What Southeast Asia travelers are thinking when booking a trip

By cameron in Uncategorized

The factors that motivate and drive booking decisions for travellers from Southeast Asia are revealed in a new report from Phocuswright.

The rising middle class in this region, includes a growing population of young, tech-savvy consumers who are eager to travel, the majority of them motivated by a desire to get away from the daily grind.

The study finds that a significant number of travelers in this market are driven by spontaneous decision making factors such as just needing a break or wanting to visit a major attraction.

According to Chetan Kapoor, Phocuswright’s research analyst Asia Pacific, the best place to reach intrepid travelers with spontaneous travel inspiration is Facebook.

Southeast Asia currently accounts for about 9% of APAC’s online leisure/unmanaged business travel market, and is projected to have a combined annual growth rate (CAGR) of 14% between 2015 and 2020.

The report reveals travelers in Indonesia, Malaysia and Singapore are most likely to travel whenever the mood suits them and the opportunity arises, with two-thirds of those polled citing this as a travel motivation.

Malaysian travelers are more likely to be driven by schedules, with available vacation time a top motivator. Kapoor says:

“Indonesian and Malaysian travelers also demonstrated some notable differences. Indonesian travelers were much more likely than those in other markets to travel for the purpose of visiting a major attraction, and Malaysian travelers were more likely to focus on spending time with friends/family.”

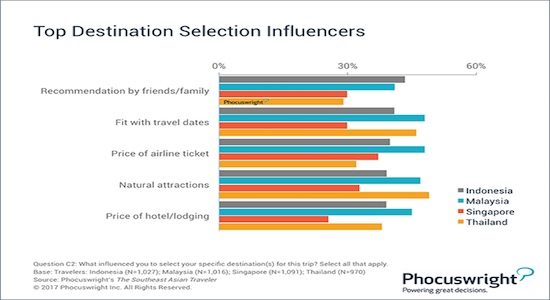

“The desire to take a break and spending time with friends and family are the key motivators for Southeast Asian travelers. When we marry this motivation to the trend that many Southeast Asians travel as a couple or in a group (family, friends), price definitely plays an important role in ultimate destination selection. However, there’s some variance by market where peer recommendations and schedules also play a key factor.”

He adds that the report hasn’t gone into detail on how likely these consumers might be swayed away from price by visuals such as images and video, and says:

“We haven’t probed decision-making in this detail, but do they shop with airline and hotel websites because they have photos, more information about their product/service, trip ideas? The answer is yes.”

Destination inspiration content and special offers posted on Facebook, where they are likely to be shared with peers, would yield positive results in the market as a whole.

Kapoor says:

“Peer recommendations are really important when it comes to destination selection. Specific to social networks/channels, which continue to foster deeper engagement between person-to-person and increasingly even companies-to-persons, it’s actually the Facebook ecosystem of apps that is prevalent among Southeast Asian travelers.”

“The Southeast Asian customer is an avid traveler. With robust and continuously growing LCC connectivity, visa-free intra-ASEAN travel and above all increasing disposable income, more and more travelers are prioritizing travel over other lifestyle spend. Taking multiple trips a year is also a rising trend, so companies need to follow this through by not only providing variety and offers, but also improved customer and local payments support.”

![]()