Comparing the performance of the metasearch giants for hotels

By cameron in Uncategorized

As consumers are always connected to their digital channels, their habits are constantly evolving.

These constant shifts have challenged the hospitality industry to keep pace with new technology and trends so as to compete in the online community space.

NB: This is an analysis by Jean-Luis Boss, chief marketing and digital services officer at Fastbooking.

Optimising a hotel’s online distribution to drive more direct traffic requires digital marketing strategy and tools to be efficient and effective in their efforts within the online community.

In 2015, just two years ago, organic traffic accounted for 62% of the traffic in a hotel website.

This figure has reduced to 42% in 2017. Undoubtedly, this is still an important source of traffic for hoteliers to leverage on.

The apparent reason being is that organic traffic to a hotel’s website is nearly free.

However, this is not sufficient to drive more traffic and conversion to a hotel’s website.

To compete effectively in the digital community space, an effective digital marketing strategy to drive more qualified traffic and conversion to the hotel’s website is pertinent.

This plan, as we all know, encompasses search engine marketing (SEM), pre-and retargeting display ads campaigns, AdWords and the ultimate driver, metasearch.

Since the fourth quarter of 2016, Metasearch has grown to become the most important advertising channel for hotels outpacing even AdWords, according to own data.

And this trend is escalating.

The evolution of metasearch in 2017

We have been managing metasearch campaigns for hotels for more than seven years.

From the launch of metasearch, our hotel booking platforms were connected to the leading hotel metasearch channels to advertise direct hotel rates.

During this period, we have seen ample growth for this digital channel, and we have learnt the strategy of optimising the various metasearch channels to generate maximum revenue for hotels with the best possible return on ad spend.

We found it important to help hotels understand the various digital channels and how they work so that they can make better choices and decisions on advertising budgets.

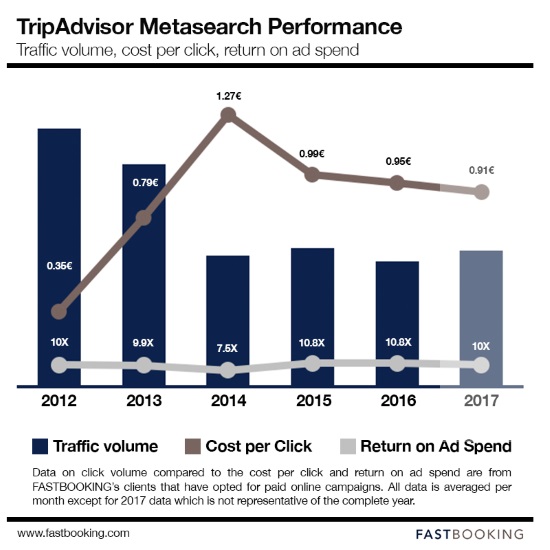

1. TripAdvisor

Over the last five years, TripAdvisor has held the dominant position in metasearch advertising, especially in areas of quality of traffic and revenue generated.

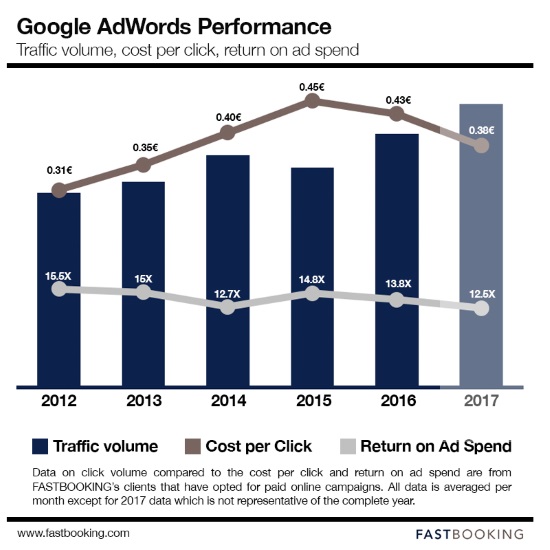

The illustration below provides the year-on-year progress on revenue generation and traffic cost versus the return on ad spend.

