Are alternative payment methods mature enough for broad adoption?

By cameron in Uncategorized

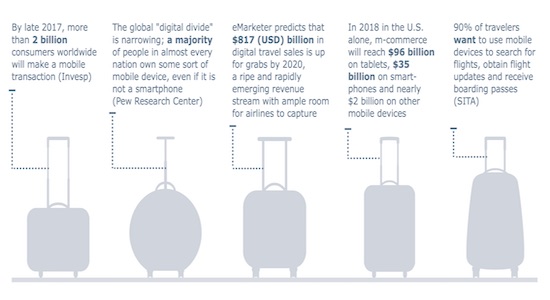

A lot of water has passed under the Golden Gate bridge since the travel industry began to discuss the mobile wallet war. While alternative travel payments have progressed, the variety of services are still very diverse and sometimes confusing, with mixed consumer take-up.

But airlines, and other travel services providers should be paying close attention to this trend because they play an important role in sales conversions in developing markets.

Simplify the path to purchase

Payment solutions provider CellPoint Mobile has recently released an industry brief on mobile commerce for the airline sector which offers guidelines for other travel companies.

Speaking to Tnooz, CEO Kristian Gjerding explains what trends in travel payments mean for the industry

He says the adoption of alternative payment methods is in-step with global mobile commerce trends, and simplifies the path to purchase.

But, Gjerding believes travel brands also need to think local, adapting to the predominant preferences of their target customers, and including solutions which may be unique to those markets.

“Airlines need to integrate any payment methods, including digital wallets, which have enough traction to warrant doing so. No doubt Android Pay, Samsung Pay, Apple Wallet and Google will warrant doing so globally.”

“If you look at the Nordics, you have Mobile Pay as the prevailing player in this region. So an airline that has traffic concentrated in this region will need it. In the Middle East, by contrast, Apple Pay is predominant.

He also highlights the importance for travel companies of payment in online conversion:

“They need to have a technology infrastructure to support it. These APMs give them some flexibility on settlement and clearing as they would have with normal credit cards.”

Gjerding emphasises that for global and local payment methods alike, the primary focus for travel brands should be to ensure that they complete the booking.

He suggests payment methods should meet four key requirements: they should be available, simple, secure and reliable.

“The technology needs to be streamlined. It can’t involve weird checkout processes.”

Ancillary Boosters

Ancillary Boosters

Finnair’s trial of Alipay onboard flights between Shanghai and Helsinki is a prime example of this thinking. The payment method is popular in Finnair’s growing Chinese market—used by more than 60% of Chinese people travelling abroad.

Adding this payment method is expected to boost the airline’s onboard ancillary sales.

When Finnair announced the trial, chief digital officer Katri Harra-Salonen said in a statement:

“The introduction of Alipay onboard is part of our commitment to enhance the customer experience with digital solutions.

“As the number of travelers grows between Asia and Northern Europe, the need for a familiar and convenient payment platform has never been greater. This new partnership with Alipay will help Chinese travelers to make payments onboard in a very convenient manner, through a system that is both fast and familiar to them.”

Some shops and sales outlets at the airline’s home base, Helsinki Airport, have also adopted ePassi-Alipay to encourage purchases.

Payment hardware is also keeping step with APMs. UK-based retail systems company ECR has recently introduced an all-in-one handheld contactless payment terminal—ECRGo2—designed around mobile wallet payment solutions including Apple Pay and Google Wallet, even PayPal.

No clear winners

Renaud Irminger, SITA Lab programme director, says the wallet war is ongoing and suggests that airlines should keep an open mind, considering what solutions are most appropriate to their business.

“Surprisingly what we are finding is that none of the people we thought would win the wallet wars have won it.

“Samsung and Google have tried wallet, but they have had limited success with airlines. Apple has had some success, but it has been a long road to implement the wallet. It still has a long way to go.

Apple is investing for the long term, and maybe will come out ahead in the next five years.”

But while digital wallets have battled for prominence at 30,000 feet, other payment solutions have grown in popularity. Irminger says:

“What has happened is the emergence of other mobile payment solutions, like WeChat, where mobile applications let passengers load their payment information.

“Of course, there is a difference between using chat applications for small payments or buying a high-ticket item like an airline ticket. I’m not sure that consumers would risk that.”

Irminger agrees that this decision is often local, based on the target market and in keeping with the relative growth and influence of the Fintech sector in the region. He says:

“The Nordic countries are very advanced for those things, but I don’t know that internationally the banks are making great inroads.

“In India there is a lot of the population who choose to pay through direct debit, rather than going through the credit card. Air France allows this and we see many airlines offering the same.”

Mobile phones as IDs will also present new opportunities for secure transactions. Irdinger says a few companies are taking advantage of the trend but it’s relatively untapped by airlines.

“An airline could request contact and better identify the person buying the ticket, using logic like name-matching, which can reduce the risk considerably.”

Approach cryptocurrencies with caution

While the influence of blockchain in the travel process is expected to intensify and cryptocurrencies, like bitcoin, have been trialled by travel companies including AirBaltic and LOT, cryptocurrencies are still maturing.

The decision to accept these alternative currencies should be guided by careful risk/benefit analysis.

Irminger says:

“From an airline standpoint, to accept bitcoin it would really have to consider if it brings additional risk or if it reduces the risk.”

He suggests that one way in which bitcoin could benefit airlines is as a protection from the fraud of last-minute bookings paid with a credit card and later contested.

“Potentially, it should be more secure because the transaction can be done immediately and it is not reversible.”

Gjerding says Cellpoint is seeing Bitcoin gaining adoption and believes cryptocurrencies will make their way into the market.

He also says travel companies need to monitor the maturity of specific cryptocurrencies and take the same approach as the decision on mobile wallets.

“In essence it comes down to a market analysis. If you have a viable market for it, then assess whether it’s viable from a business perspective.”

NB: Mobile payments image via Pixabay.

![]()