking.com and Expedia are “super-active” in the market, he said, adding that “it is hard if not impossible to beat them on Google”.

SafariNow, which has been online since 1999, has “SEO equity that they don’t have so we will be making the most of this as well,” he said.

Mobile

MTN’s backing is an important component of Travelstart’s growth plans. At the end of September, MTN had more than 30 million subscribers in South Africa, each of whom is entitled to discount on flights if they sign in to Travelstart using their MTN mobile phone number.

“We have done some shared campaigns in South Africa and while the volumes are quite low we are introducing high-value customers to them, the people who can afford to buy online travel.”

Overall, MTN, which is listed on the South African stock exchange, has more than 230 million subscribers across 22 African and Middle Eastern countries. Ekbergh said that MTN had helped Travelstart to go live in new markets, but the idea of offering discounts to MTN customers from other points of sale was “something to be explored, it is not something we have done yet.”

Market

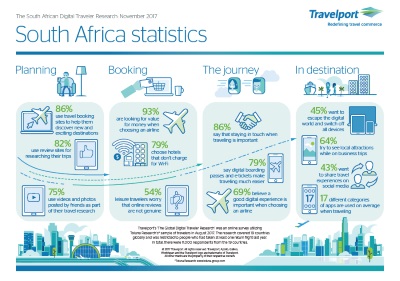

South Africa was one of the country’s featured as in Travelport’s recent Global Traveller Survey. It was ranked seventh on the report’s digital traveller league table, based on the “main indicators of digital usage by travellers in each country”, outperforming the UK, Germany, the US and others.

The study included a handy infographic which summed up the digital preferences of the country’s travellers:

(Click on the image to open a larger version in a new window)

And Google has also just released its Connected Consumer report for South Africa, which found, among other things, that 65% of South Africans can access the internet from home, with 69% getting online via mobile devices. However, ecommerce generally is still in its early stage of adoption, with only 10% of users buying online.

The growth profile for South Africa’s online travel sector is compelling, in terms of not only the demand for domestic and international travel but also the potential for ecommerce and mcommerce to become mainstream rather than niche. And with the rest of Africa also growing rapidly from a low base, there’s lot of headroom for local players such as Travelstart to build a presence.

“Other than South Africa and Nigeria, the volumes are small,” Ekbergh said. “You can’t just build a first-world B2C OTA and expect it to work in markets where 90%, 95% of bookings are offline. Corporate is interesting and somewhere we want to be more active, but for now we want to make sure that we do better in South Africa.”

![]()