Why is there no global B2C online travel brand yet?

By cameron in Uncategorized

This is a viewpoint from Philippe Der Arslanian, CEO, Answair.

The online travel space is missing something big: a global B2C brand.

Sure, powerful brands such as Expedia and Priceline dominate the news – but these aren’t truly global brands. To be global, a brand needs to be able to reach the vast majority of consumers across the world. And these brands are missing one key piece of the puzzle.

China’s uniqueness

China’s importance in the travel market cannot be understated. The IATA forecast recently revealed that China will have the largest market share in 2022, displacing the US, as its air passengers nearly double from 4 billion this year to 7.8 billion by 2036.

A truly global travel brand, if and when it emerges, will have to cover both West and East. For now, that slot is still wide open – and Chinese brands are beginning to look like serious contenders.

Cindy Wang, CFO Ctrip International stated at Phocuswright last month:

“We are still in the early stages of the journey.”

Indeed, Ctrip (and even Priceline, with its investment in China) only claims a single digit market share, which can be seen two ways: yes, it might be small, but there is also a huge potential upside in this scale-game market.

The quest for global has always been the holy grail for big travel brands. The industry is marked by the many failed attempts of the most prestigious giants. They all learnt a lesson the hard way: you can’t “globalize” by imposing a unified standard on markets with distinct regional requirements and behaviors. Nowhere is this truer than China.

Chinese Giants are heavily involved in travel

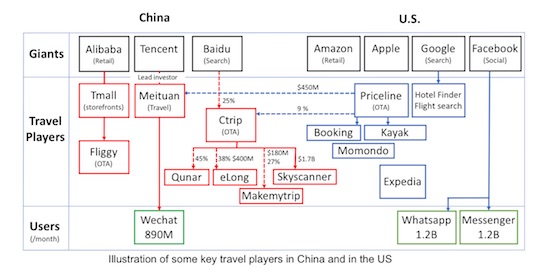

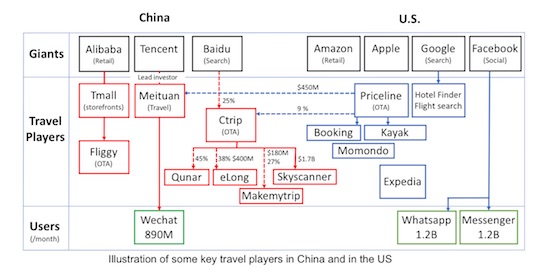

Unlike the GAFA giants (Google Amazon Facebook Apple), the Chinese BAT (Baidu, Alibaba, Tencent) are more involved in travel.

Baidu, dominant in search owns 25% of Ctrip, China’s largest OTA, while Alibaba recently launched the OTA “Fliggy”, cross-selling travel and optimizing its sales off the back of its monumental ecommerce platforms Taobao and Tmall. Tencent meanwhile, has just led a $4 billion round in China’s online firm Meituan, which is also engaged in travel.

Google is running its own independent Flight Search and Hotel Finder but the other Western giants are behind: Amazon has still not managed to include travel in its offer and it does not look like a priority for Facebook and Apple.

On the mega OLTAs side, only Priceline remains as a credible player when it comes to understanding China. Patiently and strategically, it has stepped up significant investments – more than $1 billion – in both Ctrip and, more recently Meituan Travel. Expedia has meanwhile played a more tactical game by selling off its stake in China’s eLong far too early, back in 2015.

But the Chinese giants aren’t stopping there. Ctrip – the Chinese OTA – has not only become the undisputed leader in China, it has also gone on a global acquisition spree to start a worldwide innovative travel empire, recently snapping up Skyscanner and a leading OLTA – Makemytrip – in the fast-growing India.

China is the first “Mobile Only” big country

But Chinese firms aren’t ahead just because of the giants backing them. They have one big advantage over Western firms, one granted to them by the uniqueness of their home market.

While most Western countries are still struggling to nail the shift from web to mobile with a supposedly-aggressive “mobile first” or even “mobile most” approach, China jumped directly into “mobile-only.”

Mobile growth for China’s travel industry is simply astounding. This growth results from a combination of 1) the general travel market growing at almost double-digits yearly, 2) hockey-stick type internet penetration, and 3) mobile-only adoption.

Surprisingly – this is only the beginning. Ctrip has recently stated that it has achieved more than one billion downloads of its app and that mobile bookings account for more than 60% of online reservations.

Mobile players in China aren’t so entangled in transitioning adoption schemes or gracefully-degraded responsive models. Most business models there are only designed for mobile and nothing else. Imperfect desktop solutions are sometimes added as an afterthought. Mobile becomes so mandatory that Ctrip now promotes campaigns with up to 50% savings with mobile-exclusive deals on its app.

Chinese market self-stimulation

Unlike most countries, airlines can be perceived to be weaker in China’s online ecosystem. Airlines represent a staggering 600 million passengers, growing drastically both domestically and internationally (particularly outbound and also inbound, thanks to new visa policies).

But similarly to the West at an earlier stage, Chinese state-owned airlines will have to perform better than OTAs in terms of digital penetration. When this power balance between OTAs and airlines will significantly change is anyone’s guess but airlines will eventually grasp back power and regain a clear online market lead.

To be fair, the Chinese government is also helping restore this balance, by issuing a benchmark through its ASAC (Assets Supervision and Administration Commission) whereby state-owned airlines will have to derive 50% of seat sales through direct means by 2018.

The self-enriching “Yin-Yang” dynamic equilibrium between audacious OLTAs and more orderly airlines is now fuelling a wind of innovation throughout the country. Altogether these market dynamics and stimuli will not only reinforce Chinese market growth, but also self-service adoption by Chinese travelers.

