Data from Skyscanner is helping airlines assess low-cost transatlantic potential

By cameron in Uncategorized

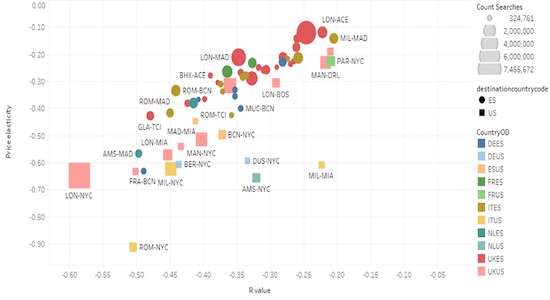

Skyscanner has released a new study of the potential market opportunities for transatlantic low cost routes between Europe and the US, by showing the city pairs with greatest traveller interest and those in which ‘price elasticity’ can help fill seats.

This highly contended transatlantic market—for decades protected by flagship carriers because of its high revenue—has recently come under pressure from LCC airlines like Norwegian and WOW!

Flagships have responded by launching or announcing the launch of their own LCC-flavor carriers. IAG has launched LEVEL and Air France-KLM has announced its intent to launch its own LCC brand, for now known as ‘Boost.’

But the long-haul operating model is perilous because airlines forfeit some of the advantages of local LCC operations, including high frequency point-to-point service and quick aircraft turn-around time. As a result, high load factors (full seats) become more critical.

By applying a price elasticity data model, developed as part of Skyscanner’s Travel Insight business planning and analytics tool, the company has identified solid Transatlantic market opportunities.

These are routes and city pairs where greater demand can be encouraged with seasonally adjusted fares tempting more travelers to book.

Using a year’s worth of data, gathered between January 2016 and January 2017, for each originating departure market, Skyscanner plotted weekly aggregations by travel dates of the median price selected for travel during the period, and the click through rate for that same week.

Skyscanner then scattered the data, ran a linear regression, and measured the slope to represent the change in conversion rate for a change in the median price.

[click image for larger version]

Finally, Skyscanner normalized the data, and the slope, revealing a ratio between the number of people traveling and the price displayed as percentage of change in traffic for a percentage change in price.

Skyscanner’s Travel Insight analytics tool benefits from the company’s historic reservations trends, accumulated from processing search and bookings data for over 60 million travelers every month.

It can reveal purchasing preferences based on price and itinerary and can be geo-tagged showing which passengers in which markets show the greatest interest in a particular route.

Airlines can use this data to predict passenger intent to book, and also to better tailor marketing efforts for conversion.

In addition to data gathered on completed bookings, Skyscanner also collects data on what point in the search process would-be travelers dropped out. This can be used to extrapolate whether price was a factor in abandoning search.

The Skyscanner Transatlantic LCC report finds that the transatlantic market is especially ‘Price Elastic’ with ample demand with the right fares mix.

With Norwegian adding a greater mix of routes from European cities to the US,including a new Rome to New York route announced at the end of last month, and the market entry of IAG’s new Low-Cost brand LEVEL, the study is timely.

IAG airlines British Airways, Iberia and Iberia Express are among Skyscanner’s Travel Insight customers.

Faical Allou, head of business development for Skyscanner’s Travel Insight product says:

“Low-cost long-haul has been a segment that carriers have found challenging in the past, however our study underlines the importance of having data to understand ‘Price Elasticity’: being able to consider traveller intent and how this links to pricing on demand for routes.

“The great news is that by using this data, we’ve been able to demonstrate that the transatlantic low cost segment, a market that has received buzz of late with the likes of IAG’s new Level brand, Jet2’s low cost approach, as well as Norwegian’s new US routes to and from Europe, has much potential for success as long as airlines are able to keep costs down and maintain strong ancillary revenue.

“This is certainly good news for both travelers who have long sought these services and for the carriers who may be able to capitalize early on this opportunity.”

Skyscanner’s Travel Insight data analysis product was also used to study opportunities at secondary airports, which contribute to the success of Long-Haul LCCs, as Norwegian’s growth shows.

Here’s a clip:

![]()