Breaking up is hard – 5 pieces of advice for owners considering (re-)signing with a hotel brand

By cameron in Uncategorized

This is a viewpoint by Peter O’Connor, professor of digital disruption at Essec Business School in Paris.

At the end of 2017, due to both advances in technology and changing consumer preferences, we are entering a new era where existing hotel industry structure paradigms are being revolutionized. The rules of the game have fundamentally changed. And the upshot for hotel owners is that it is no longer necessary, nor often financially wise, to sign their property up with traditional hotel brands to ensure success.

Once thought essential, in today’s radically changed business environment more and more owners are questioning whether they should still sign long-term deals with brands that charge double-digit percentages (franchise/royalty fees + marketing fees + loyalty fees + CRS fees + performance search fees) on their property’s overall gross rooms’ revenue (GRR), but then frequently don’t deliver the system contribution necessary to justify such an investment.

Drivers of change in hotel distribution

One of the drivers of this change is that viable alternatives to brand membership now exist in the marketplace. For example, industry analyst firm Kalibri Labs recently published a significant analysis of the hotel distribution landscape which clearly demonstrates that for most properties growth in OTA contribution continues to far outpace growth in brand contribution.

According to the study, 85% of hotel shoppers visit an intermediary whilst shopping, and OTA contribution for Midscale properties grew a staggering 85% between 2011 and 2015! In addition OTAs now capture a quarter of transient room night demand in key U.S. markets like New York, Orlando, and Miami-Ft. Lauderdale.

Of course, the oft-criticized OTA fees have also grown in dollar terms as OTA channels perform better and market occupancies improve, but it must be remembered that OTA bookings are totally pay per performance, with the hotel only paying for business delivered. As a result, more business inevitably means more fees, but also more contribution in dollar terms.

In contrast, traditional hotel brands take their cut off the top, taking a fixed percentage of all gross rooms’ revenue, including interestingly for OTA sourced bookings, in effect making the hotel owner pay twice for the same transaction.

And whilst OTAs seem to be consistently reducing commissions to pass efficiencies onto owners, as I discuss in my recent tnooz article, repeated studies show that traditional hotel brands continue to raise their fees.

Increase in franchise fees..

For example, CBRE’s recent annual Trends in the Hotel Industry survey of operating statements from thousands of U.S. hotels shows that franchise fees increased on average by nearly 6% between 2010 and 2016. My own study demonstrates similar growth, showing that despite reduced influence, hotel brands continue to charge more and more for their services.

In addition, many traditional hotel brands seem to have embarked on a path towards self-destruction. As well as failing to adequately enforce brand standards, thus giving rise to too much variability in service delivery for customers to adequately trust the brand, the current spate of mergers, acquisitions and new brand launches is slowly but surely diluting brand equity and eroding any remaining value proposition for hotel owners.

Most of the major hotel companies now have literally dozens of brands in their portfolio. This means that many hotels are suddenly competing with sister brands for the same system revenue, despite the fact when they signed up for the brand they supposedly were guaranteed exclusivity through an area of protection clause. But good luck litigating on these claims!

…and chain-sponsored soft brands

And what about the new darling of the hotel industry – chain-sponsored soft brands? These have lower costs, fewer brand standards and, on the surface, seem like an enticingly sweet deal. With many benefits and few of the financial and operational drawbacks of brand membership, these sound like a win-win for all concerned, allowing the property to profit from the chain’s technology, distribution and expertise without having to actually fly the flag, whilst at the same time allowing hotel chains to spread their ever-expanding brand and technology fixed costs over a larger number of properties and transactions.

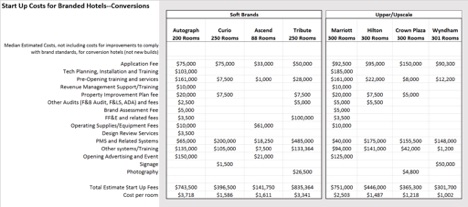

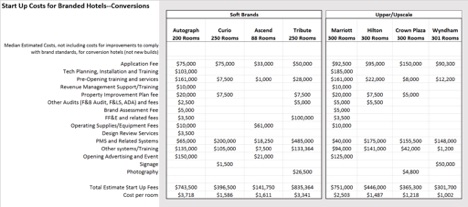

Not so fast! Signing up with a chain sponsored soft brand still involves significant upfront and ongoing costs (see Table 1). And, at the end of the day, you’re still dividing up the same fixed chain driven distribution pie with your sister properties, so the potential to drive additional business is comparatively limited.

In addition, since they are typically very attractive to vacation travelers, many soft brand owners in leisure destinations find themselves on the wrong side of the earn-versus-burn equation, meaning that they end up hosting their marque brands’ road warriors at significantly lower brand-set point redemption room rates as compared to what they could earn on the open market.

