Five ‘first-class’ tips to drive online revenue

By cameron in Uncategorized

In the rapidly growing ecommerce market, high-friction and time-consuming identity verification processes can have a significant impact on customer acquisition and retention rates.

NB: This is a viewpoint by Abigail Singer, marketing at Riskified.

Airlines and online travel agencies (OTAs) face the precarious balancing act of protecting revenue from card not present (CNP) fraud, while providing a smooth shopping experience. When competing travel sites offer interchangeable products, brand loyalty is vital, as customers tend to be even less forgiving if merchants fail to meet their expectations.

In this article I share five actionable tips for driving online revenue and providing a good shopping experience without incurring fraud-related losses.

Aim for a turbulent-free customer experience

Contacting customers to verify their identity after an online purchase not only adds friction to the shopping experience but also is often ineffective. Trying to validate their identity via a phone call may be impossible if they are in-transit or if there’s a mistake in the contact details provided (e.g. phone number with a missing digit). Sending a text message, meanwhile, might force customers to incur unwanted roaming charges.

Ideally, contacting a customer should be a merchant’s last resort. It is resource-consuming, non-scalable and generally slow, which is highly problematic when considering fluctuating ticket prices and aggressive competition.

The bottom line is that airlines and OTAs fear fraud, yet relying on this approach often leaves them with no choice but to decline good orders. Valuable online customers are either being falsely declined, or becoming frustrated by delays in the approval process.

And customers certainly show no compassion for merchants who provide a sub-par experience – 66% of US online consumers either limit or stop shopping with a declining merchant.

‘Upgrade’ online sales with these fraud tips

Many travel merchants implement rules that “filter” out high-risk orders. These filters lead to the rejection of orders with discrepancies between data points and inevitably lead to false declines. As discussed in our previous article on data mismatches, rather than relying on discrete data points to identify and reject ‘suspicious’ customers, OTAs and airlines can use information from third party sources such as social media networks, to reveal ‘the story’ behind the order.

The reality is that 98% of CNP flight ticket purchases are actually valid – it’s just a matter of being able to discern the good from the bad. Following are five safe indicators that online travel businesses should look out for:

- Group travel is safer

Travel merchants should take note of the number of passengers included in an order. Our data reveals that passengers flying alone are more likely to have purchased their ticket via fraudulent means. In fact, the rate of fraud in single passenger bookings is twice as high as in bookings for two or more passengers.

Pay attention to last minute bookings

Pay attention to last minute bookings

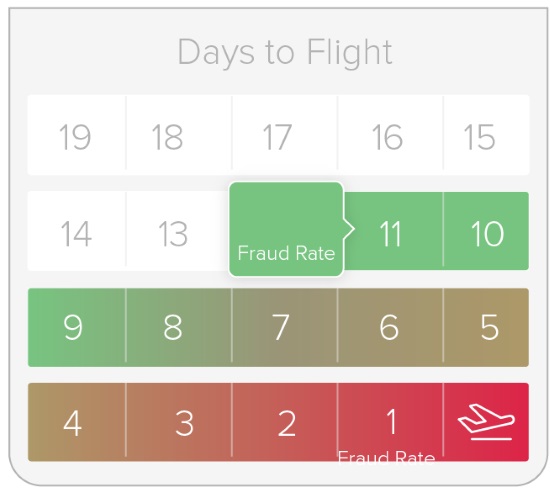

Riskified’s data shows that the closer the booking date is to travel time, the higher the chance it will be fraudulent. Genuine travellers are more inclined to plan ahead, even if this means booking their flight tickets just a week in advance. Fraudsters, however, prefer a quick turnaround time. Accordingly, tickets purchased one day before the flight are eight times riskier than tickets purchased 10 days prior to takeoff!

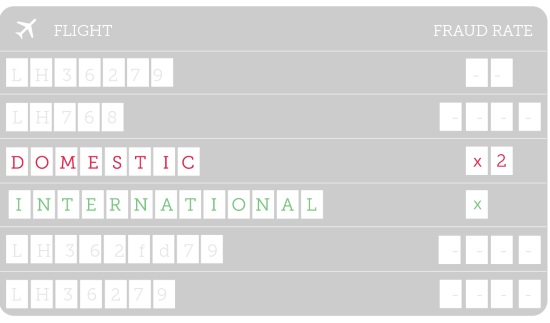

- Take note of domestic vs international trends

Fraudsters usually target higher value goods. Yet domestic flight tickets, which on average cost half as much as international tickets, hold twice the fraud risk! This can be explained by a number of factors, including that it’s easier to re-sell domestic tickets at short notice (again, people tend to plan overseas trips), and that fraudsters are deterred by the stricter identification procedures required for international air travel.

- Delve into your geographical data

Travel merchants should pay attention to correlations between geography and CNP fraud. For example, an examination of both departure and arrival countries reveals that flight tickets to and from Denmark, Poland and Japan are typically safe, whereas Indonesia, Morocco, and India carry a higher risk of fraud. However, rejecting transactions based on one data point is a bad idea, and geographical data demonstrates this well.

By delving deeper into the fraud rates in flight tickets to and from Indonesia, for instance, we can gain better insight into the source of the fraudulent activity. Our analysis shows that passengers departing Indonesia using tickets purchased with a Russian or South African credit card are completely safe. Similarly, for flights arriving in Indonesia, tickets ordered with a Russian credit card carry less than a 1% risk of fraud, while orders placed with Swiss cards are 100% valid.

- Get to know your travellers

Finally, the key to avoiding false declines is understanding who your good customers are and how they typically behave. Statistical data shouldn’t be used to devise strict rules, but rather needs to be taken into account within the broader context of the fraud review process.

To illustrate: Riskified’s data shows that tickets purchased by travellers between the ages of 18-25 (typically backpackers on a budget) are safer than those placed by passengers over 25. Tickets purchased 2-4 days before a flight, by travellers over the age of 25, are on average 75% riskier than tickets purchased by those in the 18-25 age group.

So even though last minute tickets are generally risky, incorporating another factor – in this case age – can allow travel merchants to approve more good orders.

Focus on the future

Over the next five years, it’s projected that $278 billion worth of online travel bookings will be made. With the global online travel market poised to keep expanding, airlines and OTAs will need to focus on scaling their operations to accommodate higher sales volumes.

Systematically observing trends in the data and seeking positive indicators can help travel merchants approve more orders and reduce reliance on high-friction validation methods.

Finding an effective way to distinguish between good customers and fraud attempts without adding friction to the shopping experience will be key for travel merchants aiming to beat the competition and drive online revenue.

NB: This is a viewpoint by Abigail Singer, marketing for Riskified. It appears here as part of Tnooz’s sponsored content initiative.

Other articles from Riskified:

Stop letting mismatches ground online revenues (Dec16)

Stop declining these travellers’ orders! (Nov16)

As mcommerce grows in travel, so does the need to understand mobile fraud (Oct16)

![]()