Are hotel franchise fees a growing problem for owners?

By cameron in Uncategorized

This is a viewpoint by Peter O’Connor, professor of digital disruption at Essec Business School in Paris.

While much media attention has focused on the issue of OTA cost, hotel owners have also seen franchise fees explode over the past decade, threatening profitability and potentially driving significant industry evolution.

Hotel chains have embarked on a series of extravagant marketing campaigns over the past 18 months, seemingly designed to support their direct booking and loyalty growth initiatives. Complete with extensive online advertising campaigns and flashy television ads, anyone interested in travel could not avoid being bombarded by repeated messages to visit brand websites and ‘book direct’!

Hilton for example, rolled out a “Stop Clicking Around” campaign in February of 2016 and touted it as their largest ever.

Complete with the Rolling Stones hit, “Satisfaction,” Hilton increased its media spend significantly in 2016, including a $25m television campaign. This leads to the question, where do hotel brands, with fewer and fewer owned properties, get the money to run such expensive television and media campaigns?

The majority of global hotel chains, including Hilton and Marriott, have been very vocal about their asset light strategies, making clear their business model is at its most profitable when they don’t own the bricks and mortar of the hotels they flag.

In effect these brands are metamorphosing into single brand OTAs driving business to their members. And by swooping up independents and aggressively growing the percentage of US properties that are branded, these two chains now ‘flag’ around a quarter of all bookable hotel rooms in the US.

And this is before their significant development pipeline is taken into account – currently almost 60% of all new rooms under development within the US market will be branded.

When the franchise and management contract fees from such operations are taken into account, that’s a lot of cash from a lot of hotel owners that can be used to foot the bill for these brand-focused booking campaigns.

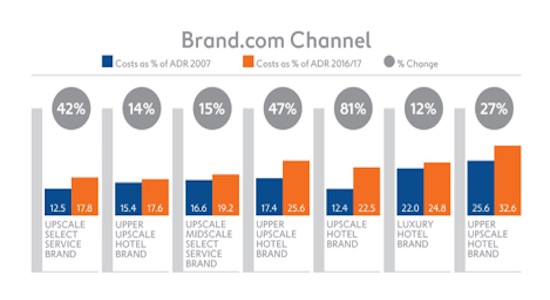

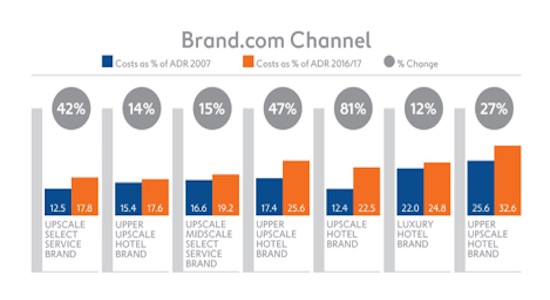

Digging deeper into the Financial Disclosure Documents of seven major hotel brands’ from 2007 through 2017 revealed some startling figures.

In the past 10 years, hotel chains have been gradually increasing brand channel costs (as a % of ADR) by 34% on average – with the most extreme ‘performer’ increasing fees by 80%.

These increases include new fees to support online marketing efforts; to increases on existing royalty, loyalty, program, marketing, and reservation fees – but significantly they are charged on all revenues irrespective of whether it’s the hotel chain that secures the booking or not, something that seems unfair given that for most properties a decent proportion of hotel bookings originate through OTAs as well as at the property level.

And while the growth in fees varies by category and brand, a clear trend has emerged: To drive their direct booking campaigns and loyalty growth initiatives, asset light hotel chains are increasingly relying on owners’ pockets to keep their advertising coffers full.

*based on 2017 STR Chain Scales

These findings are supported by Bomie Kim, research analyst at HVS and co-author of the firm’s “Hotel Franchise Fee Guide.”

Speaking to Hotel Management about the current cycle, she said:

“Brands have increased royalty fees, which aligns with the strong market fundamentals in the hotel industry.”

“We have also witnessed fewer companies offering key money for developers and owners, as fewer enticements are required in today’s environment to stimulate development in the United States.”

With these fee disclosures readily accessible, brands have also reluctantly confirmed this.

However this is just one in a long line of increases. Some branded properties have observed double digit increases over the past decade.

What really stands out here is that it’s these very chains which are so hyper critical of other industry player’s distribution costs – in particular OTA commissions.

I took a closer look at OTA commissions — are they rising in sync with franchise fees? Not exactly.

