FFPs dominate most airlines’ ancillary revenue streams

By cameron in Uncategorized

Ancillary revenue geeks rejoice – the first tranche of data from this year’s CarTrawler-sponsored research from IdeaWorks is out and shows that ancillary revenues for airlines continued to grow, in actual cash terms as well as importance.

IdeaWorks looked at the 2016 financial results from 138 airlines and has revealed three different “top tens”, ranking airlines by the total volume of sales in dollar terms, ancillaries as a proportion of revenue and ancillary revenue per passenger.

The study has been published every year since 2008 and often IdeaWorks likes to try to do things a bit differently – this year it has drilled deeper into the constituent parts of an airline’s ancillary revenue and separated out the benefits of frequent flyer or loyalty schemes (FFPs).

easyjet and Ryanair make the total top ten without having an FFP, generating just under $2 billion and $1.4 billion of ancillaries from other sources respectively. The leader is United Airlines with a total of $6.2 billion, 48% of which is attributed to its FFP; runner up is Delta, for which 52% of its $5.2 billion is FFP-related.

IdeaWorks says that the vast majority of activity occurs when airlines sell miles to the banks that issue co-branded cards.

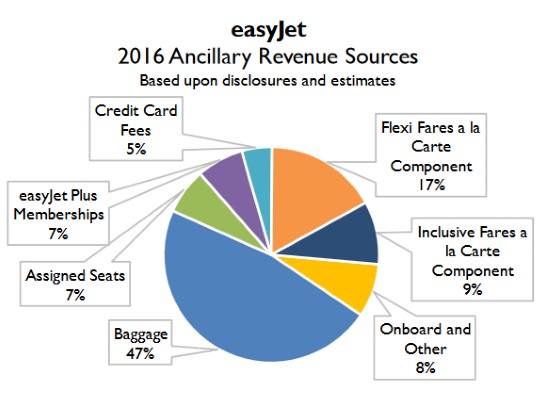

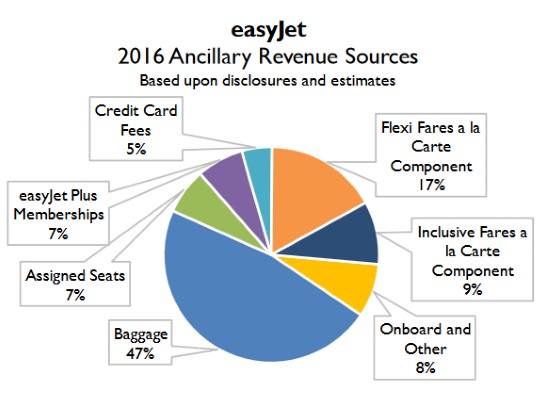

The study compares and contrasts four airlines with an even deeper breakdown of where the ancillaries come from. easyJet secures almost half (47%) its revenue from baggage fees and appears to work harder retailing its branded fares. IdeaWorks measures the premium above the basic economy fare for the ancillary figures.

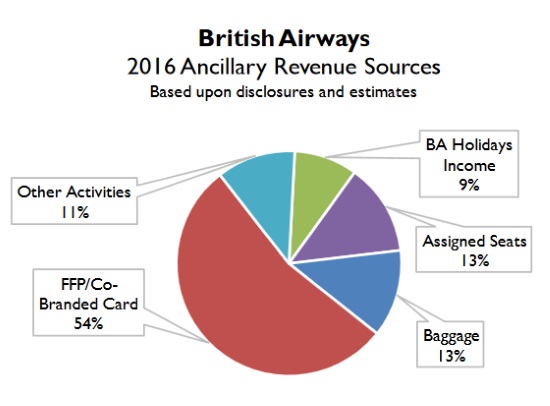

British Airways gets over half (54%) of its revenues from its FFP, with a decent proportion of the balance attributed to income from its BA Holidays tour operating brand.

When it comes to ancillary revenues as a proportion of total revenues, three US airlines – Spirit, Frontier and Allegiance – have the podium positions with each getting more than 40% from ancillaries. Wizz Air, Ryanair and Jet2 come next with 39.4%, 26.8% and 26% respectively.

The same three US carriers hold onto the same positions when ranked according to the ancillary revenue per passenger.

The retailing/merchandising/upselling of airline ancillary revenues is the bedrock of many travel tech providers, with some airlines taking on that function themselves. Successful unbundling and rebundling initiatives require deep integration into the back-end, with well-thought-out consumer-facing techniques on the front end.

But it looks from the research as if the best way to ramp up ancillary revenues is to launch a frequent flyer scheme, or make more of the one you have already. FFPs are as much fin-tech as travel tech, which means that, ironically, the businesses which created the buzz around ancillaries could be left out of the loop.

![]()