Distribution dilemma for Latin America airlines

By cameron in Uncategorized

This is a viewpoint from Thomas Allier, co-founder and CEO at Viajala.

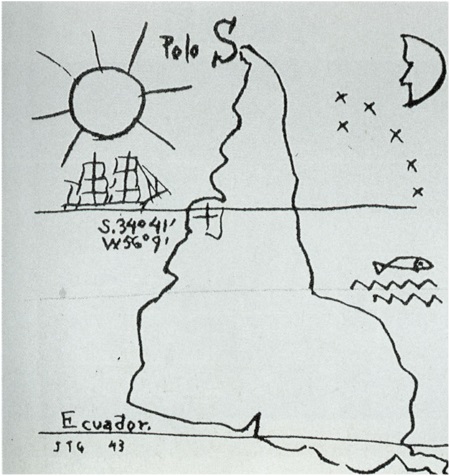

In the 1930’s Uruguayan artist Joaquin Torres Garcia opened a modern art school in Montevideo. In the 1940s he designed a logo which symbolised his lifeview – namely that South America should see itself as equal to North America and Europe and that Latin American artists should seek their inspiration locally instead of globally.

His perspective still resonates today and travel is one area where global solutions have constantly failed to address the challenges of the extremely fragmented markets of Latin America. But a strong local focus has enabled local OTAs to dominate global players in the region. As the market moves towards airline direct sales, at the same time as the low cost carrier model gets a hold, most airline content in the region remains unavailable through the main OTAs and GDS.

Air metas are emerging as the possible solution to bridge the distribution gap. To become successful, metas will need a local focus and act according to the principles of Torres Garcia’s “school of the south”.

Despegar and the first mover advantage

After 18 years of steady growth, Latin America’s leading OTA Despegar has filed for an IPO on the NYSE. With $3.3 billion in gross booking over 2016, Despegar accounts for 11% of all online travel booking of the region according to Euromonitor International statistics referenced in its SEC filing.

Over the past two decades, Despegar has had a clear role in enabling online travel booking in the region. They had an active role in bringing the consumers online in a region that still lags most others with an expected online penetration of 34% expected for 2017 compared to 52% in Europe.

Its local market expertise, such as partnering with top local banks to provide consumers with instalment payments plan, was key to its success over global competitors.

The (late) rise of low cost airlines and legacy airlines push toward direct sales

Beyond Mexico and Brazil, Latin America is still largely underserved by LCCs. According to CAPA, LCCs’ market share remains below 15% in all other markets.

However, several low-cost airlines are poised to change the landscape. From VivaColombia, that has 12% of the domestic Colombian market after only five years of operations, to future players such as FlyBondi in Argentina and LAW in Chile. A total of 21 airlines commenced or are expected to commence operation in the region between 2016 and the end of 2017 according to CAPA.

In the meantime, legacy airlines will keep pushing toward direct sales through their airline dotcoms, further challenging the position of Despegar and other OTAs. A striking example is LATAM Airlines, the market leader, that recently cut their commissions to travel agency from 1% to 0%.

Take the region’s fastest growing market Colombia. Despegar only lists two out of the seven domestic airlines, the same reach as the country’s largest flight OTA tiquetesbaratos.com. With domestic flights accounting for 80% of the total market, this is a big gap in their inventory and shows that large OTAs in the region mostly rely on GDS content.

GDS won’t ease the distribution headache

GDS are expected to play a major role in air distribution. However, the Latin American market is fragmented – the top four airlines only account for 40% of the market compared with 68% in the US. Amadeus, Sabre and Travelport all struggle to bring comprehensive content to the travel agencies, and as a result, their clients – and travellers – only get access to a portion of Latin American air content.

Lots of regional airlines do not have the scale required to work with the large GDS and rather partner with second tier distribution platforms such as KIU system or TTI. However, such platforms won’t provide the same distribution reach.

Low-cost airlines want to minimise distribution cost, which means they often decide against making their content available in the GDS or any kind of third-party distribution platform.

Another factor is that, globally, legacy airlines are looking at IATA’s NDC as a possible alternative to GDS distribution and the associated fees. While NDC is currently not part of the Latin American airline mindset, it could gain traction in the wake of wider adoption from carriers in other regions.

OTAs and GDS don’t seem to be the long-term solution the local consumer need to access exhaustive content. Flight distribution remains broken…but who can fix it?

The emergence of air meta

The flight metasearch model might well be the solution to fix flight distribution in LATAM. Its main advantages include:

- Lighter integration process : search/availability only. The booking still happens on the partner site.

- Redirect model enables airlines to upsell their ancillaries, cross-sell other vertical product, control the selling process and acquire new customers.

Mundi has pioneered the model in the region. Founded in 2008, the Rio-based company struggled to make it through the Brazilian recent recession and recently sold its assets to Kayak.

Mundi’s presence prompted other companies to enter Brazil, such as another local player Voopter which was able to grow through clever use of affiliate marketing. Global metas Skyscanner and Kayak also made their presence felt.

So far, Skyscanner appears the stronget of the two. It has scaled to about twice the size of its competitors in the country . Skyscanner’s European experience in facing high level of localised market fragmentation might have helped them to make a difference in Latin America so far.

Medellin-based company Viajala was founded in 2013 by ex-employees of Expedia and voyages-scnf with initial focus on Colombia, Chile and Peru but later expanded to the entire region. Like Skyscanner, Viajala has been able to connect directly with most airlines in Brazl, including low cost and regional carriers, bridging the flight distribution gap by bringing exhaustive content to the consumers.

Like other region, the meta landscape is not standing still. Turismocity, a spin-off of coupon aggregator Descuentocity, is growing and is the leader in Argentina; Kayak is building a team to localise its product while Skyscanner has already shown that its market expansion expertise can be applied successfully to the region.

This rising competition demonstrates that air meta has emerged as a viable way to address flight distribution fragmentation in Latin America.

To be continued…

This is a viewpoint by Thomas Allier, co-founder and CEO of Viajala.

![]()