Trump slump or big chill – how bans are playing out in travel distribution

By cameron in Uncategorized

Lots of column inches have been taken up on the policies of the Donald Trump administration but what of their impact on travel distribution and likelihood to hurt US travel and tourism?

Are we truly talking Trump Slump or, is it just bias against the administration, as recently asserted in a Forbes piece.

The piece disputes projections from several travel industry sources, and says that any impact to the US in the weeks immediately following the ban has been marginal, at best. Travel companies in the US – airlines, bookings sites and hotels, have not raised any alarms in their recent filings.

But dispelling the “Trump Slump” is more than looking at the short-term impact. The concerns raised are over potential damage to the travel sector in the long term.

So where does the travel industry stand on this?

Bookers and lookers

During the company’s recent filings call, Expedia president and CEO, Dara Khosrowshahi, dispelled concerns.

“The weekend of the executive order, certainly we saw a negative effect on trading – election, big events usually have a negative effect on trading. We haven’t observed anything meaningful on a trend basis so far.

Fortunately, we were frankly worried about kind of the chaos and all the volatility and uncertainty and effect that it would have on general business trends and especially travel.”

During the Hilton Worldwide earning’s call in mid-February, CEO Christopher Nassetta, pointed to a strong dollar as a stronger travel deterrent than the travel ban at this point.

That is an ongoing challenge for US travel, even before Trump took office.

“If you look at what we saw in the international business last year, it was down a bit in revenue. I think it was down 2.5% to 2.8% I think but 2.5% to 3%. That was obviously pre-travel ban. That had a lot to do with the strengthening of the dollar in my mind.

You did see some markets continuing to show very good growth, mostly Asia Pacific to the US. But a lot of the other markets, including Canada close by, we saw drop off.”

Trump’s economic policies may somewhat exacerbate that problem.

Nasetta adds:

“My sense is you’re going to continue to see pressure on international business, and I think that pressure is largely going to be driven by even further strengthening of the dollar.

If you look at what’s happened over the last 90 days, the dollar has strengthened a lot. That is not good for international inbound business. So, I think you’ll see continued impact.”

But the travel ban policy itself has had little effect. He says:

“As it relates to the travel ban, we’ve been tracking it as carefully as we can. We have not seen any material impact as a consequence of what’s happened over the last two or three weeks.

We obviously will keep watching it and keep an eye on it, but nothing in anyway material that’s come from it at this point.”

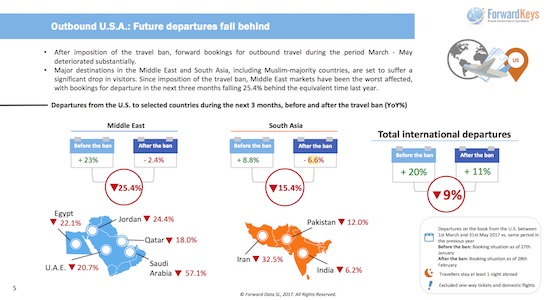

Zooming-in on North America, the story shifts somewhat, though the strong dollar, as well as other political changes abroad, take some of the blame. IATA says:

“North American airlines had the slowest demand growth, with traffic rising 3.2% in January, compared to a year ago. Capacity climbed 3.1%, and load factor was flat at 80.3%.

Traffic on the trans-pacific market has continued to trend upwards but North Atlantic traffic growth has weakened since the middle of 2016, reflecting softer demand on UK-US routes.”

Because the North Atlantic route is the world’s most valuable air route, any weakening of demand should be a concern. For now, it is off-set by stimulus from lower airfares, but this dilutes profitability over time.

However, the weaker performance of the North Atlantic market is also driven by factors beyond the travel ban, including the strong dollar.

According to IATA:

“Any impact of the new US administration’s travel ban, and the extent to which this is deterring travel to the US, will become apparent in forthcoming months’ data.”

Forward Outlook

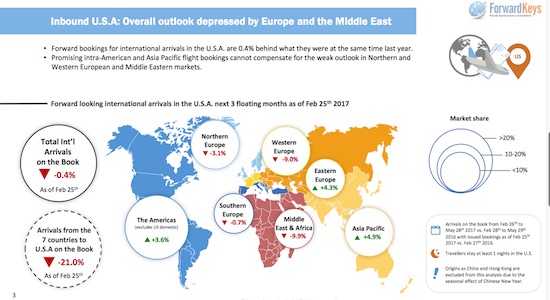

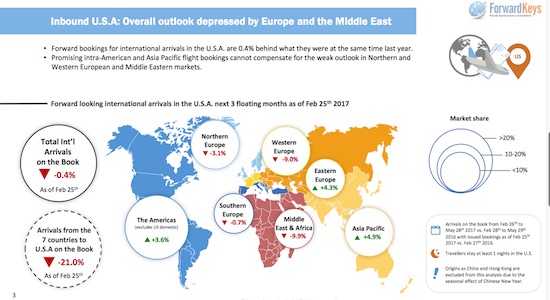

ForwardKeys issued warnings to the Trump administration of potential negative impact before the publication of a revised travel ban.

