Transaction frequency data revealed for India’s OTAs

By cameron in Uncategorized

Kalagato has come up with a new set of metrics which give a fresh perspective on India’s online travel market.

The data analytics firm has made public some of the findings from its paid-for research, and there are two distinct points of interest – transaction frequencies and the importance of rail.

Over the past couple of years, India’s market has been one of stellar volumes growth and market share battles. Investment has been forthcoming – profitability less so.

The scene was set in 2015 when MakeMyTrip said in an earnings call that it was focusing on gaining market share, meaning net revenues would be hit. Of course, that was before MakeMyTrip picked up investment from Ctrip, writer of the rule book when it comes to building share in a growing market.

In this context, customer acquisition is vital. The publicly-disclosed sums spent on sales and marketing by MakeMyTrip and Yatra show a continued increase. Promotional campaigns, incentives and discounts are used to attract new users to the brands, often at very low margins. Bollywood superstars are employed as brand ambassadors.

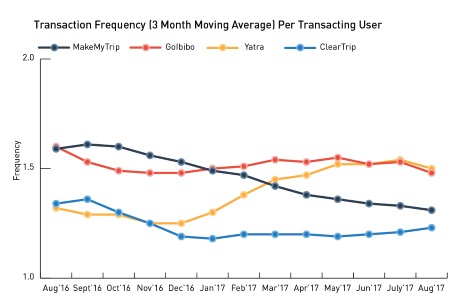

But acquiring customers is no use if you can’t retain them, and this is where Kalagato comes in. It has looked at MakeMyTrip, GoIbibo (part of the same business after the 2016 merger), Yatra and Cleartrip and come up with an “transaction frequency (three-month moving average per transacting user” benchmark.

(Click on the image to open a larger version in a new window)

It notes that:

“GoIbibo’s transaction frequency has consistently been the highest in the market. But perhaps more interesting than the continuity of that one statistic – is MakeMyTrip’s dramatic decline and Yatra.com’s ascendance in the same period.”

The devil as ever is in the detail, with no reference to transaction value. MakeMyTrip has a strong position in higher-ticket hotel and packages, while GoIbibo operates in the mid-scale segment. The timing of Yatra’s steep rise during the first few months of 2017 is of note and may or may not be related to its launch of a marketplace and the post-IPO publicity.

Kalagato’s other chart shows the importance of rail in the Indian market, and this again connects back to the customer acquisition costs. While the brand campaigns and discounts are one way to attract users, so too is offering them products at an entry-level price point in order to not only acquire the customer but also to familiarise them with transacting online.

These charts also include data from online hotels aggregator OYO, booking.com, RedBus (also part of MakeMyTrip group), Abhibus and Travelyaari.

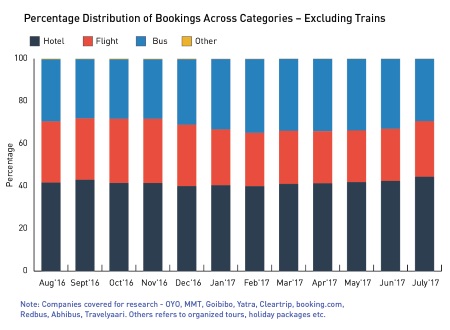

Two charts show how dominant rail is, in volume terms at least. Here is how the bookings are broken down by segment without rail:

(Click on the image to open a larger version in a new window)

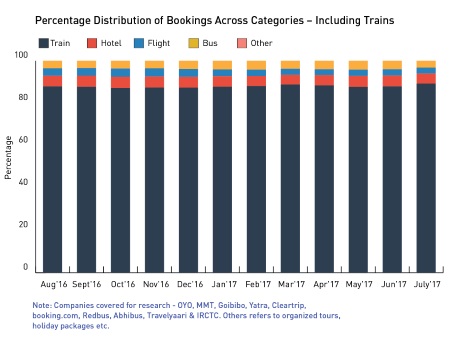

Add in the state-owned IRCTC and rail accounts for more than 80% of the total.

(Click on the image to open a larger version in a new window)

Kalagoto’s take on its own findings is:

“There is still a massive opportunity to build services around rail travel. Over 20 million people use the Indian railways every day, ticketing is just the first point of service for these customers. Secondly, the runway for the rail to air shift is still long and straight.”

The imminent expansion of Indian air capacity explains the potential shift, but the present opportunity lies in the sheer volume of people using rail, all of whom are potential customers for the OTAs. There will be more commuters than travellers among the 20 million daily users but the argument is those people buying rail tickets online today could buy a five-star three-week vacation in a few year’s time.

That’s the theory at least, but connecting Kalagato’s two sets of stats raises some questions. Even when factoring in low-price rail and bus purchases, the transaction frequency seems low. Having acquired the customer, it appears that India’s leading OTAs still have some way to go in converting one-off customers to regular customers.

The drive for share and customer acquisition will continue to dominate India’s online market for some time – the market is maturing in the major metropolitan areas. On its latest earnings call, MakeMyTrip’s Deep Kalra, told analysts that “large opportunities for new user growth will likely come from the non-urban parts of the country.”

User growth will grab the headlines, but perhaps businesses need to look at how many of these new users become repeat customers.

Related reading from tnooz:

Skyscanner India not playing the mega-marketing game (Aug17)

Ola finds a way with Google to open up rural India (May17)

Paytm ramps up travel category [in India] after blockbuster start (Feb17)

Photo by Jayakumar Ananthan on Unsplash.

![]()