What we learned analyzing 496,470 hotel affiliate clicks

By cameron in Uncategorized

This is a viewpoint from Jeff Howard, founder of HotelsNearDCMetro.com.Opinions and views expressed by all guest contributors do not necessarily reflect those of tnooz, its writers, or its partners.

For five years our boutique travel websites have been sending a stream of traffic through various hotel affiliate programs. We examined all of our historical affiliate clicks in order to determine what programs pay the most.

Here’s what we found from our own data, followed by our takeaways for affiliate marketers, CMOs, startups, and big brand hotel chains.

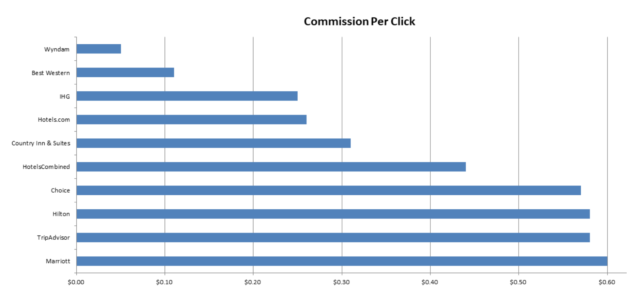

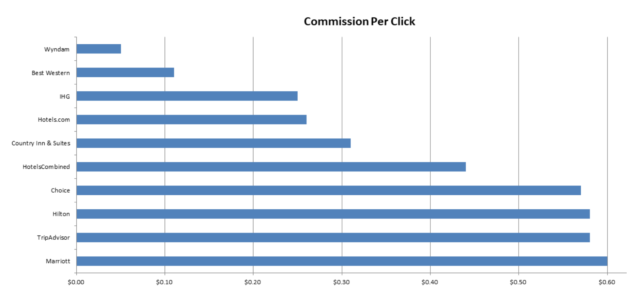

Our commission payouts: per click

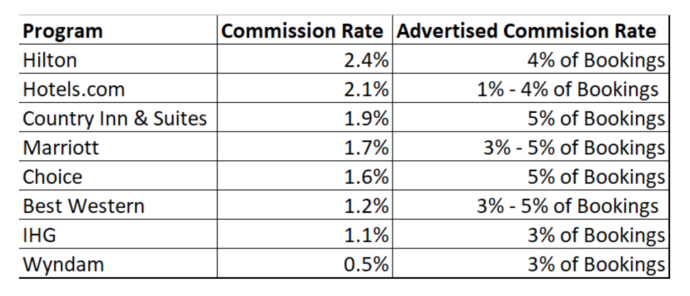

Our commission rates vs. advertised rates

Takeaways for CMO

When we compare the affiliate cost per click to what it may cost to generate the same traffic in Adwords, we find the cost per click is cheaper by at least $2 (estimates from ahrefs). For our targeted keyword set, the average cost per click is $2.90.

As for banners, that cost per click averages $.70 on our website. This means that all the affiliate programs we participate in are seeing a lower cost relative to banners.

Considering that our website is recommending hotels as an impartial third party source, we are acting as an influencer. We help the traveler narrow down options. This makes the affiliate traffic often a warmer lead over banners and Adwords — and also turns out to be a more affordable option to the marketer looking to reach travelers in the most financially effective way.

Takeaways for travel planning startups

This data can help you benchmark potential earnings. It can also inform the process as you weigh pros and cons of handling the checkout process in-house versus sending traffic away to book at a well known brand.

I’ve consulted for travel startups that invested reams of hours trying to get people to book on their website. This effort always took away time from building a better product. One way to free up time for product is to consider affiliate networks. While your startup is young, you could leverage affiliate programs with deep linking to help cut down on the time need to validate your MVP.

If your startup is aimed at delivering value in the planning stages of a travel purchase, we suggest using TripAdvisor’s affiliate program in order to validate an MVP within days.

If there are no commissions within one or two weeks, then perhaps your site is too far up in the funnel to earn commissions on booking. In that case, you will likely be up against a fierce battle to bring customers back. That’s an expensive battle not worth fighting.

