Data rules and loyalty building strategies for travel brands in Asia

By cameron in Uncategorized

Loyalty building is apparently a high priority for Asia’s travel brands, with data analytics as a top priority to deliver loyalty-fostering personalization.

The survey, part of a recent report by digital consultancy SapientRazorfish, prepared for the Digital Travel Asia Summit, shows that of 100 senior travel executives serving the APAC region, including VPs of marketing and directors of digital marketing, reveals both strengths and weaknesses in digital CRM practices.

Data rules

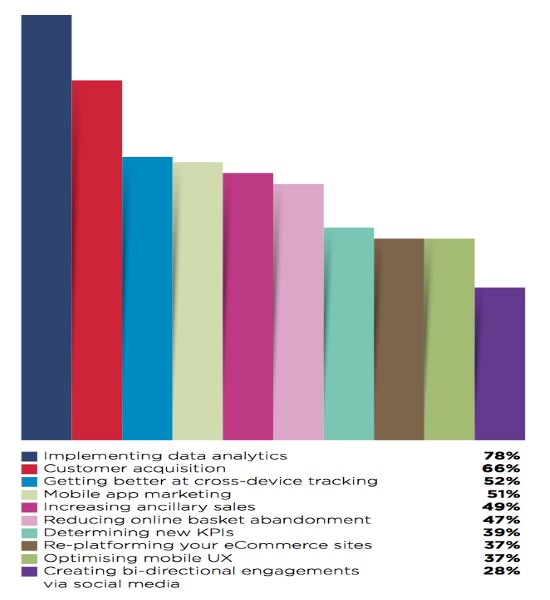

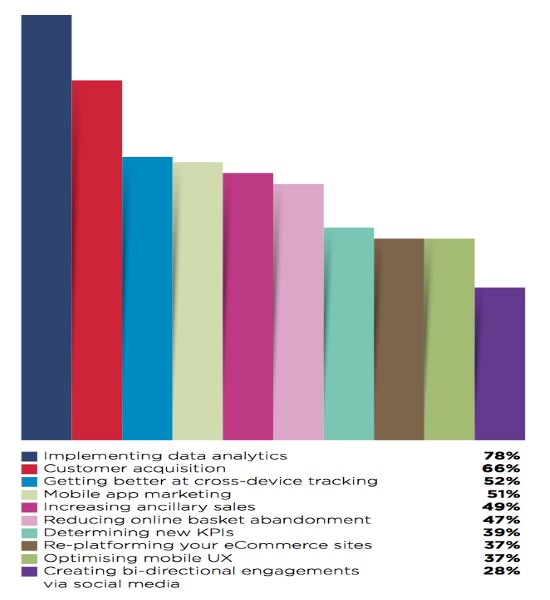

Asia’s travel industry is heavily focused on data with 78% of those surveyed saying they plan to implement data analytics this year.

It is a significantly predominant priority, even outranking new customer acquisition (66%) and significantly higher than mobile app marketing (51%) and social media engagement (28%).

Seton Vermaak, travel and hospitality lead for South East Asia, at SapientRazorfish, comments:

“Data is the lifeblood of any successful business and it runs deep in the travel sector. Data allows us to better understand and serve Asia’s travelers—to meet their expectations for a personalized and premiumised experience each and every time they travel.

“As Asia’s travel industry becomes increasingly competitive, brands are realizing they need to better serve their customers in order to maintain their share of the market.”

- Only 15% of travel brand leaders are confident that they have a well developed system for data analytics.

- 46% are currently implementing a system and 39% have a system in place but want something better.

- 85% of travel brand leaders hope to apply consumer data to fostering brand loyalty.

Seton adds:

“More than four out of five of the region’s decision makers recognize that they are ill equipped to provide customer value and increase loyalty with their current data analytics capabilities.

“For those playing catch-up, it’s a comforting statistic to know you’re not alone.

“This same data makes CEOs nervous, since, for those four out of fuve who are ill equipped, the news is not good. With the help of data, that fifth brand is poised to leapfrog competitors and steal share, fast. How?

“By providing a personalized, premiumised experience—and this is exactly the type of interaction today’s tech-tenacious travelers expect.”

Social media is confusing

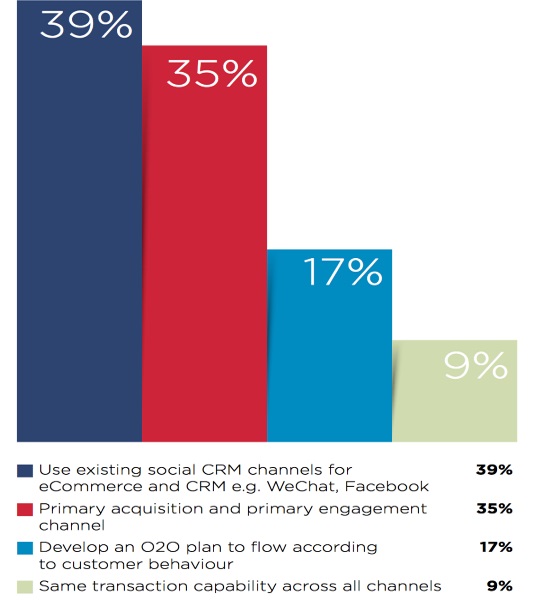

Asia’s travel companies may not be getting a good return on their social engagement, the report suggests, because they are not effectively following the lead of their customers.

