Flight Centre commits to digital, growth and M&A

By cameron in Uncategorized

Flight Centre Travel Group‘s half-year results highlight a number of its recent investments, including a move into China and a stake in an artificial intelligence tool for unmanaged travel.

However, a strong operational performance in the six months to end-Dec16 in most markets has been impacted in financial terms by “widespread airfare discounting, economic uncertainty and exchange rate volatility.”

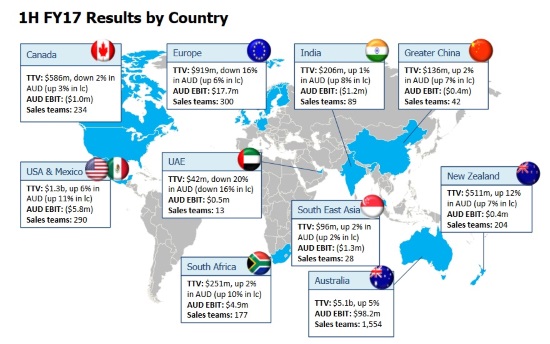

The latter headwind is made clear in the following slide, which shows the difference between its performance in local currency and how that then converts into Australian dollars:

(Click on the image to open a larger version in a new window)

Europe is the clearest example of this, where a 6% increase in total transaction value when measured in local currency converts to a 16% drop in Australian dollars.

Managing director Graham Turner said:

“While we were disappointed that our record sales [group TTV of A$9.3 billion] didn’t translate to record 1H profits, our A$113.2 million underlying profit before tax (PBT) was a decent outcome, given the conditions.”

It has been forced to drop its full-year guidance slightly, and now expects underlying PBT for the year of between A$300 million and A$330 million compared with its previous guidance of A$320 million – $355 million.

Elsewhere, the results also aggregate and announce a relatively busy period of mergers and acquisitions for the business as it looks to expand not only its geographic reach but also its product footprint with “sectors adjacent to travel” of particular interest.

During the half it acquired the business travel operations from eDreams Odigeo in five markets – Germany, Sweden, Finland, Norway and Denmark – as part of a move to create a global travel management company.

At the time no price was disclosed, but the H1 presentation has a line which talks about “a net cash impact” of the deal of A$6 million.

Other deals during the half include taking a 49% stake in Australia’s Ignite Travel and taking over India’s Travel Tours Group.

The announcement also reveals that Flight Centre has taken a stake in Shenzhen Sunny Holiday International, a business described as “a small travel agency that is licensed to sell outbound travel to Chinese nationals to its network.”

And it has also announced that its Little Argas accelerator has made its first investment, taking a stake in Claire, “an intuitive AI-powered travel technology service that has just entered beta testing in the USA and…has been developed to target the unmanaged SME market.”

Further acquisitions are likely within key growth sectors, it said, highlighting corporate and in-destination opportunities.

Click here to access the results release; click here to access the presentation.

![]()