It’s travel distribution Jim, but not as we know it

By cameron in Uncategorized

Amadeus has pinpointed four areas where it sees the most change in the travel industry and travel distribution in the next decade.

A report put together, for Amadeus, by the London School of Economics and Political Science, talks in detail about the four areas chosen after studying current “disruptive factors” including consumer behaviour, mobile, big data and artificial intelligence, regulation and travel risk.

The four areas identified in the “Travel distribution – The end of the world as we know it?” study are:

- Complexity and innovation in air travel distribution

- A revolution of sharing economy services in hotel and car hire

- Innovation and hybridisation in travel retail

- The rise of the gatekeepers in traffic acquisition – i.e. Google, Facebook etc

They’re not rocket science with much of the above already happening across digital travel distribution.

No travel technology conference is complete without the threat of Google conversation.

And, the hotel industry is already reacting to the home stay trend with some larger players even investing in the area.

The report goes on to look at the different ‘pathways’ each area identified might take.

With airline distribution, for example, pathway one is all about the limits airlines will face in pursuing their direct sell strategies. A much more positive outlook however is pathway two, where airlines, IT companies, global distribution specialists and other aggregators partner to move things on.

Then, with travel retail, pathway one talks about meeting customer expectations and improving the experience while pathway two highlights the rise of “giant meta OTA companies”.

Again, not rocket science but underpinning all of this, and with frequent mentions throughout the study, is the need for collaboration with “more shared innovation” listed as one of six areas to focus on to meet the challenges.

Quoted in the report is Ryanair marketing chief Kenny Jacobs who sums it up:

“Everyone looks at their part of the industry from their own point of view and doesn’t necessarily look at the consumer. The retail business is much more consumer orientated and has been for 25 years. The travel industry could learn a lot from retail in terms of opening up and what’s the best solution for consumers.”

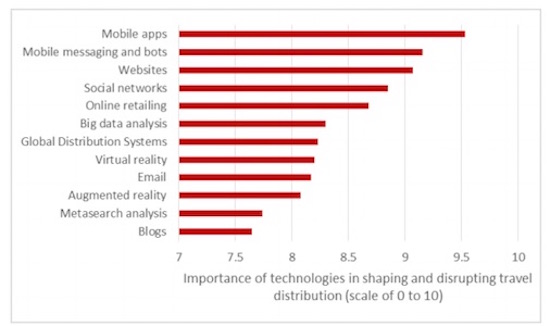

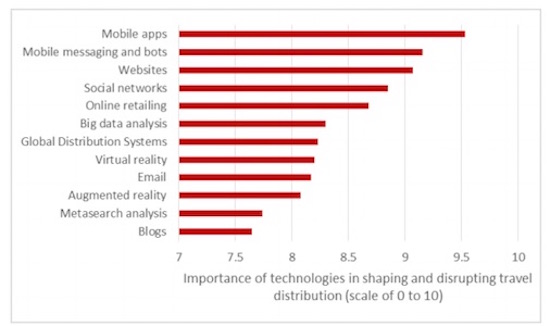

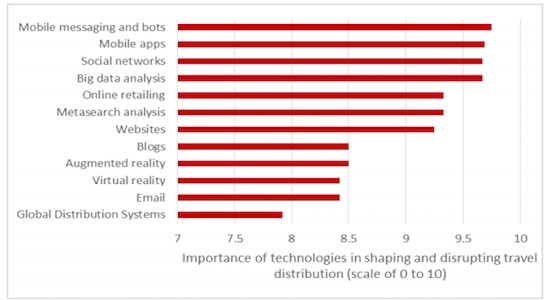

For the purpose of the study, LSE also quizzed travel retailers and airlines on the importance of different technologies in disrupting travel distribution (see charts below).

The retailers highlighted mobile apps, mobile messaging and bots and websites as the top two followed by websites and social networks.

The airlines, meanwhile, put mobile messaging and bots at the top in terms of importance followed by mobile apps, social networks and then, big data.

And, while global distribution systems came somewhere in the middle for travel retailers, they were demoted to the bottom by the airlines surveyed after blogs, email and virtual reality. Perhaps this highlights the ongoing conversation between airlines and the distribution giants around fees, value and the need for new ways for carriers to retail their products and services.

Travel retailers view:

Airlines view:

![]()