Could air services decide which city will win Amazon’s HQ2?

By cameron in Uncategorized

For a number of US cities, the bid to attract Amazon’s new HQ2 has been one of the top development priorities, with each candidate making attractive concessions in hopes of attracting the tech giant to build its facility and deliver jobs.

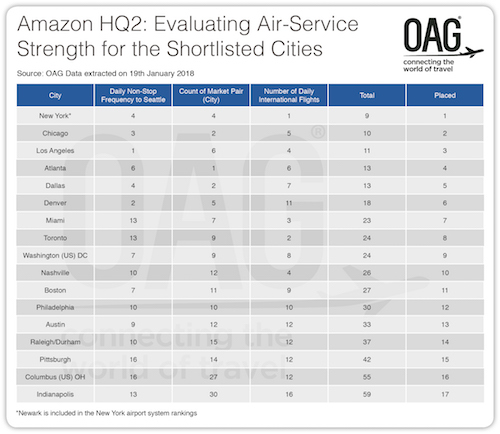

To help Amazon decide, OAG has put together a helpful ranking of the contenders based on their air services potential. OAG considers the number of destinations served, availability of non-stop service to Seattle, and the range of international connectivity.

Each city is ranked individually for each category with the sum result as the final ranking.

OAG’s ranking favors the established aviation mega-hubs of New York, Chicago, Los Angeles, Atlanta and Dallas-Fort Worth. New York is a combination of New York City and Newark, each ranked first because of their combined air services from JFK, EWR and LGA.

While OAG’s rationale for ranking the cities by air service is sound, there are other soft factors in air service which could also drive Amazon’s decision.

For example, airports may be willing to give airlines additional concessions in order to attract new routes and help their chances of earning Amazon’s bid.

An example would be British Airways launching direct services to Heathrow from Austin and new services to Asia in development at Boston, both of which OAG cite.

(Click on graph for a larger version)

Amazon may also look at issues of service reliability, and a low-hassle factor in the journey, which would give an edge to some of the smaller airports included in the list.

There’s a precedent for this corporate thinking from one of the world’s other large and influential companies: LEGO. The toy giant built Billund airport for its own private use before opening it up to community service, assisting both transportation of its employees and logistics deliveries.

A corporate-grown airport favors the development needs of that corporation which gives the cities with smaller airports on the HQ2 list a unique edge.

Airlines may also have a lot to do with it. Beyond air services and connectivity, Amazon may consider onboard experience and loyalty programs. Two primary airlines which may drive the decision going forward are Alaska Airlines and Delta Air Lines, both of which lay claim to being Seattle’s home-town airline (though Alaska’s claim pre-dates Delta’s).

Could Alaska help make Pittsburgh the next Billund for Amazon?

Last November, Alaska Airlines announced a planned launched daily non-stop service between Seattle and Pittsburg starting in September of this year. When we saw this announcement it peaked our interest in connection with the Amazon bid because of the flight schedule and also Pittsburgh Airport’s strategy for rational growth and cost efficiencies, as stated atthe CAPA airline event in London last year.

The Alaska Airlines flights are also very commuter-friendly, departing Seattle at 8:25 and arriving at Pittsburgh at 4:10 pm; with Pittsburgh departures at 5:20 pm arriving in Seattle at 7:50 pm.

It’s a stretch, but one we find enticing given Alaska’s acquisition of Virgin America, the airlines new corporate image and passenger experience improvements, as well as Alaska’s focus on automated self-service enhancements throughout the journey.

Certainly, Delta Air Lines has a lot to offer and will be pushing its strengths at Atlanta and beyond.

For its part, OAG touts the strengths of its US headquarters in Chicago and Boston, both of which offer a number of advantages in connectivity. Boston, OAG is quick to point out, offers the shortest connections to Europe and Chicago hosts two major airline alliances.

Oh, Canada!

Still, we shouldn’t underestimate Toronto. After all, Amazon may want to plant a flag in a city that not only offers great passenger experience at the terminal and convenient international and domestic connections, but also because it offers something the other cities don’t have: it’s in Canada.

Ongoing debates on immigration and visa policies in the US, and the potential conflicts in hiring a diverse staff, could tip the balance in Toronto’s favor. Besides, Toronto has US Customs and Border Protection pre-clearance which makes onward travel to the US a breeze.

![]()