Vermaak points out:

“There is a common misconception that engagement needs to happen on the same channel a customer was acquired on: if I acquire a customer on Facebook, for example, I must cultivate my relationship with that customer on Facebook. This is a pitfall for many travel brands.

“Brands need to create a CRM program that works on the social platform of choice for their target market. We needn’t, and indeed shouldn’t, reinvent the wheel here.

“The key is to fit the brand into people’s lives and habits as they exist already, not to create new platforms to engage them from scratch. Convenience is king, and travelers don’t like to be relocated from their established ecosystems.”

- 39% Use existing social CRM channels for eCommerce and CRM e.g. WeChat, Facebook

- 35% Primary acquisition and primary engagement channel

- 17% Develop an O2O plan to ow according to customer behavior

- 9% Same transaction capability across all channels

Room for digital improvements

Despite Asia’s travel brand’s perception that they are ahead of the curve on digital interactions, their customers feel there is plenty of room for improvement.

90% of travel brands which participated in the study felt that their cross-device customer experience was as seamless. However, consumers rated only 48% of the digital experience as advanced. Another 42% qualified it as ‘fair’ and 10% rated their experience as ‘behind the curve.’

Vermaak says:

“We know from our own research that travelers in APAC are tenacious for technology.

“What’s more, their expectations of technology and the online experiences provided by brands are the highest in the world, which means that even if your US customers are satisfied, it’s likely that your APAC customers are not.

“We embrace technology faster in this region: as marketers and product managers, we have to be ahead of our peers in the West when it comes to offering a seamless cross-device customer experience. This is an area in which brands should be ever-evolving.”

People are still a travel brand’s top asset

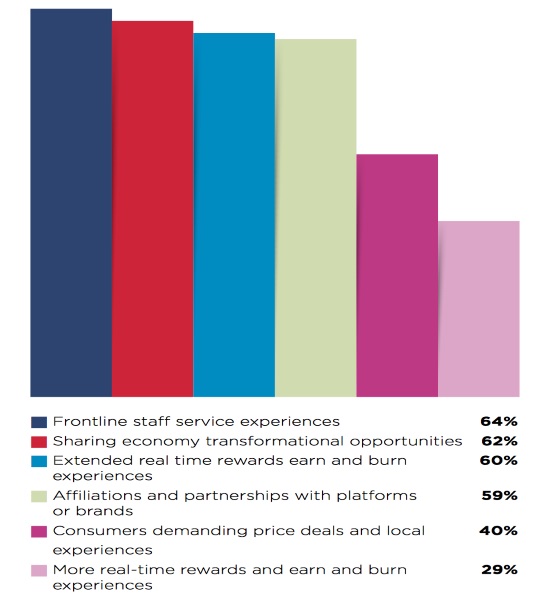

Asia’s travel brands recognize the important role frontline staff play in building customer loyalty.

Vermaak says:

“The importance placed on the frontline experience for travel and hospitality brands harks a return to the core of hospitality—to be hospitable.”

While technology has an important role to play in the personalization of the travel experience, with data analytics guiding that personalization, ultimately it is personal service which delivers on promise.

Vermaak explains:

“Often in the service industry, frontline staff deliver these next-generation loyalty experiences.

“Technology can take the lead in crafting a seamless planning experience, but it’s the experience on-the-ground that truly makes or breaks a traveller’s intention to recommend a brand and to remain loyal when it comes to further travel opportunities.”

While travel brands recognize the value of their front-line staff as a competitive advantage driving growth (64%), other drivers like sharing economy transformational opportunities (62%), extended real time rewards (60%) and brand partnerships (59%) come close.

What is love?

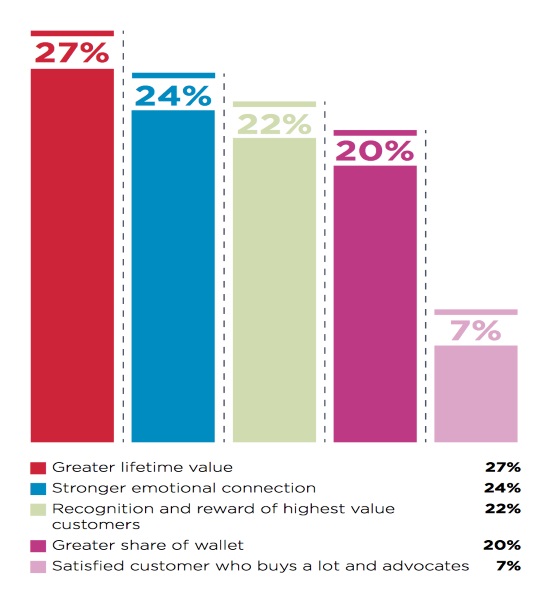

It’s also interesting to note how Asia’s travel brands define loyalty. The lifetime value of customers serving as the measure for most (27%) brands.

By contrast, few brands (7%) apply a more traditional definition of loyalty: satisfied customers who are repeat buyers and brand advocates.

Vermaak says:

“My question to brands is this: can you put a fiscal value on what a customer is worth to you over a lifetime? If you can’t, there’s some homework to be done.

“You need a practical understanding of just how much a lifetime customer is worth—that way, you know how much you’re losing if you fail to satisfy them.

“It’s impossible to have a real conversation about acquisition and loyalty without having a grasp on the fiscal value of a lifetime customer.

“Often, brands have a definition of loyalty that is unique to their business, but it’s always imperative to know how much that loyalty is worth.”

![]()