NDC tipping point? Seeking speed – Part One of Two

By cameron in Uncategorized

This is an analysis by Philippe Der Arslanian, CEO, Answair.

“It offers three strategic possibilities: drive revenues, reduce costs, and enhance customer service… The technology is new enough that many difficulties remain, however.”

Addressing New Distribution Capability impact in 2018?

No, questioning web impact back in 1998 (Cornell, “The Internet as a Distribution Channel”).

Fast forward 20 years, history repeats itself. Just like the web two decades earlier, NDC, shows tremendous potential and should fundamentally change the travel business model once again.

NDC is much more than a simple technological upgrade. At its core, NDC can allow airlines to become true retailers, and gain full control by exposing unique attributes e.g. passengers details, rich content, fare families, bundles, some of which were only initially promoted on their website or mobile app. This recent Digital-driven retailing strategy could now extend to both current channels such as travel agencies, TMCs, OTAs, aggregators/TOs, metasearchers, and emerging ones such as instant messaging, bots and other AI-powered devices.

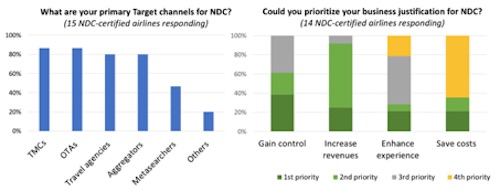

Moreover, NDC isn’t just seen as a simple standard to be implemented and tracked against metrics such as cost-savings or revenue. Indeed, according to a high-level survey and conversations conducted with 15 NDC-certified airlines, the #1 priority for justifying NDC turns out to be “gaining control.”

Given the mounting frustration of executives not being able to manage their channels in real time, master sensitive airline data assets, choose the speed of delivery, or simply enjoy the freedom to open up to third-party content, this shouldn’t come as a surprise. This sentiment is also shared by a number of new high-profile retail leaders hired by airlines outside of the travel industry that find themselves unable to unleash their creativity because of numerous legacy constraints.

Interestingly “save costs” is clearly priority #4 for many. While some airlines want to also use this technology as a way to reduce costs by going direct, some key channel actors first stress the importance of content. For instance, American Express Global Business Travel (GBT) “does not consider NDC as a way to bypass the GDS but to enhance the offer, not to replace the actual very efficient process.”

The promise is also to drastically expand from a shopping/booking traveler’s purchasing experience to a lasting relationship, one that spans the entire traveler journey (and finally gets ahead of Amazon!). Similarly to the Web, the acid test for NDC to eventually take off is – for leisure and business travelers alike – a brand-new experience.

This is an amazing objective, on par with that promised by the web 20 years ago. By the day, airlines develop new use-cases and enrich and deploy new merchandising possibilities across all channels. But just like back then, NDC feels like it is just that: a promise, and one that hasn’t yet been fulfilled. Pop open the hood of the NDC car, and you’ll mostly find a work-in-progress.

Popping open the hood

So, where are we today on NDC?

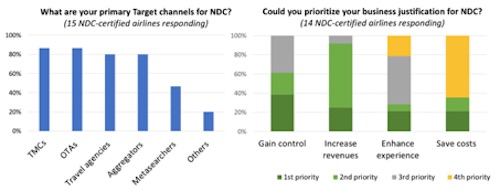

A great place to start is the IATA registry. 51 airlines were NDC certified as of February 2018, and of these, not all were at the same stage. The certification scope contains several dimensions: NDC certification levels, NDC versions, and the range of qualified NDC verbs. To put it simply, in January 2018 only 9 airlines were using the recently-published stabilized version (v17.2) and had obtained a level-3 status to cover the entire lifecycle i.e. shopping, booking, payment, ticketing and some servicing. Unsurprisingly, these include some big ones such as the Lufthansa Group and American Airlines.

Further digging reveals that only two carriers have declared compliance with the verb OrderReshopRQ/RS, which allows to rebook e.g. to another date. As a result, other airlines actually have to rely on a hybrid model using a mix of NDC and classic Web Services. Aggregating and reconciling bookings from different sources – NDC and Non-NDC – and from different airlines will also add a new level of complexity (not to mention interlining and complete end-to-end servicing). This is clearly non-optimal.