Although TripAdvisor remains as one of the key channels on the market and is still one of the best performing platforms for metasearch, its numbers have recently declined both in traffic volume and return on investment.

Brief history:

- In 2012: The volume of clicks was much higher because TripAdvisor still had its infamous pop-under system (opens a separate page on the website). Anyone searching for information on a hotel would receive six or more offers at the same time.

- In 2013: TripAdvisor system changed to display dynamic rates, causing traffic to decrease while the cost per click increased.

- In 2014: The cost per click peaked to 400% from 2012, and the return on the ad spend declined. However, the conversion rate was much higher with much more qualified traffic.

- In 2015: The prices evened out and a steady reduction in the cost per click. Return on ad spend reverted to the 2012 level which was consistent around 10X the previous levels.

Our analysis

TripAdvisor produces highly qualified traffic with good conversion rates and has a very international audience even though it is strongest in North America.

For hotels in Europe and Asia, this translates into a high return on investment as the average stay is longer than domestic or regional audiences. From our analysis, users who book through TripAdvisor has an average stay of 4.5 days.

The bidding system has improved over the years but remains quite opaque. The priority is given to the highest bidder, and as an advertiser, you will not know how much that bid is.

One can opt for a “share of clicks,” which somewhat guarantees that one will be visible and receive clicks a certain percentage of the time. Changes in bidding and campaigns can be managed on a daily basis.

Our tip

Do not systematically bid for the first position as the cost can rapidly raise and returns will lower. Instead, use TripAdvisor’s reporting to stay within the top 3.

Additionally, if one’s ADR is low, opt for the “Instant Booking” model to keep costs low.

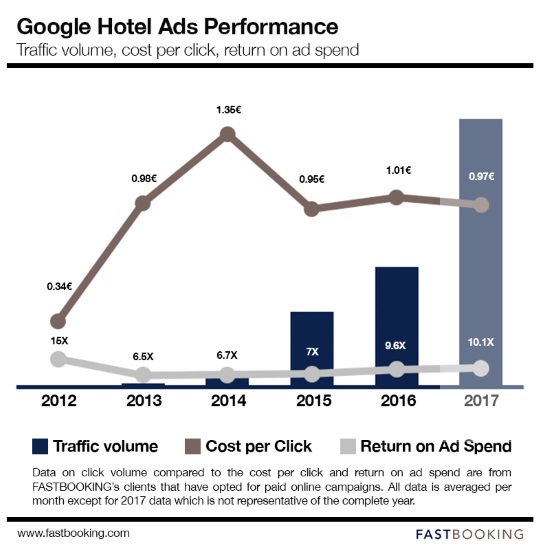

Google launched Hotel Ads as Hotel Finder in 2011. Since then the product has changed names to Google Hotel Price Ads and now to Google Hotel Ads. The product and performance have grown exponentially every year both in terms of click volume and return on ad spend.

Following a slightly different business model than other metasearch products, Google launched with a pay-per-click model that was based on the total cost of the potential reservation. They retained this model but added a performance model which is a percentage of the actual booking fee.

Based on click volume, Google’s Hotel Ads matured in 2016, and today the click volume equal or surpasses TripAdvisor while keeping a very profitable Return on ad spend.

As Google is integrating the ads deeper into its search results, maps, and other products, it is poised to become one of the leading hotel metasearch providers in the market.

Our analysis

Google Hotel Ads currently has the most qualified traffic of all metasearch providers.

Traffic volume is now at a level that makes it a compelling investment for hotels and hotel groups of all sizes.

However, it is quite complicated to manage the bidding system that offers extremely granular possibilities.

This is too complex to manage unless one has a full-time e-commerce or advertising manager.

Google Hotel Ads has stopped developing direct connectivity with hotels and is always connected through a third party.

With Google’s experience and expertise in AdWords, they have developed a management system to optimise bidding and precise geo-targeting.