Data: Start-up costs for branded hotels

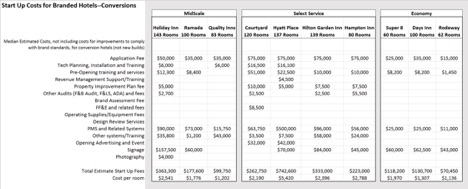

And if you’re thinking soft brand deals come with shorter contract lengths, think again! Despite industry perceptions, as shown in Table 2, Autograph Collection and Marriott branded properties in fact have the same term length.

All of a sudden, this one-foot-in-the-door foray of being a brand without being a brand can turn into an escape room with no clues. The honeymoon phase is short, but the consequences of making a short-sighted decision to grab an easy slice of the distribution pie could leave you in an untenable situation further down the road.

Luckily, we are now entering a new era in hotel distribution, one where technology companies have the potential to level the playing field for independents without the onerous fees typically associated with traditional chains. In the future, we will likely see additional new innovations that will generate significant pay-per-performance driven occupancy from diverse technology players such as Amazon, Google, Facebook, and Alibaba, supplementing the already substantial amount of business being driven by today’s OTAs.

In fact, in terms of market capitalization, Google’s travel division might already be larger than Expedia and Priceline combined if it were a standalone company. And Amazon, with demonstrated success in the non-travel space, has yet to significantly tap the power of its Prime membership program by offering one of the most attractive online products of the online economy to its outstanding loyal customers.

So what is an hotelier to do today?

Regardless of whether you’re a branded hotel owner or an independent, there are five important things you can do today to get ready for the oncoming revolution in travel distribution:

Push back on Gross Rooms Revenue based deals. Don’t pay for something that the distributor hasn’t actually contributed to providing. If an OTA is delivering the business, why are you paying the brand? Question every fee and line item that you’re charged and ask what it’s for. Although independent contracts with OTAs are typically at a higher commission than those under a brand affiliation, it is usually far cheaper to list independently when all the additional brand fees and charges are taken into account.

Consider signing up for independent soft brands. Preferred and Leading Hotels of the World offer representation and easy access to distribution technology at a more reasonable cost. One of the competitive strengths of such companies is their attractive loyalty programs, which drive substantial amounts of business at competitive fees verses large brands and their soft brand siblings. In addition to traditional independent soft brands, there are also representation companies, alliance networks and marketing brands like Magnuson Hotels, as well as CRS providers like Travelclick and Synxis who can get you connected to the GDS at minimal cost.

Consider an economical management company. Companies like Two Roads Hospitality provide critical operational support in distribution, accounting, HR, and marketing. Although they charge on a fee basis, these are often more reasonable (typically in the 2-4% range on a GRR basis) compared to the cost of using major brands. And, rather than being measured in decades, their agreements are in 3-5-year range, and owners can terminate after one year with some form of liquidated damages.

Work with your OTA market managers. Optimize the business you can get from these still-growing channels and take maximum advantage of the free tools they provide, including in particular market intelligence and revenue management services – that’s two less cheques to write every month. And remember that the most overlooked and underappreciated advantage of working with OTAs is that you only pay for bookings delivered, unlike brand arrangements that saddle owners with fees for customers they don’t actually deliver to the hotel.

Think critically before signing or renewing long-term deals. Today’s hotel sector is simply too dynamic to commit yourself into multi-decade deals on the wrong terms. Paying GRR on declining system revenue is just bad business. Ironically the supposedly highly restrictive and over controlling OTAs typically offer the most flexible terms, with some offering 2-week outs, virtually no start-up costs, and no termination fees. This contrasts sharply with hotel brands, where you typically face significant sunk costs ranging from about $1000/room for a Wyndham to over $5000/room for a Hyatt Place (see Table 1) and insane termination expenses and liquidated damages ranging between 3-5 years’ worth of fees for getting out of agreements that range between 10-20 years (see Table 2). And these figures don’t include the cost of extraordinary termination damages or litigation expenses. And before signing, make sure you retain well clued-in legal counsel. A good lawyer can help you negotiate reduced termination penalties and liquidated damages should the need arise as well.

Conclusions: pay attention and challenge convention

With the distribution environment evolving rapidly, hotel owners are today paying closer attention to how their properties are being represented and sold. Facing increased financial pressure, most are seeking a better understanding of whether the investments they are making and the fees that they are paying are actually delivering concrete results. As a result, all bets are off.

Many hotel owners are questioning conventional thinking and traditional ways of doing business, with the result that many pre-existing assumptions and relationships are now being critically reevaluated. And, unless they change their business models and methods of operations, it’s increasingly looking like traditional hotel chains, with their inflexible terms and exorbitant costs, are emerging as the big losers.

Over the past decade, in industry after industry we have experienced digital disruption, where the well-established giants tumble as they fail to adequately react to changing technological and consumer trends. Today that tsunami is about to hit the hotel sector. Right now, its effect is unknown, but the one thing we can be sure of is that things will never be the same again.

This is a viewpoint by Peter O’Connor, professor of digital disruption at Essec. The views expressed are the views and opinions of the author and do not reflect or represent the views of his employer, Tnooz, its writers, or its partners..

![]()