Airport access options on schedule to lift airlines’ ancillary revenue

By cameron in Uncategorized

Airlines seeking to stay ahead of the competition in their home markets and grow their ancillary revenue could benefit from diversifying the ground transport options they offer to travellers.

NB This is a viewpoint by Johannes Thunert, founder and CBO for Distribusion Technologies.

While car hire has long been a staple of the ancillary mix, it addresses the needs of only a few passengers. Most of the travelling public will get to and from the airport by other means, often by scheduled ground transport such as bus transfers or express trains.

Why airport access can improve passengers’ experience

Nearly one billion passengers per year use scheduled ground transport to get to and from the airport – made up primarily by 430 million passengers in Europe and 504 million in Asia-Pacific.

Most of these bookings are made independently from the flight, directly with the bus and rail transport provider, which adds a layer of inconvenience for passengers when planning their journey.

And each booking made directly with the bus service is a missed revenue opportunity for airlines, flight metas or OTAs who could be earning a commission on every ticket booked.

In addition to making the total journey smoother for travellers, facilitating bus transfers opens up an opportunity for airlines and airports to add new services, such as helping travellers get to a secondary airport where the fare might be lower.

Figures from the Airports Council International – Europe show that 63% of European citizens live within two hours of at least two airports; 38% live near three or more airports.

The deciding factor for these passengers on which airport and airline to choose is driven not only by the fares but also convenience. Presenting the ground transport options as part of the search and booking path can help passengers square the circle between cost and convenience.

The study was produced in 2012 but the quotation below remains relevant:

“Passengers are becoming more price-sensitive and less time-sensitive, meaning that they will travel further to find the best deal. This is partially related to the increased proportion of leisure passengers, as well as the increased online availability of information and choice.

“The majority of passengers have a choice of readily accessible airports. There is significant overlap of routes serviced by neighbouring airports. Transfer passengers can also pick and choose their transfer hub. Different modes of transport also offer alternatives to passengers.”

Expanded ground transport services, which include bus transfers, can help airlines serving destinations from secondary airports. And easily bookable reliable ground transport can be positioned as a way to attract passengers away from airports dominated by a competitor airline.

How modern API technology enables smooth integrations of ground transport services

For any of these benefits to become deliverable, airlines must make booking convenient. In today’s market that means ensuring effective digital sales integration, including but not limited to mobile channels.

Integrating bus transport ticketing into digital sales channels requires coordination with bus service providers to address capacity limits and service schedules. Though passengers may be able to book a bus ride within a few minutes ahead of their departure, the operator needs the information at the same time to allocate seats. This requires an alignment between the booking platform and the ground transport provider to ensure a fluid travel experience for customers.

There is also exception management to address, including flight delay. There needs to be a process in place to cover disruption, and this is best achieved through technology.

Distribusion has addressed these needs with an API-based solution that offers a booking path for all ground transportation along the same sales channel. The API allows the same ticketing integration for all operators, whether a passenger books a National Express ride in London or a small bus transfer in Mallorca. It includes mobile ticketing, and takes care of the global payment and settlement flows.

To make the interface more readily available, Distribusion has partnered with CarTrawler and Amadeus Germany.

Distribusion’s partnership with CarTrawler has opened up pre-paid bus services to all one hundred of CarTrawler’s airline partners and 2,000 online travel retailers, bookable through CarTrawler’s airline ancillary merchandising platform.

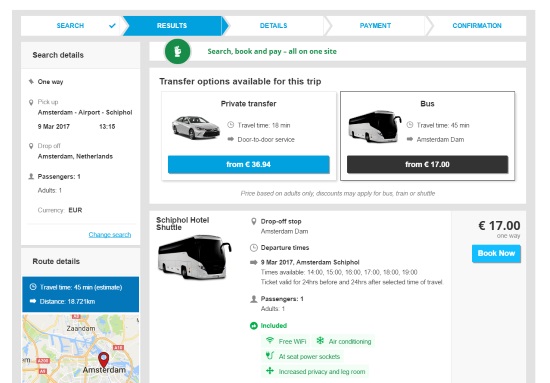

Travellers receive a full view of scheduled travel information for comparison, including service provider name and services included during the journey, such as in-bus WiFi and power sockets.

Tommi Holmgren, director of ground transportation at CarTrawler, said:

“With the widening of our existing bus transfers product, alongside car rental, taxi, private transfer and train solutions, our travel partners no longer need to leak customers to other websites nor are they forced to work directly with them, exposing their valuable customer data.”

Through Amadeus Germany, Distribusion offers travel agents access to more than four million intercity and airport bus transfer connections to 2,500+ destinations in more than 35 countries in Europe and Asia. This includes rides from leading bus service providers such as National Express, Ouibus and Sindbad. The partnership will be extended to other regions soon.

Diversifying ground transport options facilitates ancillary revenue growth

Research house IdeaWorks and CarTrawler predict airline ancillary revenue will reach $67.4 billion worldwide in 2016. Of this figure $44.9 billion is revenue from “optional” services, such as onboard sales of food and beverages, checked baggage, premium seat assignments, and early boarding benefits. A smaller share, $22.5 billion, comes from non-flight activity which includes the commission-based sale of ground services to travellers, including car rentals and hotel accommodations.

But as airlines work to increase ancillary revenue they need to shift away from a focus on what might be perceived by passengers as punitive ancillaries; that is, charges for services which were previously free or services where the benefits of paying are not clear.

But a service such as an airport bus or transfer shuttle has a clear and tangible benefit, addresses a specific passenger need and makes the door-to-door travel experience more enjoyable.

Airline profitability and customer satisfaction will in the future depend on a healthy mix of airline and ancillary products, with a broader range of convenient and affordable ground transport options a key component of the products on offer.

In a fiercely competitive landscape, airlines should see ground transport bookings as a way to generate revenue and to encourage loyalty and repeat custom by helping the passenger have a better total trip experience.

NB1: This is a viewpoint by Johannes Thunert, founder and CBO for Distribusion Technologies. It appears here as part of Tnooz’s sponsored content initiative.

NB2: Image by ArtesiaWells/BigStock.com

![]()