The bids are managed every few minutes if not instantly, making it a reliable metasearch platform for budget control and adjustments.

The system is very open and offers full transparency on performance, competitiveness and opportunities.

Our tip

To be effective when advertising on Google Hotel Ads, we recommend for budget hotels to switch to the performance model and for Deluxe and luxury hotels with a higher ADR to use the cost per click model.

Hotels must ensure that these multiple campaigns are constantly monitored and managed.

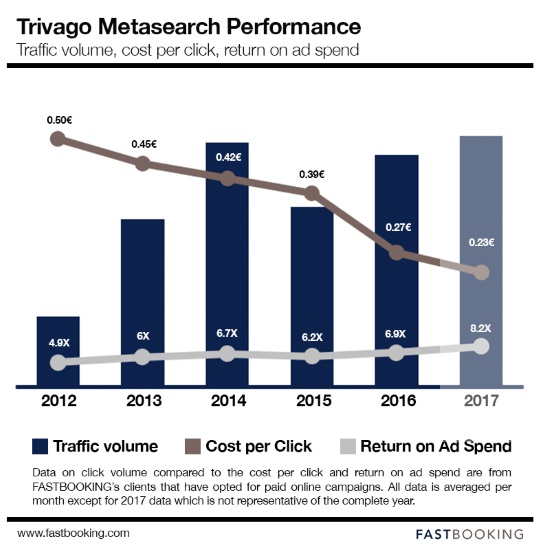

3. Trivago

Trivago has always been one of the main click volume producers on the metasearch market.

The cost per click is the lowest of all the metasearch providers, yet the ROI has not been as good as TripAdvisor or Google Hotel Ads, although it is increasing.

The steady growth of the platform since the part equity acquisition by Expedia in 2013 and the subsequent large investment in brand visibility through TV ads make this platform a very attractive option for hotels that require a boost in brand awareness.

Our analysis

From a budget management perspective, this is a platform that requires careful observation and management.

We have seen massive traffic increases each time TV ad campaigns are launched.

However, the conversion rate is relatively low. To ensure that budgets are not depleted, we recommend hotels to make sure that their budgets and bids are properly managed for maximum returns.

Small changes in bids (such as a single cent increase) can have a significant impact on impression share and can result in budget over-spend.

There is no built-in budget capping, though some third parties have created their own. The platform is improving quite frequently, including in its management possibilities.

Trivago can be used successfully for international traffic, but it is most efficient with inbound travellers from Europe.

Finally, the business model is the cost per click only. As many of the hotels used for this analysis were located in Europe, the average length of stay was shorter than TripAdvisor (2 nights versus 4.5).

The ranking system is prioritised by the best rate first and the bid second, if there is full rate parity the bid obviously takes priority.

Our tip

As Trivago’s ranking model prioritises rates if one can have a slightly lower rate on their website one will get more clicks at a lower cost.

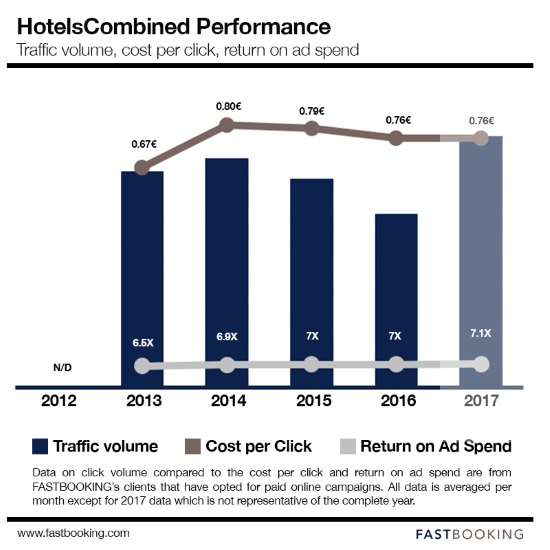

HotelsCombined is one of the most important metasearch partners for our hotels in this area.

