Interview: Mobility solutions, Waymo, and Zipcar with Avis Budget Group’s Jeff Kaelin

By cameron in Uncategorized

Jeff Kaelin’s been busy. As the vice president of products for Avis Budget Group, he’s been listening to customers and infusing feedback into a modernized user experience. The flagship brand’s new app signals a maturing view of how to make an app that truly serves the rental customer.

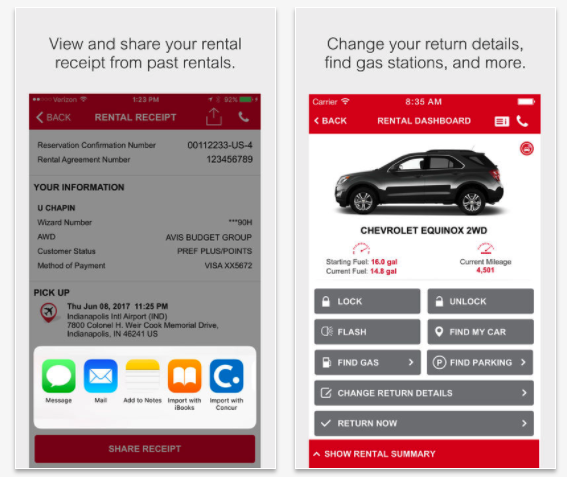

With simple-but-effective tweaks, such as being able to swap out a car immediately and flashing lights of a car when lost in a parking lot, the app brings modern conveniences directly into the rental experience.

I sat down with Jeff at GBTA last month to discuss the evolution of Avis Budget Group from a rental fleet to a full-on mobility services company.

Electric cars have gotten an enormous amount of attention over the past year. With the availability of charging stations, what happens if I rent a car and run out of electricity? Does Avis start doing charging stations in order to offer full-electric vehicles?

Today, as you know, the infrastructure is not readily available to support those types of always-on electric vehicles. That will be a change that will take awhile to get out throughout the industry.

Seems like a good app integration, adding those charging stations.

I think making those available, and alerting customers, will be really important. Like everything, there will be a learning curve for customers about how long I can push this vehicle, how long can I go for and what the safe margin of error is. Because the first time a customer gets stuck because there’s not a charge of the vehicle, they call us. We are the ones who will have to deal with that, whether it’s quick charging or bringing out a replacement vehicle.

Walk me through the process that you went through when designing the app to identify the challenges users were facing.

It’s all about co-creation. We put our customers at the center of this journey. We really sat down and listened to the things that were hardest to hear. Our customers aren’t shy about telling us what they don’t like about car rental. We’re trying to address those pain points.

I’m really proud that we have a closed-loop feedback mechanism. Our product team, on a weekly basis, listens to the verbatims that come back through our customers. Either through our NPS channel or through a number of listening posts that we have throughout the app. And they identify pain points of our customers and infuse those into our sprint cycles to make sure we are addressing customer concerns.

We’re very proud to call out those changes driven by travel managers, those things that are driven by travelers, and letting travelers know that their opinion matters. To those.

How does Zipcar fit into that? Did that culture help infuse that thinking, and where does the brand fit in with rental cars in general?

You know we acquired Zipcar five years ago. It’s a company that’s incredibly focused on the customer experience. Of course, we took our learnings from all their best-in-breed solutions, their best in breed mobile app and their focus on the customer, and leveraged that into our journey.

Our future is about being a mobility provider, and as the model shifts from a pay to own, to a pay to use model, we have a number of solutions across brands. And really what will distinguish the uses will be the context of the brands. Zipcar being more of a membership model, Avis being more tailored to our commercial use cases, and Budget really focused on the major brands.

What about Waymo? How does that partnership fit into this model? You’re kind of testing the waters to learn what it’s like to maintain a car that’s self-driving.

One of the strong points we bring to the mobility landscape is that we are one of a few mega-fleet owners used to managing a diverse fleet makeup. We know how to clean vehicles, maintain them, ship them and the logistics of having the right cars in the right place at the right time.

Waymo is a great partner for us. It’s a great opportunity for us to learn about what the future of the mobility landscape is going to be. And to use some of our best in class fleet management services back to Waymo.

Very interesting. If a car could even just reposition itself for you, that would be a huge win.

When you talk about mobility, everybody likes to think about autonomy to level 5. I think about simple use cases where we move a tremendous amount of vehicles through our lots. If you think about standard, repetitive movements from the return area to the cleaning area. From the cleaning area back to the rental area. Really short distance, pre-determined routes might be an interesting opportunity to start testing autonomy on a real, limited basis.

And then would it be worth the money, as far as the cost versus the savings on labor. You have damage, you have labor. And when you think about where your resources are best leveraged. If we’re not using the labor for that, what are the things we can do to make it a better end-to-end experience for our customers?

So it’s really exciting. There will be lots of announcements to come in the coming months. It’s a strong partnership environment, as everybody is partnering with everybody to get a feel for the mobility landscape.

As we expand our connected car model, it’s going to allow us to expand our connected car model. It’s going to allow us to expand our distribution outside of our traditional brick-and-mortar footprint to put cars where you need them. The difference in some of our cars would be the context of the brand you want to interact with.

Let’s talk distribution, sharing content and increasing corporate travel bookings. Is that a struggle where you have to be put into a GDS, and offer up commissions? Does a direct-connect model make more sense for car rentals?

So we actually have a large direct-connect infrastructure. We’re embarking on a journey for our next-generation API. We do direct connects with our 3rd party partners, with the airlines, within corporate booking websites. Travel managers and travelers want to book when and where they want to. So we have to provide them that access they need.

We want partners to consume our mobility solutions when and how they want to. Whether they want to consume one brand or multiple brands, in limited cases or in all cases, and whether they want to integrate Zipcar into those selections.

Do you think that corporate fleets would be more inclined to do self-service technology with Avis behind the technology? Are fleets the first place that will see self-driving? What’s the first real traction we’ll see, which segment in vehicles?

I think that’s anybody’s guess. Certainly, there are lots of opinions about that. It could be large companies or municipalities. We have a strong commercial base of customers that may help us open doors for partners.

Would Zipcar ever do an Uber competitor, but with only self-driving cars? Is there something like that from Zipcar in the future?

Avis Budget Group and Zipcar are evaluating the mobility landscape and figuring out where and when we should play — and what areas we’re best suited to address.One

One pain point with Zipcar was always having to do the round trip, and returning the car to the same place.

You know what? We’re running pilots in Brussels and in London, we have floating fleet. And so now you can do it. Some people refer to it as one way, some people refer to it as floating. Dynamically, we’re managing the ebbs and flows of the inventory. But the ability to pick it up and return to a different location. And soon, the cars can self-drive themselves back to the station. And you can go anywhere you want, one way.

When I think about autonomy, I think about some of the use cases like airport shuttles on fixed loops. It may allow you to do more frequent interactions on a smaller scale. There’s a lot of great products. And a lot of great technology that’s coming out. I think the technology will probably be ready before the regulations. It will be a race.

When you think about the size and scale, globally, of our fleet. We run tens of millions of miles on our vehicles. There’s a lot of learning that can take place from a connected car fleet about what those use cases look like. And what those future needs are going to be.

![]()