B2C payment costs next up to be disrupted – proof of concept revealed for IATA Wallet

By cameron in Uncategorized

From automation to biometrics via digital payments, day one of IATA’s World Passenger Summit in Barcelona focused around digital strategies to simplify the journey.

Greater automation

Passengers want greater automation of the journey, and airlines are eager to deliver.

IATA’s Global Passenger Survey 2017 (GPS), released at the summit, found that passengers want more self-service processes when they travel.

- 68% of passengers want to self-tag their bags with electronic bag-tags being the preferred option

- 48% of passengers wanted to self-drop their bag

The survey also found that automation introduced at security points and border processing is popular with passengers.

- The number of passengers using automated immigration gates and kiosks increased by 6% in 2017, reaching 58% with a satisfaction rate of 90%

- 72% of passengers preferred to self-board, an increase of 2% over 2016

Pierre Charbonneau, IATA’s director passenger and facilitation said:

“Passengers have never been as empowered as they are today. Self-service solutions range from mobile check-in and bag drop, to self-boarding and automated border control. Smartphone- and tablet-toting, passengers want to use these mobile devices to control their travel experience.

“They expect easy access to the information they want, exactly when they need it in the travel process. Airlines and airports that make the most use of technological innovations will be giving a better travel experience to their customers.”

Single token identity

Biometrics are front and centre in the process of simplification with airlines and airports alike hoping to eliminate queues and security screening altogether.

- 82% of travellers would like to be able to use a digital passport on their smartphones to replace their paper documents and to be used for booking flights to traveling through the airport

- 64% of passengers favoured biometric identifiers as their preferred travel token

Nick Careen, IATA’s senior VP for airport, passenger, cargo and security said:

“Passengers want to use one single biometric identity token for all their travel transactions from booking flights to passing security and border control and picking up their bags. IATA’s One ID project is rapidly moving travel towards a day when a face, iris, or fingerprint will provide the key to a seamless travel experience.

“The technology exists. Its use in aviation needs to be accelerated. Governments need to take the lead by working with industry to establish a trusted framework and agreeing the global standards and security protocols needed to use the technology.”

Easy payments

The association’s ongoing Simplifying the Business (StB) program continues to advance, and simplified payments will be a focus for the year ahead. The association made headway with B2B payments over the past year, with its IATA Financial Gateway (IFG) product which lets airlines accept various forms of payment, including BSP Cash or EasyPay from GDS and non-GDS channels alike.

But the association is looking at how to incorporate newer alternative forms of payment as fintech advances, including for B2C applications.

As the association writes in a dedicated StB White Paper published at IATA WPS:

“There remain significant barriers to entry for emerging forms of payments—and balancing convenience, security and cost remain a challenge. While cards remain the most popular form of payment, emerging entrants have demonstrated that segments of customers are willing to adopt alternatives if convenience, cost, transparency and security needs are met.”

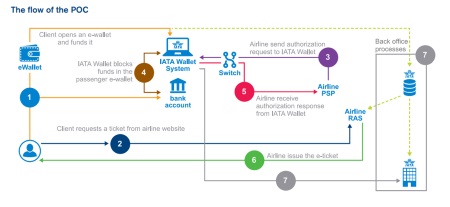

The paper includes a proof of concept for an IATA Wallet concept, which would make this possible.

Click on the image to open a larger version in a new window

IATA also hopes to benefit from payment improvements by reducing the overall costs of payment processing to the industry, which is higher than the costs of distribution. IATA said in the StB paper that current industry costs for payments are $7.7 billion, including $1.8 billion in indirect sales BSP card merchant fees, and $1.8 billion in indirect sales ARC card merchant fees, as well as $2.9 billion in direct sales card merchant fees, with fraud adding $1.2 billion in costs.

Image by BigStock.

![]()