Hoteliers need to think wifi not Weibo to satisfy Chinese outbound

By cameron in Uncategorized

The sixth edition of hotels.com’s annual Chinese International Travel Monitor identifies a disconnect between what hoteliers are doing for their Chinese travellers and what the travellers actually want.

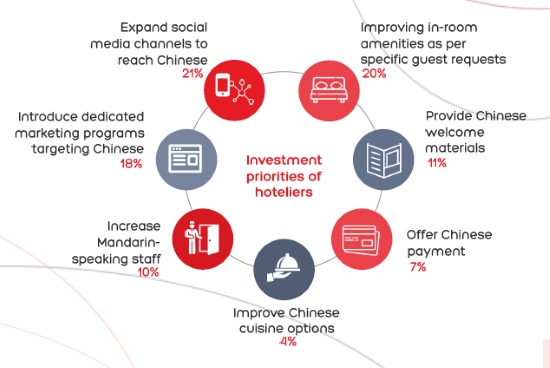

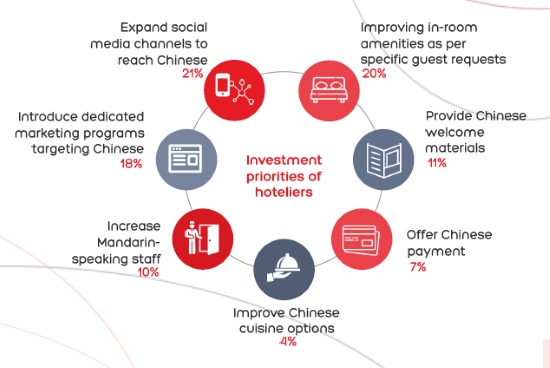

The gap identified by the research is that hoteliers are prioritizing budgets around social media and marketing campaigns over spending on the specific services that Chinese travellers require.

As hotels.com says, “the risk is that the existing service gaps might get bigger”.

As hotels.com says, “the risk is that the existing service gaps might get bigger”.

According to this report, Chinese travellers want, in order: free wifi, a Chinese breakfast, a kettle in the room, Mandarin-speaking staff and for the hotel’s printed materials to be also available in Mandarin.

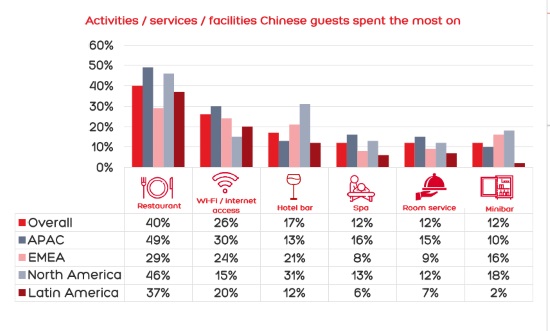

But hoteliers don’t seem to get it – having a Chinese restaurant on site is important for guests but not a priority for hotels. Hoteliers, having invested in marketing to attract the Chinese visitors, are then missing out on revenue beyond the room rate as a result.

The chart below breaks down the on-property spend by region.

The Chinese outbound market is huge – 122 million in 2016 according to China National Tourism Administration – so there will be variations and exceptions which prove the rule. The chart above shows that hotels in Latin America attract less on-property spend, explained by the region being popular with Millennial travellers who are more interested in “local” experiences.

Millennials get a lot of attention in the research. This group is informally broken down into younger (born in the 1990s) and older (born in the 1980s) Millennials. The younger Millennials are embracing the alternative accommodation sector with 29% having stayed in a vacation rental property or hostel over the past year.

Chinese Millennials are not that different from their global peers – wanting authentic, local experiences. However, Chinese travellers generally are more adventurous in terms of not only their choice of destination but also what they do when they get there.

For the first time, shopping is not the number one activity – last year around two-thirds of Chinese outbound expressed an interest in shopping – this year it has dropped to only one-in-three.

Sightseeing and dining have taken its place and the gap will grow, with 50% of the sample planning to spend more on dining and activities on their travels this year.

For tours, activities, ticketing and restaurant apps this indicates a strong potential increase in in-destination business from Chinese travellers. Having a Chinese payment provider is vital if this interest is to be concerted – Union Pay is by far the most used but the study notes that Alipay is preferred by younger travellers.

Elsewhere, the dominance of online and mobile as the primary channel for search and booking is confirmed. The study says that 94% of travellers look at an online price comparison site when planning their trip and that more than half plan between two and six months before departure. On average the Chinese travellers spends 12 days planning

The report runs to more than 70 pages and combines data from more than 3,000 Chinese international travellers, 3,800 of hotels.com’s global accommodation partners with other internal data and other third-party research.

Click here to access the report in full.

![]()