Olivier Jager, CEO of the marketing intelligence company, says the travel ban did materially damage the US travel industry, particularly marked for travel between the US and the Middle East, but also global.

“There has been a 39% meltdown in travel to the Middle East and when the ban was first announced, there was a 6.5% slump in bookings to the USA. The slump was reversed when the courts struck down the ban but Donald Trump’s promise of a new ban has triggered a second 4% slump.”

Jager adds:

“Donald Trump’s on-off travel ban has created a rollercoaster ride for the travel industry. Some passengers do not know where they stand as they await President Trump’s promised new order.

“It’s not at all clear when that will come. In the meantime, uncertainty reigns and the presidential rhetoric appears to be deterring visitors to the USA.”

But any “deterrence” resulting from the travel bans—version one or two—is not so clear.

Following the publication of the revised travel restrictions on Monday by the Trump administration, The Association of Corporate Travel Executives, published a statement saying the new ban was less of a shock to travel, but still a “public relations misstep for the United States travel industry.”

ACTE Executive Director Greeley Koch says:

“The global business travel industry had been waiting for the new travel ban, so the issue carried less shock and surprise the second time around. Our response rate to this second travel ban survey was much slower, indicating the industry had time to prepare for the announcement.

“Eighty-four percent of respondents indicated they were familiar with the provisions of the new ban within hours of its signing. This is a dramatic difference from the blindsiding they got a month ago.”

The association’s survey of business travel managers showed an even divide on the question of future impact of the revised ban.

When asked if the provisions of the new ban would pose travel difficulties for companies, 45 percent responded “yes,” and six percent categorised the difficulties as “significant”, 50 percent said they perceived “no difficulties,” and five percent claimed “the question did not apply.”

More positively, 66 percent of respondents said the new travel ban “had not caused their company to rethink conducting business with the US.”; though 21 percent said these bans were causing their company to reconsider doing business within the US, of which four percent categorised their reconsideration as “significant.”

Meanwhile, 91% of business travel managers said their companies had not cancelled meetings in the US for locations abroad; while nine percent indicated their companies had.

ACTE even acknowledges that its own first global travel conference of 2017 in New York City, scheduled for April 23-25, 2017, enjoys higher international bookings than a similar event last year.

So with all of this good news, why does ACTE describe the travel bans as a PR misstep?

The Big Chill

ACTE believes the real “Trump Slump” is damage done to perceptions of the US as a friendly travel destination, something which may not have immediate impact but could have lasting impact.

Koch says:

“Though the numbers clearly indicate that there is no change in travel, nor travel planning, for the majority of companies doing business in the US, a seed has been planted within 21 percent of survey respondents.

“The US does not need any excuse for companies to prefer travel to other countries. Ultimately, we are talking about jobs here. Jobs at the airports, in hotels, in surface transportation, and in restaurants. The business travel community is weighing the benefits of this ban against its more obvious liabilities.”

ACTE reports:

“Twenty-two percent of respondents reported their travellers were still experiencing delays or harassment crossing US borders, with one percent claiming significant delays or harassment. Recent ACTE events in Singapore and Canada generated strong concerns regarding the ban. Association officials in Canada stated that Canadian-born passport holders were being delayed and turned back at the border.”

Koch adds:

“This is prejudicing an uncounted number of leisure travellers from considering the US as a primary destination. We don’t want it to spread to business travellers.

“Once started, this can be a difficult process to reverse.”

ACTE also points to raised levels of concern for US businesses travelling abroad. They feel more vulnerable to threats. Fifty-five percent of survey respondents told ACTE they felt a heightened threat awareness. Fifteen percent of those categorised the threat awareness as “significant.”

Perhaps the term Trump Slump should be discarded as a misnomer. What travel faces is less the risk of falling, and more the threat of falling asleep in icy conditions. One might call it a Trump Chill.

Despite alarms raised by certain reports, there has been marginal impact directly attributable to the US revised immigration policy, if any, for now.

Barring a catastrophic unforeseeable event, as the months go by, we are more likely to see an adjustment instead of a single big drop.

But this Trump Chill is not limited to the Trump administration, nor to the US.

But this Trump Chill is not limited to the Trump administration, nor to the US.

IATA’s director deneral and CEO, Alexandre de Juniac, warns against a global isolationist and nationalistic trends.

“Aviation is the business of freedom. Air travel liberates people to lead better lives and creates greater economic opportunity for all by bringing people closer to trade and markets.

“Governments have a responsibility to secure their borders. They must also preserve the enormous economic and social benefits provided by borders that are open to trade and travel.”

Trump is not alone in lowering the thermostat. He and others leaders like him now actively promote an “us versus them” philosophy which creates a chilling world climate in which the stranger is generally seen as a threat rather than a welcome guest.

So perhaps we should just call it the Big Chill. In the long term, that can never good for travel. When the freeze is deep enough, it’s difficult to move.

NB: Trump effect on travel distribution image via Pixabay.

![]()