Big room for growth in ancillaries for Asian travel brands

By cameron in Uncategorized

Asian travel brands have plenty of room to grow sales of ancillaries by presenting customers with personalized offers.

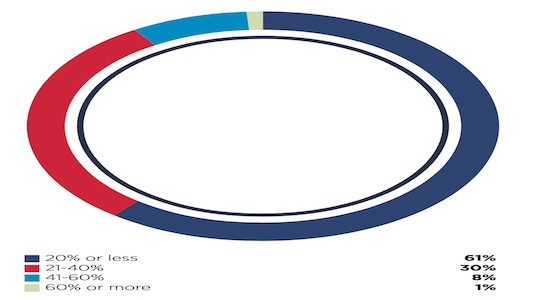

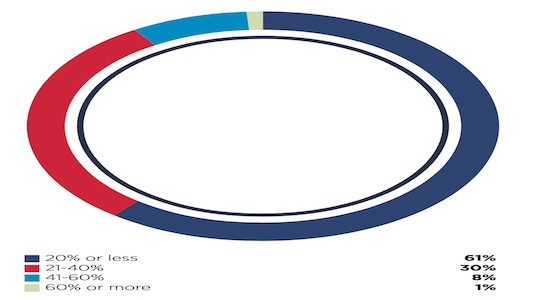

A report prepared by SapientRazorfish in the lead-up to Digital Travel Asia shows that while the share of revenue generated from ancillaries is modest.

- 61% of those surveyed said ancillary sales represent 20% or less of their sales revenue.

- Only 1% of those surveyed said it represents 60% or more of their sales revenue.

But 83% of Asian travel brands said they expect an increase in ancillary sales over the next twelve months and only 17% said they expected ancillary sales to decrease.

But 83% of Asian travel brands said they expect an increase in ancillary sales over the next twelve months and only 17% said they expected ancillary sales to decrease.

Seton Vermaak, travel & hospitality lead SEA at SapientRazorfish says:

“Such is a sphere that may be further bolstered as travel brands compete directly with OTAs, facilitating a relationship that affords direct sales for a range of travel products and services. This new model also has huge implications for data analytics capabilities—for both customer-facing insights and better supply chain management.

“Ancillary sales are about more than just face value revenue generation: they present a utility that heightens the end-to-end experience for travelers. These types of suggestions allow brands to showcase how well they know a traveller, to foster a relationship by showing an understanding of their need for convenience.

“This is an important driver for the new loyalty offering expected by today’s traveller. More than this, though, ancillary sales provide even more data—more information to share with strategic partners and to feed back into better understanding a customer.”

Travel brands listed data analytics which could be applied to personalization as a high priority for the coming year, which would allow them to present customers more appealing products, services, and experiences.

Vermaak says:

“Today’s business leaders are taking a more holistic view of the travel journey. For airlines, it’s about more than just the flight, and successful hotel brands are going beyond merely offering a room. Many brands are shifting their focus to creating a better end-to-end experience for travelers.

“With the modern consumer model, it’s about enabling the customer experience throughout the entire journey, and ancillary sales are at the heart of this extended offering.”

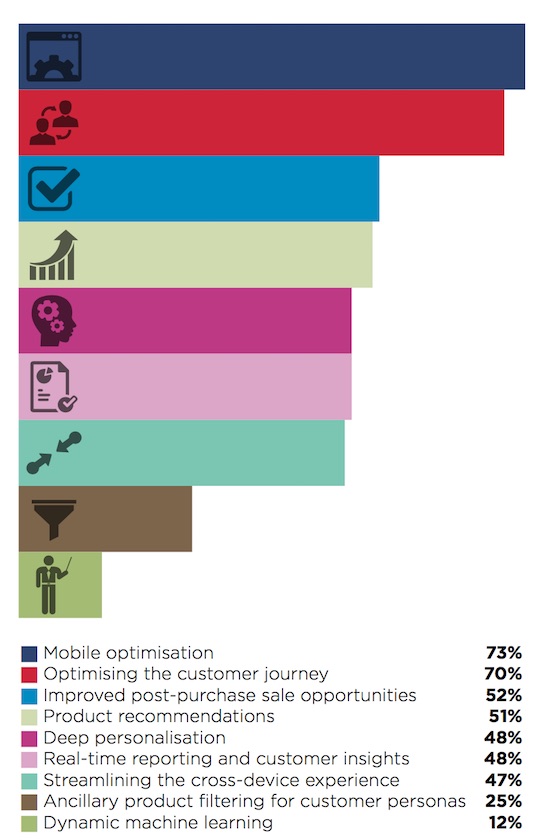

Related to this, while 51% will focus on better product recommendations and 48% plan to focus on deep personalization, only 25% plan to focus on ancillary product filtering around passenger personas in their cross-platform channels to encourage ancillary sales.

There is an additional opportunity to boost sales of ancillary products as last-minute add-ons, when the need is most immediate, on mobile.

With 73% of companies planning to optimize their mobile platforms in the coming year this would be an opportunity to consider better integration of ancillary products with last-minute contextualized triggers.

For example, airlines might offer last-minute upgrade alerts or extra baggage, hotels might add prompts to make restaurant reservations while guests are on the property or promote tours and activities.

One of the strengths of last-minute buys is that they separate the extras from the big ticket at the time of booking.

One challenge to implementing dynamic mobile ancillary sales strategies—and to encouraging sales through mobile channels in general—is that many Asian consumers have trust issues with ePayments.

Asian companies are addressing this with secured payment options – 69% of those surveyed said they plan to introduce trusted payment options for their mobile channels.

Vermaak says:

“Whilst travelers want convenience, certainly, they also want to feel comfortable with ePayments. Though Chinese consumers have a low barrier to entry for mobile commerce, many non-Chinese travelers feel wary of paying on mobile devices.

“Because of this, brands are rightly employing user review systems and secured payment options as a means of assuring customers that their travel choices are both safe and suited to them.”

The full report can be downloaded here.

Related reading:

Data rules and loyalty building strategies for travel brands in Asia

NB: Asia travel image via Big Stock.

![]()