As mcommerce grows in travel, so does the need to understand mobile fraud

By cameron in Uncategorized

As mobile becomes an established transactional channel for most travel companies, either via an app or through the mobile web, fraud in mcommerce needs to be taken seriously.

NB This is a viewpoint by Yarden Altshull at Riskified.

Conversations around mobile fraud will get louder as the relative share of mobile transactions continues to grow – according to forecasts, mobile purchases will account for 70% of total digital travel sales in the US by 2019.

The ramifications for online travel merchants are clear: they need to accommodate the influx of mobile consumers while ensuring that they have adequate tools to scrutinize these orders for fraud.

Riskified has reviewed hundreds of thousands of travel orders and has uncovered some interesting fraud-related statistics for this burgeoning industry segment.

Mobile is safer

Mcommerce currently accounts for roughly 25% of order volume in the online travel segment, and contrary to popular belief, mobile transactions are actually safe. As volume grows, the risk landscape may change, but in the meantime these orders are 31% less likely to be fraudulent than their desktop counterparts.

Mcommerce is still evolving, and the tools that fraudsters currently use were developed for desktop computers, and are less common or less effective for use in mobile devices.

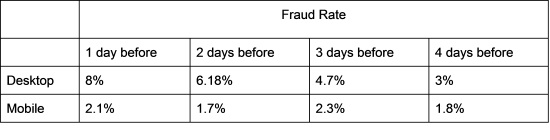

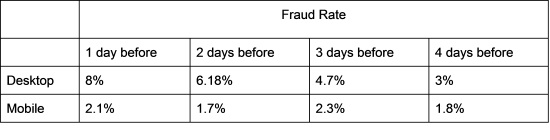

One of the areas where merchants experience high levels of fraud is last-minute tickets. The number of days between the purchase and travel dates is correlated with fraud rates. Orders made just a day before the travel date from a desktop computer carry a significant 8% fraud rate, meaning that 8 of every 100 such orders are clear-cut fraud. The rate tapers down as the gap between the purchase and travel dates grows.

However for orders made via mobile device the fraud rates are significantly lower, and vary much less with time before travel date, hovering between 1.7 and 2.3%.

The fraud is in the details

Although mobile orders are safer, fraud still exists, and merchants need to know how to detect it. Here are some stats to can help discern the good orders from the bad ones:

- Fraud by operating system

While the operating system used by the customer wouldn’t intuitively seem like a fraud indicator, we can actually gain some insight by analyzing orders based on this parameter.

65% of mobile orders Riskified reviewed were made with an iOS operating system (or an Apple device), while 34% were made with a device powered by an Android operating system

Among these orders, the fraud rate for Android orders was about 52% higher when compared with orders made via iOS:

1.37% of orders made via Android-powered devices were clear-cut fraud

0.9% of orders made via iOS-powered devices were clear-cut fraud

Fraud by browser

Many travel merchants have a dedicated app which customers use to book flights or hotels. But those who don’t may end up getting orders via a mobile web browser. These merchants may find the following statistics useful: 63% of orders are made via a Safari browser; 32% of orders are made via Chrome; 3% of orders are made via an Android stock browser (the default browser on many Android devices)

Of these, Safari orders are safest, with a 0.9% fraud rate. Next is Chrome, with a 1.22% fraud rate. And the browser that is most abused by fraudsters is the Android browser, where 3% of orders were clear cut mobile fraud.

Don’t let fear of mcommerce fraud hold you back

The ascent of mcommerce has left too many merchants intimidated and perplexed. Online orders placed using mobile devices should be embraced as a tremendous business opportunity, and should not be perceived as something to fear.

Merchants need to ensure that their web app or mobile site is delivering a visually appealing, simple and comprehensive shopping experience.

And on the fraud front, merchants are advised to analyze the wealth of data that exists regarding mobile shopping. Merchants who are able to pick up on mobile fraud trends will be in a great position to ensure that good customers are not falsely declined, and chargebacks are kept to a minimum.

NB This is a viewpoint from Yarden Altshull of Riskified. It appears here as part of Tnooz’s sponsored content initiative.

NB2 Image by Dolgachov/BigStock

![]()