Travel giants getting stronger in summer

By cameron in Uncategorized

Summer is upon us, and beaches, pools and resorts are filled with revellers enjoying their travels around the world.

Yet, even as vacations are being enjoyed now, it was the meticulous planning done in the spring that was responsible for the hotel bookings, travel arrangements, tour reservations and more that are currently populating itineraries.

Q2’s importance to online travel players is significant as it speaks to the companies that will enjoy the fruits of the summer season.

We dived into the season’s biggest stories in our US Quarterly Index, taking a look at some of the key risers and trends for OTAs, metasearch, airlines and other booking sites.

Rising traffic buoys giants

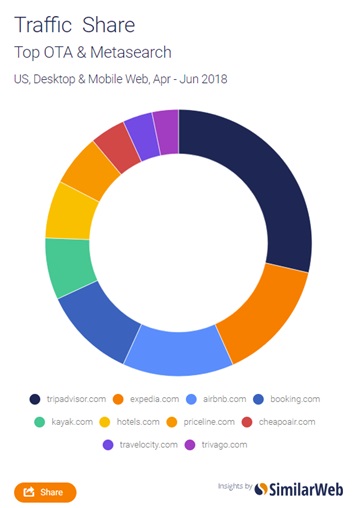

The summer season is a boon for the travel sector and the digital world was a major beneficiary with traffic to the top 10 OTA and metasearch sites increasing by 10% in June compared with April and May. However, while an increase in the digital travel pie may be an opportunity for the entire ecosystem, the largest giant was the prime gainer. Traffic to tripadvisor.com grew by 15% in Q2, expanding the metasearch giant’s market share lead to 28.6%, an increase of 3.6%.

The rise speaks to the seemingly endless potential of the site, but also has strategic implications across the travel ecosystem. Currently, outgoing traffic from tripadvisor.com remains dominated by OTAs such as booking.com and expedia.com.

This only deepens the demand for brands, and hotel brands in particular, to improve their engagement with the site. The ability to effectively define and execute a strong partnerships plan will be a key element determining the ability of other travel players to chip into the Booking/Expedia dominance.

Q2 also spoke to the growing importance and centrality of paid search to overall marketing strategies for the top sites. Traffic to the top 10 sites from this channel increased from 72 million visits in Q1 2018 to 81 million in Q2. This strategy has proven to be a critical resource for driving traffic, especially in a mobile web market still marked by the relative lack of focus on this tactic. As competition increases, the brands that made an effort to drive value early will maintain a significant advantage.

Google Flights continues to soar

Google’s much discussed position in travel is increasingly being felt for airlines, and Q2 marked a significant step forward. Google Flights accounted for 24% of the referral traffic to the top 10 airlines behind only kayak.com.

The top sites in the sector collectively enjoyed increases in their monthly traffic as well. Monthly traffic to southwest.com increased to 42.5 million visits from 39.1 million in Q1, while aa.com grew by 1.6 million monthly visits and delta.com grew by 3 million visits.

Yet the largest riser in the category was flyfrontier.com which saw an 8.2% increase in their monthly visits from Q1. The strength is positive sign for airlines, who have been struggling to this point to drive significant traffic. The big questions will be whether they can maintain the growth by finding channels to increase traffic during less ‘peak’ periods.Giants separating in accommodation bookings

As with other travel sectors, wider growth ahead of the travel season benefited the category leaders most. In the Accommodations category, the top four sites – marriott.com, hilton.com, ihg.com and choicehotels.com, gained an average of 1.4 million monthly visits each – a total increase of 10%, while the bottom four saw stagnant traffic overall.

Category leaders seeing the bulk of the benefits from seasonal peaks is nothing new, but the strength could speak to the growing opportunity ahead for the major sites. As they are able to continue to optimize their strategy, the challenge facing other sites will be even steeper.

For more insights from SimilarWeb, click here.

This is a viewpoint from Gitit Greenberg, director of digital insights at SimilarWeb.

Other articles as part of the series:

Following the leader – Booking.com ahead in the online travel stakes (Jun 2018)

The data says: Global demand growth for Airbnb, TripAdvisor and Agoda (April 2018)

A data dive into the power and positioning of Google Flights (March 2018)

![]()