Given this very complex web of different versions, various NDC levels, ranges of supported NDC verbs, and interoperability challenges, can we still talk about a unified push and fast NDC adoption? Could aggregators and developers still deliver on the “write once, deploy everywhere” promise without tricky versioning management?

It is easy in hindsight to see the move to the Web as a given evolution, that would take place no matter what. But it seems harder to apply the same logic to NDC – even though the same questions were being asked at the time. Adoption was also slow, hesitant, and in varying degrees just like what we are seeing now with NDC.

With NDC, we haven’t reached that tipping point… but we will, hopefully soon.

What needs to happen – the NDC tipping point

Prove a business return

As NDC stands today, there is still a lack of indisputable business justification being communicated. NDC transformation programs need board approval after all, which involves pitching and building a solid case for this massive endeavor. However, due to the fact that NDC is so multiform, and airlines business models are so diverse, there is no single path to NDC success – and therefore no easy arguments to deploy on NDC’s potential returns. It allows many diverse use cases ranging from rich content, direct connect, post booking ancillaries, personalization, dynamic merchandising and more – each of which could live as projects of their own.

Furthermore, while some use-cases are interesting, they should be viewed as only a first step towards a bigger play. For example, NDC might allow an airline to double their conversion rate with direct bookings on metasearchers – a great result, if not for the fact that this would only have a moderate impact on the overall profitability equation because it would only be a fraction of that airline’s acquisition mix.

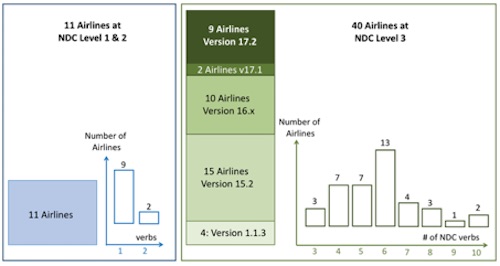

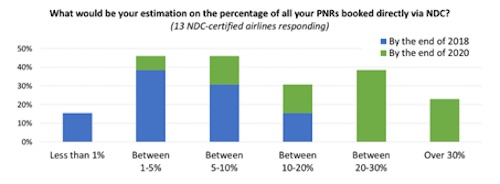

As shown below, most of the NDC ROI drivers are revenue-driven (vs. Cost-justified), starting with the ability to personalize offers and bundles along with all expanded channel reach, conversion increase, and enhanced ancillary attachment rates.

As more and more use cases pile up, one can expect NDC adoption to ramp up with solid business cases. When that happens, we will most likely see the majority of airlines begin to agree on massively deploying NDC technology throughout the value chain, and thus unlock the ability to decide which business model is most appropriate down the line.

Create a pull & push effect

Today, many airlines are pushing their NDC solutions to their trade partners. But this “push-only” approach is leading to wildly different adoption levels depending on the solutions being proposed, the quality of prior communication on this change, the pressure on costs, the size and type of partners being involved, and their business model impacts.

NDC won’t be able to truly take-off in a push-only environment. Rather, all players may need to first realize what’s in it for them to see a true pull and push emerge. Web was not simply a matter of airlines pushing digital channels, but also of consumers clamoring for it, combined with the rise of new business models.

If anything, many airlines believe that they will eventually tighten their relationship with their trade-partners as a result of this NDC shake-up. One airline stated: “Pull is all about content”. Content will further foster and cement this relationship when it comes to dynamic price points, rich media, personal attributes and post-booking ancillary opportunities.

The exiting channels will be a big part of the pull factor – a trend that has already begun. Looking only at strategic TMCs, Business Travel Show’s latest research revealed “that over a third (35%) of buyers now regard NDC as a good thing, compared to just 11% a year ago.”

Philippe Chérèque, president of American Express GBT, says:

“We foresee that the NDC technology will help us provide more choice to our customers with richer content and further enhance our extraordinary traveler care with better personalization across the entire journey.”

