Enough of the Amazon of Travel talk, airlines can aim higher

By cameron in Uncategorized

Ever since ecommerce hit the airline industry’s radar, every year we’ll hear a new batch of leaders (including Ryanair’s CEO Michael O’Leary) declaring they want to become the ‘Amazon of Travel’.

My reaction is always the same: “…that’s it?”

NB: This is a viewpoint from Philippe Der Arslanian, CEO of Answair.

First off, it’s a disturbing show of the lack of appreciation there is for the full potential of digital in the airlines space.

Maybe these leaders just want to amplify their brand impact and become so loud that meta-search engines lose their relevance? Or perhaps they seek a business model embracing as many products as possible vs. the typical ‘flight product + related ancillaries’.

Whatever the case, this strategy is simply not ambitious enough.

Don’t get me wrong – Jeff Bezos has to remain an inspiration when it comes to retail. Airlines still have a lot to learn, and Amazon is where they should learn it from.

It is a visionary learning machine with incredibly innovative demand forecasting, product search ranking, product and deal recommendations, merchandising placements, and much more.

It’s no surprise that an increasing number of carriers have hired pure retailing leaders to infuse, distil and manage this new cultural change within their traditional businesses.

Turning to Amazon-like retail is a much needed transition in the industry, but it isn’t the final stage that airlines should aim for. Lest we forget, Amazon itself tried the “travel” segment – and failed.

‘Amazon Destinations’ was expected to shine in the online travel domain.

Its advertisement and acquisition costs would have been very low while providing new cross-selling opportunities. And yet, it came to an abrupt stop in October 2015. Why?

One response may be: simply because travel is not just another “vertical”.

Airlines need to introduce a brand new retailing horizon and trigger new business models.

To understand why carriers aiming to be the ‘Amazon of Travel’ is limited from the start, one must pit Amazon against airlines on three fundamental retail dimensions: merchandising, personalization and data, and innovation.

Merchandising

Shopping for airline tickets is completely different from your typical experience on Amazon.

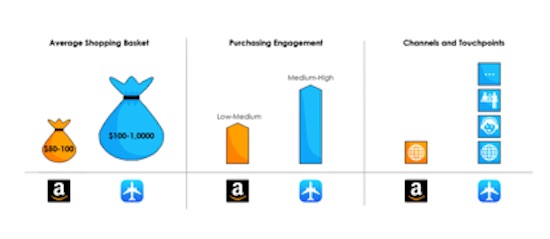

Not only is the average shopping basket significantly higher (an estimated range of $100-$1,000 for airlines, vs. only $50-$100 for Amazon), but the emotional investment in the purchase is dramatically higher as well.

This conditions the success of an upcoming vacation or crucial business trip – and is therefore a high-engagement process.

Closing the sale is far more difficult, and it explains why most airlines decide not to distract from the sensitive process of buying an air ticket with too many cross-selling offers.

Better to close the deal first, and then talk about additional options.

The simple truth is that the ‘shopping basket’ is not the right tool for airlines anymore.

The unique and evolving nature of the traveler/airline relationship will require something better.

A mobile companion, for example, could be more adapted to the need for continuous conversations and notifications, cross-selling by tapping into the impulsive behaviour of Millennials on dozens of touch-points throughout the journey (e.g. check-in, parking, security, boarding…), and more generally, by fitting into the concept of ‘micro-moments’, as defined by Google.

In a way, moments are what air travel is all about – and airlines will need the right communication devices for it.

IATA NDC One Order is the real underlying promise for such new direction.

Personalization

I have been an Amazon customer for 20 years (I bought my first book on amazon.com in Nov. 1997), and yet as far as Amazon is concerned, I fit in only two boxes.

I am either an IT geek or an avid mountaineer. That’s it. Amazon has 20 years of purchasing data, and yet is only able to push me into these two buckets.

When it comes to personalization, the number of profiling attributes with travel, compared to retail, is simply staggering.

Sure, Amazon’s machine learning and predictive algorithms do a lot (think of the success of the ‘People who bought this also bought…’ feature).

But travel has a quantity and quality of data, both explicit and implicit that is an order of magnitude over what Amazon crunches today.

And that’s just the beginning. Add in geo-localization, behavioral data captured over several travel days, changing profiling attributes (business or leisure), cultural purchasing habits, and social dimensions and you get a truly intimate knowledge of your customer. Not just any traveller either – airlines are by nature more international, while Amazon is still very US-centric (65% of its revenue comes from the US – a proportion that is actually growing).

Travel personalization can, and should, become extreme.

Not in an intrusive way, but based on an intimate learning aimed at enhancing the experience and reducing the stress of travel, especially when things go bad. Oh, and with a nice side-effect: increasing average revenue per pax.

Innovation

Innovation is probably the only segment where Amazon has a clear upper-hand on airlines. Be it with small retail innovations like the visionary ‘Buy now with one click’, or larger business model innovations such as rolling out new hardware technology (the kindle) and creating a gigantic market for affiliate marketing, is unparalleled.

Amazon takes big innovation gambles, which sometimes don’t pan out (who remembers the “fire phone”?), but when they pay off, they pay off big.

Just look at Cloud services, which have now become a significant part of Amazon success (representing 9% of their revenues with an impressive 55% YoY growth). The list goes on.

This innovative quest is something airlines have been completely unable to replicate – until now.

Similarly to the Amazon marketplace, airlines should open up their content and models and allow a number of value-add players to openly access their assets.

Ideally, this will trigger a creative ecosystem momentum, something that is sorely lacking in the airline space.

Travel personalization can, and should, become extreme. Not in an intrusive way, but based on an intimate learning aimed at enhancing the experience and reducing the stress of travel, especially when things go bad.

Oh, and with a nice side-effect: increasing average revenue per pax.

The analysis of these three axes is revealing. Yes, the “Amazon of Travel” mindset is important.

But airlines also shouldn’t forget just how different their business is from Amazon’s – and therefore, why their retail solutions should be just as unique.

Carriers need to go farther, by establishing novel retail models, becoming more conversational, and eventually deepening their collaboration with airports.

After all, the amount of consumer data Airlines collect is incredible – and subject to the right learning and processing – could transform the way we travel.

Air tickets shouldn’t just be seen as an online transaction with a limited ‘session duration’, but a true and lasting relationship forged and continuously enriched throughout the journey.

Amazon is a great model for comparison, but maybe it’s time for airlines to really invent something new. Carriers should broaden their horizons, and look at what other inspirational giants are doing too.

Take Facebook: Mark Zuckerburg recently adjusted his mission to: “Bring[ing] the world closer together” – and in a way, isn’t that what airlines are all about?

NB: This is a viewpoint from Philippe Der Arslanian, CEO of Answair.

NB2: Airline personalization image via Sergey Kohl for BigStock.

![]()