New research on the state of travel startups in 2017

By cameron in Uncategorized

This is a viewpoint from Valentin Dombrovsky, Chief Alchemist at Travelabs and Phocuswright Innovation Platform Ambassador.

Phocuswright presented findings from its report “The State of Travel Startups 2017” at Battleground: The Americas on September 12. This year, the startup focus was a standalone event for the first time. As Phocuswright research serves as a source of invaluable information on travel tech market trends, I’ve pulled out a few takeaways worth sharing.

Please note that the individual slides shared below are also compiled into one Slideshare below, which can then be viewed in large format.

We live in exciting times for travel startups

As the travel industry itself experiences huge growth over the past few years, so has the speed of innovation in travel technology and the launch of startups.

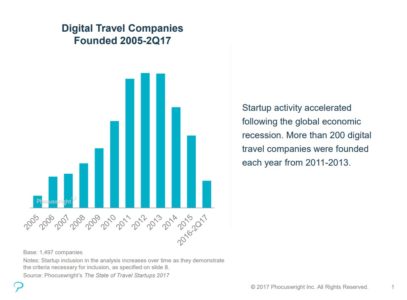

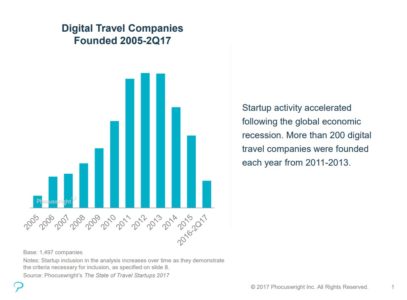

Startups need to meet some qualifications to be included in the report (like demonstrating a product in the market, verified funding, a viable business model, or a significantly unique approach to solving a travel industry problem). With these criteria in mind, the report has covered 1497 companies founded since 2005. More than 1,000 were founded after 2010 (with peak years being 2011-2013).

Travel companies founded since 2005.

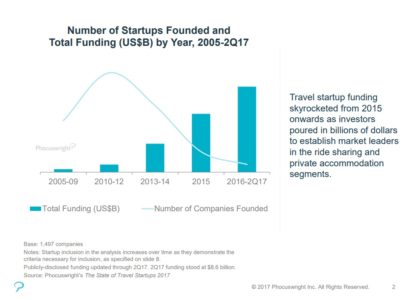

The report uncovered a startling fact about travel startups funding: while $62B was invested in startups, more than 94% of that ($58.4B) was invested in the years after 2012.

This includes huge rounds in companies like Didi Chuxing, Uber and Airbnb, which collectively accounted for 63% of total funding. Yet, the numbers show that a lot of money poured into the travel tech market.

Startup count and funding amounts.

Travel startups today have more opportunities to thrive than ever

I remember founding my travel startup just a few years ago, back in 2012-2013. There were almost no incubators or accelerators dedicated specifically to the travel tech industry.

Today, opportunities seem to be endless and new ones appear every day.

The incubator ecosystem

From corporate programs built by intermediaries (Amadeus NEXT or Travelport Labs) to incubators founded by travel suppliers (Cockpit Innovation Hub or Hangar 51) and destination-powered incubators (Paris Welcome City Lab and London Traveltech Lab), there are many places where early-stage startups can learn from more experienced industry peers.

Phocuswright itself is becoming more open to early-stage entrepreneurs with its Innovation Platform, offering plenty of opportunities for the beginners in travel tech.

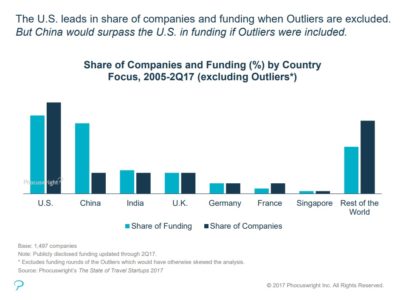

Most of the funding happens in US and China – the rest of the world is still to catch up

U.S. and China account for 57% of total travel tech funding – and other countries are still to catch up.

Of course, these countries are home to the largest funding outliers, or companies that raised rounds of more than $100M like the aforementioned Didi Chuxing, Uber and Airbnb. But these are also the largest travel markets in the world, with the Chinese market having the potential to take the lead in the very near future.

At the same time, the number of recent seed investments in travel startups in Europe has risen over the last few years. This is partly due to emerging incubators playing an important role in attracting the investments to travel startups. Given this development, we shouldn’t count Europe out in this “funding race” either.

The geography of travel startups and funding.

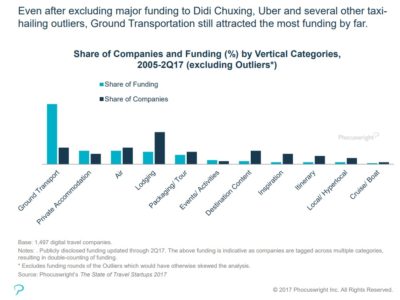

Ground transportation is sexy – inspiration and planning are not

If we look at the funding by vertical, ground transportation accounts for more than half, even excluding such outliers such as Didi Chuxing, Uber and other taxi services.

It seems that this sector is really “ripe for disruption” with bus and train ticketing being the verticals where the “next Ubers” might soon be born.

The most popular categories for travel startups.

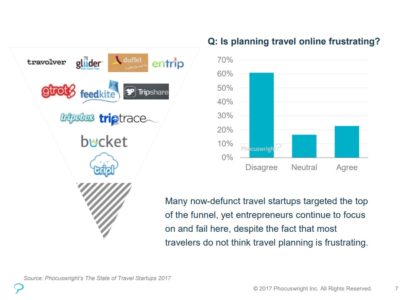

At the same time, inspiration and itinerary planning seem to be very interesting for newcomers, but not so interesting for investors. After all, ‘another trip planning startup’ isn’t the best startup pitch!

No wonder that these verticals have the most number of companies that failed (43% and 41% respectively).

Don’t forget that these are the only companies that met the criteria for including into the report – I believe the number of failures would be larger if we’d take the whole market into account.

Consumer experience planning travel.

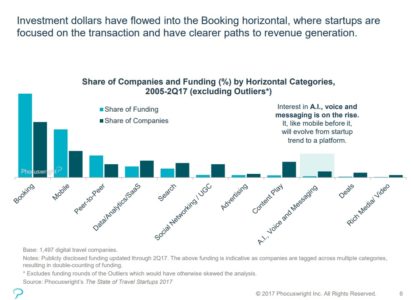

Artificial intelligence is on the rise

While the majority of funding comes to those focused on the transaction, artificial intelligence is definitely going to be heat up over the next few years.

“Money goes to money.” This rule is especially true in travel startup funding as 70% of the funding was given to the companies that deal directly with customers and do the transaction. The further you are from the end of the funnel, the harder it is for you to convert customers into buyers, thus getting funding also becomes tough.

At the same time, the area which seems to be “underfunded” is artificial intelligence. Most of the companies working in that area use b2b models (or at least have some product for b2b customers), thus their sale cycles are longer and they need more time to come into maturity.

Big success stories like Uber and Airbnb seem to attract investors’ money into the b2c space, but the wind might change soon and we’ll see a rise in both customer demand for AI-based solutions and investor interest. One of the signs for AI travel tech finding its way into investors’ hearts might be the Evature-Booking.com deal, which happened recently (after the report was released).

Where are investments heading?

Opinions and views expressed by all guest contributors do not necessarily reflect those of tnooz, its writers, or its partners.

Special thanks to Phocuswright for allowing the use of edited versions of slides from the “The State of Travel Startups 2017” Report.

![]()