Lyft attracts investment from Alphabet in $1 billion round

By cameron in Uncategorized

CapitalG, an investment fund which is part of Google’s parent company, Alphabet, is leading a $1 billion funding round for Lyft as money continues to pile into the “mobility” sector.

At the time of writing, the only official details are in a short blog post from Lyft. CapitalG’s official Twitter and LinkedIn accounts link to the post.

The blog post also says that when the round is complete Lyft will be valued at $11 billion.

And it also says that CapitalG’s David Lawee is joining the Lyft board. Lawee is a Google veteran, whose roles there included five years as its vice president of corporate development, in charge of its M&A activities. Before that he was its first VP of marketing.

Lawee’s position on the board and his deep working knowledge of Google is relevant because CapitalG “works with Google experts to help [its] portfolio companies solve core operational and business challenges in a variety of areas, including product, engineering, marketing, sales, and operations”.

Coverage of the annoucement in the mainstream, business and tech press is generally framed around what this might mean for Uber. Google Ventures, another of the search giant’s investment funds, was widely reported to have been part of a $258 million investment in Uber back in 2013.

On the other hand, there is also the ongoing legal dispute between Google’s self-driving car business Waymo and Uber, in which the former accused that latter of stealing trade secrets.

Other angles include trying to unravel the various cross-ownerships and shared investments within the “mobility” sector and bring order to the chaos.

CB Insights has produced a mammoth “Uber strategy teardown” in which it speculates on the future direction of Uber under Expedia Inc’s former CEO Dara Khosrowshahi.

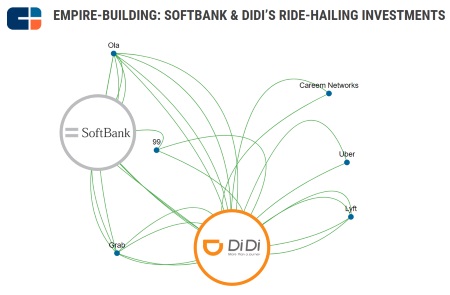

The report includes some useful infographics. The investments in the sector made by Japanese investment house Softbank and China’s mobility giant Didi illustrate the various interests each has in the sector and where Lyft and Uber fit in.

Click on the image to open a larger version in a new window.

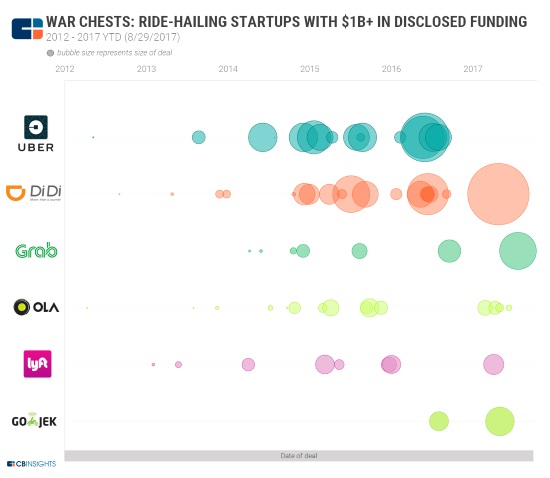

And it also includes a chart which compares how much cash each of the leading mobility businesses have raised (or at least mobility businesses with a valuation in excess of $1 billion.)

Click on the image to open a larger version in a new window.

It seems as if every week there is another billion dollar deal somewhere within the mobility sector. Lyft’s statement about the CapitalG investment says that “less than 0.5% of miles traveled in the US happen on rideshare networks”. The growth profile for the sector is never in doubt and is widely discussed – profitabilty on the other hand is noticeable by its absence in the statements and speculation.

![]()