But this pull will also come from outside of the traditional travel industry – just like it did for the web. Just imagine Amazon (Alexa), Google (Google Home), Facebook (Messenger), Alibaba or even Airbnb embracing an NDC-only approach. Suddenly the “pull” requests for NDC would drastically ramp up. The current airlines’ struggles to evangelize solutions would become a thing of the past, and everyone would be piling onto the NDC bandwagon. Some are already exploring this direction: Lufthansa and Emirates for example, have established their flagship stores with NDC in collaboration with China’s retail giant Alibaba.

However, the true and final pull that will allow NDC to become mainstream is just as simple as it was for the web: the travelers themselves. Travelers are the ones who will decide, and it would be a mistake to limit this pull and push to the airline B2B ecosystem. Travellers might not know whether their booking is NDC-processed or not, but they will love this experience e.g. sophisticated search and comparison on OTAs on all possible criteria, personalized end-to-end journey across all channels …etc. As one airline put it “the customer’s experience remains our first NDC priority, increasing revenues comes after.”

Amplified with a mobile-only adoption , for both business and leisure, travelers will be the ones validating NDC on the go.

Move from project to transformation program:

For a majority of airlines today, NDC endeavors are projects or pilots, not a program. For some, it’s a way to test the waters without substantial financial commitment, usually with single dimension NDC projects i.e. with a simple use case, through a specific channel, or during a shopping-only phase. For others, it’s to avoid too high of a disruption with their existing environment.

Today, these approaches are no longer the most efficient, as many airlines will soon realize. 20 years ago, the web started as an IT delivery, then a side-project that eventually shifted to an ecommerce shop before becoming a profit center and finally developing into an enterprise-wide digital transformation. The switch to NDC will require just as complete a Transformation program – wouldn’t it be better to shortcut some of these many steps?

This transformation journey will vary from airline to airline. Carriers have different agendas and relevant strategies depending on 1) Geographies such as US and China with huge domestic markets and unavoidable players, 2) Full service or low-cost models with significant different channel mix and legacy connectivity, 3) distribution mix with various degrees of reliance on some partners, and 4) channel receptiveness on adoption schemes from incentivizing NDC-adopters to penalizing non-NDC compliant players.

Most airlines executives can have it both ways though: short term, by enhancing profitability, and long-term, by gaining control to decide their fate strategically. But aligning quick wins with a long-term view increasingly requires a well-structured transformation process involving all stakeholders from the start.

Arber Deva, head of direct distribution, Lufthansa Group Hub Airlines states

“As part of its overall commercial strategy, the Lufthansa Group has implemented a comprehensive distribution transformation program over the last couple of years, addressing all dimensions:

Product (end-to-end NDC API enabling offer and order control)

Processes (technology and trade partners on boarding and performance steering)

People aspects (dedicated organization across the Lufthansa Group’s three Hub Airlines).

Looking ahead Lufthansa Group will continue broadening its offering through direct channels by engaging with all actors and taking a lead role to foster NDC adoption with the objective of meeting the increasingly individual and dynamic demands of its various customer groups.”

Final inflection – It has to happen fast

There will eventually be an inflection point – but the sooner it arrives, the better. Hesitant decision making, slow upgrades, pilot-only approaches, and reluctant deployments may cause the simplification and standardization promise to tumble, with too many options to manage and aggregate. This is a significant risk, because the true advantages of NDC, and the potential pay-offs for airlines and their partners, will find themselves delayed by additional costs and hassle.

If airlines quickly adopt technology standardization (based on version 17.2 and beyond) and transform their distribution based on ambitious business cases however, combined with the rise of new channel entrants – then no doubt NDC will take off quicker than anyone expects.

As shown above, this should allow these carriers to significantly shift traffic via NDC, approximately from a single-digit figure by the end of the year to an optimistic 20% by the end of 2020. One can be hopeful that by that time, just like the Web became a retail show window by opening up internal processes to the world, NDC will bring airlines to expose their enriched content and all distribution players to embrace this simple standard. A new era of travel is about to begin – and travelers will love it.

This article is the first of two on NDC. In the second article, we will focus on the technology/solutions factor, also critical in the NDC tipping point.

This is a viewpoint by Philippe Der Arslanian, CEO Answair. The views expressed are the views and opinions of the author and do not reflect or represent the views of his employer, tnooz, its writers or partners.

![]()