One of the first companies in the hotel metasearch market, HotelsCombined delivers an excellent return on investment for hotels targeting travellers going to Asia Pacific, Australia, and New Zealand demographics.

Our analysis

Although the click volumes are lower than TripAdvisor, Trivago, and Google Hotel Ads, the demographics served by HotelsCombined are a valuable addition to hotels seeking travellers from Asia Pacific region.

Click volumes are stable, and the business model only costs per acquisition with very little control over visibility.

However, it is a must if one wants to add traffic from those regions.

We have included Google AdWords, even though it is NOT a metasearch channel, as a comparison between advertising costs and returned on investment for hotel marketers.

AdWords are still one of the most cost-efficient advertising channels for hotels both in terms of return on ad spend and click volumes.

AdWords have consistently had the highest return on investment, and even though metasearch has recently overtaken AdWords as an advertising channel, in terms of revenue generated, it remains a vital channel for hotel marketers.

The efficiency of AdWords is extremely high when using it to protect one’s hotel brand name from OTAs or other third parties trying to advertise on one’s name.

Our tip

Be careful when targeting broad or generic keywords such as “Hotels in [city]” as these keywords are very expensive and have a low return on ad spend for individual hotels.

Focus instead on a mix of 80% brand keywords and 20% broader keywords with extreme care on budget spend.

6. Display advertising

We also included display advertising as we have noticed through our campaign management that this nicely complements metasearch advertising, both in brand awareness and conversions.

Through running multiple campaigns using targeted display channels and retargeting, we have seen an average return on ad spend of 10.2X.

This makes it a very profitable addition to the advertising mix.

Our tip

Individual results depend on the hotel’s location: High-interest destinations such as the main cities tend to have a better return since there is more traffic from the pre-targeting campaigns.

The trick here is to ensure that there is enough display volume to generate brand awareness without over-saturating the ads to the travellers, and knowing when to turn the campaigns off so as not to display irrelevant advertising to the guest.

Key takeaways and recommendations

Metasearch can help you drive more traffic to your website:

- Metasearch is to become the most important advertising channel for hotels. Select the different digital players that are most pertinent to your business according to your sales area and your objectives: mass volume or high return on investment.

The efficiency of your direct booking strategy depends on your price:

- We have noticed a substantial difference in return on ad spend for hotels that chose to give advantages to direct bookings. Lowering rates for direct bookings is one of the most efficient ways to make metasearch generate substantial direct revenue. We have noticed a return on ad spend by an average of 2.5X. As a general rule of thumb, if one is selling at higher rates on one’s website the results will not be profitable. At rate parity, the results are acceptable, although this lowers the direct booking percentage.

Look for professionals:

- To secure a hotel’s direct bookings or simply to increase revenue across multiple sources, metasearch and digital advertising channels have become mandatory channels for both independent and chains hotels. We recommend hotel groups and chains to create an internal team for campaign management and optimisation. For independent hotels, it would be wise to use an experienced digital agency.

Keep monitoring:

- Metasearch, like all online advertising platforms, is not set-it-and-forget-it platforms. It requires optimisation to ensure that the return-on-ad-spend is kept profitable.

(One final) Food for thought

The constant change in technology has kept hoteliers on their toes with constant adaptation. Different shifts in digital strategies to maximise direct traffic includes metasearch in the hotel distribution mix.

We have witnessed that if digital marketing strategies are handled with experience, paid traffic can represent 30-50% of market share per hotel.

This is definitely worth the effort and attention.

Metasearch, notably Google Hotel Ads, are strong allies to Independent hotels. This would provide high visibility and conversion as compared to OTAs.

Now the question that remains is “How to be connected to Metasearch?“

Hotel distribution is not going to get simpler; it will require a constant shift of strategies.

Mobile, new technologies such as chatbots, etc. will continue to transform the digital landscape.

But this also mean new opportunities and improved performance possibilities for hoteliers that embrace these new trends and technology.

NB: This is an analysis by Jean-Luis Boss, chief marketing and digital services officer at Fastbooking.

NB2: Download full data infographics here.

![]()