Understanding the Airbnb phenomenon, using 3D maps

By cameron in Uncategorized

There are various ways of viewing the rise of Airbnb on both a global and in individual country basis.

And, depending on who you ask, you’ll inevitably get a different perspective.

Hotels are either nervous or bold, whilst at the same time consumers are either thrilled with the range of options now available to them or have a tale of some misfortune.

Yet these are anecdotal – with the industry relying solely on data-bragging from Airbnb itself, or local authorities, in order to understand the impact of the home-sharing trend.

Thankfully, organisations such as the Valais Tourism Observatory in Switzerland are also keeping an eye on what is going on in regional markets, and are happy to share their findings.

Switzerland is an interesting country to look at, primarily because it is quite small in terms of population (8.5 million) but has a diverse tourism and travel sector catering for a large winter ski market, traditional summer trips and a large business travel requirement due to it housing a number of large, global organisations (Nestle, International Red Cross, UBS, International Olympic Committee, FIFA, World Trade Organisation et al).

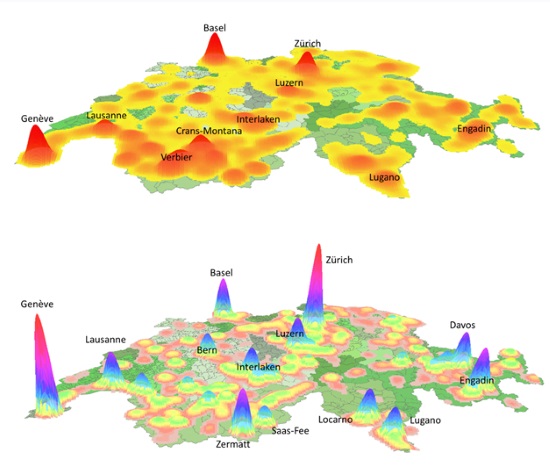

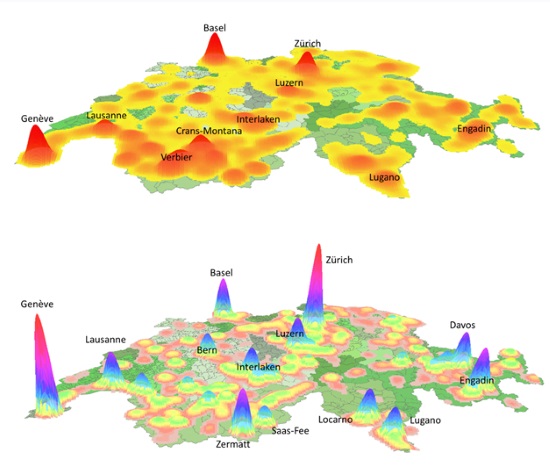

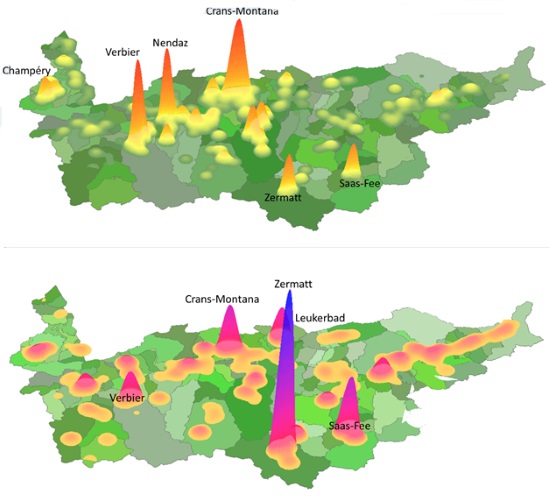

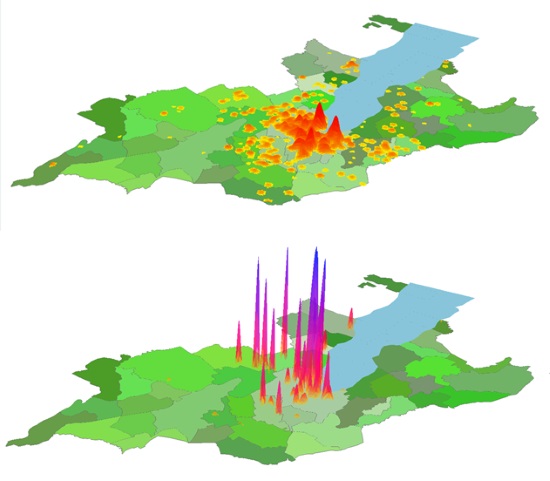

The VTO created a series of 3D maps to illustrate the size of the market in the country – with it calculating there are around 48,000 beds in 18,500 Airbnb properties and 220,000 beds in over 3,700 traditional accommodation types).

(Scale: red to yellow relates to Airbnb’s offer; blue to violet is hotel supply)

The Swiss market as a whole:

“Three champions can clearly be distinguished (Geneva, Basel, and Zurich) followed by a “class 2” (in blue on the map, for example Zermatt or Lausanne). As one of the champions, Basel distinguishes itself by being the only site where the Airbnb supply is almost equivalent to that of hotels. There is a noticeable margin for growth in the other locations.”

In Valais:

“Airbnb prevails, for example in Verbier, Nendaz, and Crans-Montana, but not in Zermatt. The explanation is to be found in the importance of the self-accommodation sector (second homes, vacation homes and chalets), which is significant in Verbier, Nendaz, and Crans-Montana, but less dominant in Zermatt. In Valais, both types of accommodation (Airbnb and the hotels) seem to coexist as Airbnb tends to occupy areas where the hotel offer is weak.”

In Geneva:

“Accommodation establishments (hotels and Airbnb) are primarily organized around the bay, despite some exceptions. Hotels are more centrally located than the accommodations offered by Airbnb. In addition, it turns out that Airbnb tends to occupy three key districts: Eaux-Vives, Pâquis and Plainpalais. It is particularly interesting to note that outside of the city center of Geneva and the bay, the canton is rather deserted of an Airbnb supply.”

NB: Full analysis here.

NB2: Swiss accommodation image via Pixabay.

![]()