If commissions are not coming, it is also possible that the information on the website isn’t meaningful to a target audience. You’ll need to work to redefine the product market fit.

Takeaways for big brand hotel chains

What surprised us most from the data is that big hotel chains are not that competitive relative to some meta search engines and OTAs. This could just be our data; nonetheless, it was a surprise.

We saw this as counterintuitive for big hotel chains, considering that hotel properties are paying OTAs 15% to 20% on bookings. Branded hotels chains could look to affiliate marketing as a way to close the gap on OTAs, while also enjoying more direct bookings at a lower commission rate.

If hotel chains want to increase direct booking, we suggest doing away with a commission model around completed bookings. It can be more lucrative to drive direct bookings through a pay per action model, as affiliates see revenue in days not months. This increases the stickiness of affiliates, and makes them invest more time and resources into driving direct bookings to your property.

Takeaways for affiliate marketers

Assume the commission rate for most booking-based programs is going to be much less than what’s advertised. In our case, the commission rates are actually one half to one-third of the advertised rate! That’s a significant difference, and must be accounted for in any financial projections.

This difference is because of cancellations, rules in the program, breakdowns in tracking, bookings occurring after the cookie duration, and, in most cases, a complete lack of cross-device tracking. Together, these variables eat away revenue.

We are beginning to explore different business models by working directly with hotels. This allows us to control the variables a bit more, and align our interests with hotel partners.

Be mindful of how much it costs to generate traffic. In our case, seeing these numbers signaled that there is virtually no way we can invest in ad spend to drive traffic. That eliminates a primary way to scale up traffic. We put a good deal of effort into both UI/UX improvements and conversion optimization. Yet, despite some small improvements, we found that driving traffic is often a better use of time than refining the UI/UX.

We strongly suggest investing all your efforts into optimizing for TripAdvisor because you’ll be able to see earnings much earlier. We suggest utilizing the deep link generator, which allows you to generate links to specific hotel properties you recommended.

Using simple blue text links that are accurately placed in articles highly outperform banners, button and much of the creatives provided by the affiliate programs. We also didn’t find any of the deal rebates and coupons affiliate programs provide mattered to our users. The fundamentals matter — so don’t neglect the most basic things when you deploy your affiliate program. It will likely outperform the rest of your efforts.

How we gathered our affiliate click data

As for extracting our data, we first had to consider our objectives.

Ultimately, we wanted to know which affiliate programs are paying the most per click. We wanted to understand how much money our site is generating per click when we use things like widgets vs. text links. We also wanted to isolate any poorly performing affiliates that might be paying extremely undesirable commission rates.

Most of all we wanted to get a basic analysis that gave us a better sense of what affiliate programs to prioritize without removing too much customer booking choice.

One of the largest challenges when gathering a valid data set for these objectives is accounting for different affiliate commission structures.

If an affiliate program pays per booking, there is a lengthy delay from the point of the customer booking to the time it takes for us to see the commission hit our bank account.

To explain fruther: not only does the customer have to complete the stay but then the commission has to be processed internally, funded and paid out by the hotel.

We have uncovered in some cases affiliate programs delay the funding payment step, or even accelerated it in correlation with the end of a quarter.

Other affiliate programs pay per lead, or a commission is triggered because the visitor you sent performed a specific action. Over time, we have grown fonder of these payout structures because they give us predictability in terms of month to month revenue.

Given this criteria, we made sure to examine data that was at least six months old. This would allow the commission per booking structured programs a long lag time on payouts.

Since we have data going back to June 2012, we believed looking at clicks to commission payouts is going to give us the right barometer to solve our objectives. Therefore, our data set looked at all affiliate clicks generated across all four of our websites since June 2012 until April 2017.

Limitations of study: Of course, we are just one website in one obscure niche, the findings could be much different by examining other websites.

This is a viewpoint from Jeff Howard, founder of HotelsNearDCMetro.com.Photo by Mar Newhall on Unsplash.

![]()