My admittedly non-scientific study (OTA commissions are generally not public) in fact reveals the opposite trend. Over a ten-year period, per booking commissions through online travel agencies seem to have ostensibly fallen.

“As we scale our fixed costs relative to demand, we want to make sure we pass on those economics not just to our shareholders but to our partners.”

He also confirmed that Expedia’s commissions have come down several hundred basis points in recent years.

While the exact amount these commissions have dropped varies by OTA, region, and property, industry experts peg average commissions in the 20-30% range in 2007 and in the 10-13% range for large global chains in 2017 (1).

As OTA commissions have declined, we’ve observed higher hotel participation over this same period of study. This increased participation with OTA’s is likely not driven just by reduced distribution cost alone.

Increased visibility of these channels spurred by media equates to “free marketing” via the Billboard Effect for hotels (2). Additionally, increasing spend on technology to support both consumers and hoteliers is also likely behind OTA expansion.

Both Booking’s RateManager and Expedia’s Rev+ product are examples of the types of tools that the OTAs are putting into the hands of owners to provide valuable market insights and help increase performance for hoteliers.

If the trend of rising brand fees and declining OTA fees continues, owners will increasingly be caught with one foot squarely on either side of the fence.

OTAs will use their scale and marketing expertise to market to travelers looking for a comprehensive shopping experience where they can comparison shop across brands as well as bundle services such as air and car rentals.

As a result, chains will be forced to even further ramp up efforts to grow their loyalty programs in order to drive brand value to owners. This will probably include technology CapEx investments (costs currently not included in franchise fees) to help prop up, and even strengthen, the brand, despite the fact that they are being funded directly out of the pockets of hotel property owners, irrespective of the actual contribution to the brand in question to the success of the individual hotel.

Increasingly, it seems, it’s the hotel owners who “can’t get no (buh-duh-dum) satis-faction.”

It’s no wonder therefore that many owners are exploring an increasingly diverse range of alternative ways to drive business to their properties.

Apart from the increasingly questionable brand value, the benefits provided by hotel chains include superior access to distribution channels; a range of technology based systems to support these distribution efforts; as well as centralized, brand-focused, marketing expertise.

Today however boundaries between different travel industry players are becoming increasingly blurred, presenting hotel owners with interesting alternatives to access similar benefits without the constraints and expense of signing up with a traditional brand.

For example, technology providers such as Sabre Hospitality and sister company Trust International now provide not just technology systems but connectivity and expertise.

Soft brands such as Leading Hotels of the World and Best Western have majorly expanded the portfolio of relevant services they provide to members, and practically all of the major chains have seen the writing on the wall and introduced ‘Collections’ – schemes that allow independent properties to benefits from the distribution systems and technology of the brand at a fraction of the costs of actually flying the brand flag.

Some industry analysts have (controversially) gone so far as to suggest that new build properties should refrain from signing up with a chain and instead rely on better value OTAs to drive business.

In any case, it seems that the global hotel chains’ ‘gravy train’ is increasingly under threat. As hotel owners increasingly question the value they are getting for their ever-increasing franchise fees, brands will be forced to radically change their business model.

Already several are modelling scenarios where they only charge fees on ‘’controlled distribution’ – the actual value of bookings driven through direct branded channels (which may help explain some brands almost psychotic focus on direct booking, and loyalty program growth, campaigns at the moment).

But if hotel brands do move in this direction, how will they differentiate themselves from what we currently call OTAs? Having criticized the latter for so long, how will they be able to justify adopting what essentially would be an identical business model?

And from the customer perspective, what would be the advantage of booking through such a single brand system, when OTAs provide wider, multi-brand, choice; attractive loyalty programs and comparable prices?

Thus, strategically it seems that hotel chains are stuck between a rock and a hard place! Most recognize that significant evolution of their business model is needed, but few are willing to admit that the oft-criticized, totally performance-related, OTA model may yield the bottom line results they’re looking for!

This is a viewpoint by Peter O’Connor, professor of digital disruption at Essec. The views expressed are the views and opinions of the author and do not reflect or represent the views of his employer, Tnooz, its writers, or its partners..

Footnotes:

(1) Deutsche Bank Market Research: A look at Loyalty Pricing and RSS Conference Takeaways; 2Q16 Preview, Page 4, Paragraph 4

(2) Chris Anderson, the Billboard Effect: Still Alive and Well”

Image via Erik Mandre for BigStock.

![]()