Three challenges for a global quest

Taking into account China’s uniqueness, the potential winner of the first B2C global travel brand will have to focus on the following drivers to succeed:

#1: Content

One of the key value propositions for travelers is choice. This is what has driven the success of metasearch engines such as Kayak, combining both full service and low-cost carriers into one single display. On the accommodation side, this is similar to what booking.com offers, with both regular hotels and alternate apartments, all of which are instantly bookable.

Ctrip’s platform also wants to offer it all – air, hotel, train, bus, vacation packages, guided tour, car rental, insurance, visa services, attraction tickets, ground transportation, you name it. But beyond providing the widest range of travel content to its visitors, Ctrip has internally structured each segment into independent business units, each responsible for their own content, an organization designed to help foster innovation.

The next challenge is to combine all these travel “tabs” (a la Amazon) to provide all relevant options within a streamlined decision-making process. The global brand will have to provide all the right content at the right time.

However, B2C players will have to focus on this global content along with advanced personalization to reconcile the comprehensiveness of bookable offers with a small mobile real-estate and an ever-decreasing attention span.

#2: Chat

An important key to unlocking a global travel giant is to look at what will become consumers’ favorite communication channel: chat. Here again, the US vs. China battle is raging with Facebook Messenger and Whatsapp (totaling 2.4B users / month) and Tencent Wechat reaching close to one billion users/month.

Imagine this: a client books a ticket through the app and immediately receives a chat message from the airline confirming the reservation. The customer has a question about baggage allowances? They ask it in the chat message thread. At the airport, the plane is delayed and the gate has been changed, and the traveler receives a live update with immediate information and a discounted offer to exchange miles for lounge access – again, payable through chat.

More importantly, chat is the perfect channel for airlines to circumvent the stranglehold OTAs have placed them in, by allowing direct and personalized conversation with customers. The infrastructure it has set up, be it for booking, payments, or with mini-programs, allows for the most fluid user experience imaginable.

In China, Wechat has not only eclipsed all other chat-related apps (Weibo, and the now forgotten Renren and Kaixin) – but has also made leaps and bounds into m-commerce, either through chat or directly integrated mini-apps in its platform. Increasingly, WeChat is the Chinese internet.

Chat may become the ubiquitous, conversational, intimate, and instant service consumers are waiting for. It will conveniently allow all travelers to connect with all relevant stakeholders e.g. their providers, other travelers, social groups, and digital assistants in one single place and throughout their journeys.

#3: Simplification

Glenn Fogel, CEO and president of the Priceline Group stated in Miami last month:

“We are here to make travel easier,” and, “That’s what we need travel to become, is to take the friction out.”

There is definitely an opportunity to further consolidate and simplify. In addition to a multiplication of brands, there are also too many business models, specialized portals, and diversified segment-focused solutions. This fragmented landscape prevents travel giants from achieving basic economies-of-scale and drives unnecessary complexity into their traveler experience.

In China, the metasearch model has been mainly replaced by a more logical metabook. “Facilitated” booking models have now become the norm to create a frictionless purchasing funnel.

The resulting conversion increase (up to 50%) stated by Skyscanner demonstrates that this simplification scheme works. Ctrip made no secret that it will change established business models to a simpler OTA by empowering the European metasearcher with fulfillment capabilities.

The concept of “storefronts” managed by Alibaba also tends to simplify the deployment of online businesses. Alibaba, for example, will enable Marriott to use its storefront travel service platform on Fliggy to ease the experience from planning to paying, from hotel room to sightseeing activities, while providing a unified loyalty scheme.

On top of advanced content and fully interactive chat, simplifying the customer experience regardless of country and destination still remains the holy grail needed to become a true global leader.

Will a global B2C travel brand finally emerge?

On one hand, a global brand makes complete sense for global travellers.

It would represent a silo-breaking opportunity with a true one-stop shop for travelers and providers alike. It would offer the perfect degree of personalization, based on the overall set of data and preferences covering the end-to-end trip, rather than picking out specific attributes on hotel, cars or packages, often completely out of context. It would allow for massive A/B testing, quickly becoming more relevant to a global travel audience.

A global brand would also trigger new levels of upselling and cross-selling opportunities – a whole level of magnitude over the current specific ancillary services. Signs of this are already apparent with some Kayak flights being offered on booking.com (usually perceived as a hotel-driven site).

But even with a global brand, specialized and local brands will not lose their relevance. Instead of a one-size-fits-all, wishy-washy platform, expert services on travel adapted and relevant to specific needs and culture will better resonate with travelers on a region-by-region approach.

Brand segmentation is also a way to expand reach and allow associations, ones that make a specific brand relevant to a specific audience. This may explain why Expedia has kept Travelocity and Orbitz as independent brands. Ctrip also claims that separate entities are positioned on customers’ needs, with Qunar aimed at price-sensitive customers while Ctrip itself targets the higher segments.

For now, Ctrip and Priceline/Booking are on the right track to achieve a strong duopoly on a truly global scale. From a financial standpoint with both groups standing at $24 billion and $85 billion respectively in terms of market cap, the current focus may not be the global brand itself but rather the above business drivers to capture more market share.

They will likely be the first to build their global, advanced data-driven platform before extending (and consolidating) their brands externally and on a global level.

Time will tell from where the first truly global brand will emerge. My money, however, is on China.

Related reading:

OTA big guns on what the future holds for their businesses

Priceline’s Glenn Fogel on metasearch, home-sharing, direct booking, and localization in China

This is a viewpoint by Philippe Der Arslanian, CEO Answair. The views expressed are the views and opinions of the author and do not reflect or represent the views of his employer, tnooz, its writers or partners.

![]()